Fed Still Pouring Gas on the Inflation Fire; What Happens When It Tries to Stop?

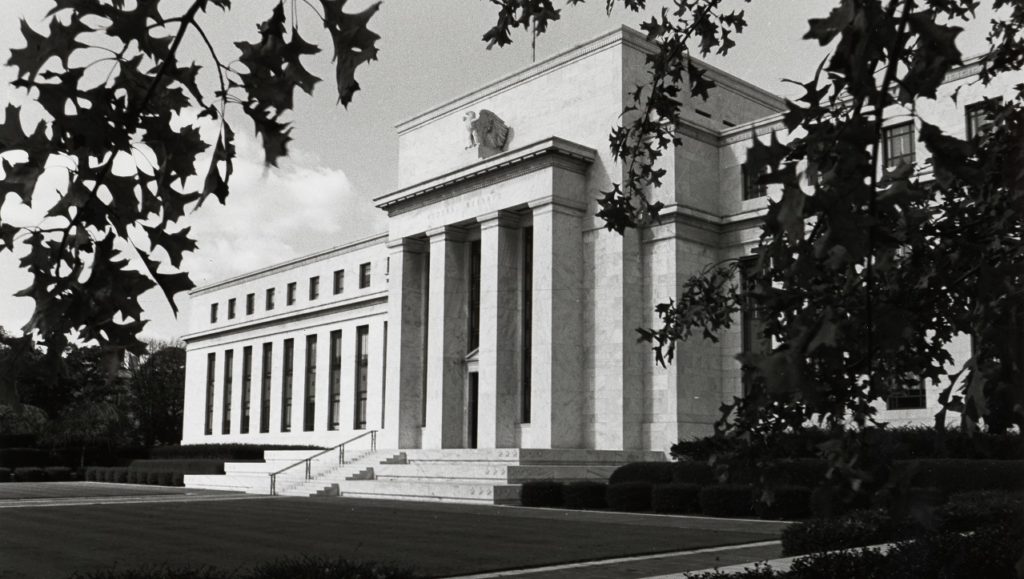

The Federal Reserve wrapped up its first Federal Open Market Committee meeting of the year yesterday without any real surprises. Despite everybody screaming about an inflation problem, the Fed will keep its loose, inflationary monetary policy in play for at least two more months.

Interest rates remain locked at zero. But the FOMC said it will likely raise rates “soon.”

With inflation well above 2 percent and a strong labor market, the Committee expects it will soon be appropriate to raise the target range for the federal funds rate.”

Most analysts expect “soon” to be at the March meeting.

But Jerome Powell left some wiggle-room in the trajectory of the Fed’s monetary policy, saying, “At this time, we haven’t made any decisions about the path of policy. I stress again that we’ll be humble and nimble.”

Powell also indicated that the Fed would be “data-dependent.” As Peter Schiff said in his podcast, “If the Federal Reserve was depending on the data, they would have raised interest rates a long time ago, and they would now be much higher than zero.”

It’s important to reiterate that despite the inflation freight train, the Fed left interest rates at zero. If the central bank was really ready to go to war with inflation, why wait until March? Why is it still pouring gasoline on the inflation fire?

The FOMC also offered some more details on “significantly reducing” the Fed’s massive balance sheet. The central bankers said the plan was to reduce the balance sheet primarily by limiting how much principal it rolls over from maturing bonds. But the FOMC did not set a specific date for the beginning of quantitative tightening, nor did it offer any hint on how much it would ultimately pair down its nearly $9 trillion balance sheet.

But the FOMC said it was not only going to reduce the size of the balance sheet. It also plans to change the makeup, shifting away from mortgage-backed securities and weighing its holdings more toward US Treasuries. This comes as no surprise given that the federal government needs to Fed to keep its thumb on the Treasury market in order to finance its massive deficits.

During his press conference, Powell said balance sheet reduction would begin at the “appropriate time.” But he then said he didn’t have a specific timeline and that the FOMC hadn’t discussed it.

“Really?” Peter asked in a tweet.

What exactly do they talk about when they meet, sports? We’re screwed and they know it.”

The last time the Fed attempted “double-tightening” – balance sheet reduction and interest rate hikes – was in 2018. The central bank was forced to abandon both when the stock market tanked. By the end of 2019, the Fed had cut rates and had pivoted back to quantitative easing. It seems highly unlikely that the Fed will be able to pull off double-tightening today with an even bigger stock market bubble and an economy even more levered up with debt. Even the mainstream has realized raising rates will exacerbate a global debt crisis.

But Powell claims the economy is much stronger now than it was the last time the Fed tightened. In another tweet, Peter said the economy is not stronger.

It’s just a much bigger bubble. Even a smaller pin would produce a larger financial crisis.”

Quill Intelligence CEO Danielle DiMartino Booth told Kitco News that she thinks this tightening cycle could quickly plunge the economy into a recession.

I think that [a recession] could happen in a very compressed way because we have seen, as opposed to an economic recovery that stretches out over ten or 11 years, we’ve seen a very compressed economic cycle this time and the Fed has shifted from a loosening stance to a tightening stance in what feels like record time, so there’s absolutely no reason to think that the market will not start to anticipate the inversion of the yield curve and even move up expectations for when the economy slides into recession.”

In an interview on the Wharton Business Daily podcast, Peter said he thinks we’re on the path to stagflation.

I think inflation is ultimately going to push the economy into a recession as consumers are forced to spend more and more of what they have on food and energy and insurance and just the basics. They’re not going to have discretionary spending. And when they have to cut back, that means a lot of other people lose their incomes, lose their jobs. This is going to be stagflation.”

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]