Tax Cuts Without the Reform

Last week, the House passed its version of “tax reform,” along party lines. The final vote came in at 227-205, with the entire Democratic caucus opposing the bill. Thirteen Republicans joined the Democrats in voting no.

The debate now shifts to the Senate where things will likely become more contentious. Wisconsin Republican Sen. Ron Johnson has already announced he opposes the current Senate plan. And the Senate bill differs from the House version – significantly putting off corporate tax cuts for a year. If the Senate can get something passed, the two chambers will have to figure out a compromise plan.

Peter Schiff has been saying the Republicans aren’t even really attempting to reform the tax system. He called the GOP plans “tax cuts masquerading as reform.” Peter is not alone in this thinking.

As Peter said, reform means fundamentally changing the tax system. That’s not happening. There may be some good things in the tax plan – but we can’t really call it reform. And without significant reform of the system, it becomes questionable whether or not the plan can actually spark the economic growth being promised.

Dan Kurz of DK Analytics also contends that the Republican plan isn’t true reform.

There isn’t less complexity, less politics, and lower compliance costs together with one uniform lower rate (flat tax) to ‘set Adam Smith free.’ Instead, it’s a 429-page monster bill with more legislating through the tax code. This ‘more of the same’ fudge, if it becomes law, will reduce the tax base and further fatten tax attorneys’, tax accountants’, and other swamp dwellers (crony) wallets more than it will unshackle the maligned, bill-paying Main Street sector of the US economy.”

Kurz seems to view the plan a boon to well-connected cronies and a bust for the average American. He pointed out that the average taxpayer will lose a lot of their deductions. He also listed several important things missing from the package, including any efforts to rescind depositor property rights-eviscerating bail-in legislation, or a return to Glass Steagall depositor protections.

This implies that Trump’s Goldman Sachs-laced cabinet isn’t interested in scorching colossal plutocratic transfers of wealth on the heels of the TARP blowback. Sadly, neither Trump’s Fed head choice, ‘easy money’ Jerome Powell, nor his cabinet, nor the recently disclosed social engineering via revenue collection, revisited’ tax plan will do anything to reduce the water level in the very swamp that Trump promised to drain for the benefit of Main Street workers and makers.”

Most significantly, Kruz echoes something Peter and others have noted – the tax plan doesn’t do anything to shrink the size of government.

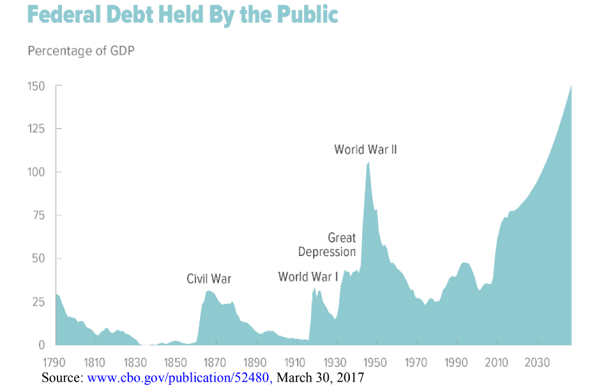

The 429-page GOP tax bill behemoth doesn’t squarely address reining in a spendthrift federal government whose operations-based debt has risen from $9.2trn in Q4:07 to an eye-popping $20.5trn thus far in Q4:17. The resultant sea of red ink equates to true average annual deficits of $1.13trn over the past ten years, most of which took place during one of the longest, albeit weakest, official real GDP growth periods in history — a period in which Social Security and Medicare (mandatory) spending only began a stout generational rise thanks to 10K baby boomers turning 65 daily from 2011 through 2030! Perhaps most important/most threatening of all under the plan even fewer citizens would have ‘skin in the tax rolls game,’ which is not exactly conducive to balancing the budget.”

Currently, over 40 million American households pay no federal income tax. Trump said his plan would add another 31 million to that total. That’s good news for people in those households, but it doesn’t bode well for the broader economy. As Chris Edwards at the Cato Institute pointed out, “Taking more people off the tax rolls is not a good way to keep the government limited. If something is ‘free,’ people will demand more of it.”

In other words, the proposed GOP tax bill, if enacted along current lines, may worsen the “current law” debt/GDP prediction below.

The nuts and bolts of the GOP plan offer some good and some bad. There are definitely tax cuts. Some people will benefit. But others will pay more. There is a little doubt that slashing the corporate rate would be beneficial. But without offsetting decreasing government revenue with spending cuts, the overall impact on the economy won’t be as significant as some people seem to think. As we’ve said before, there is compelling evidence that a debt to GDP ratio over 90% retards economic growth. The US debt to GDP ratio already stands at 105%.

We just can’t say that the Republicans are really offering comprehensive tax reform. They’re not simplifying the system. They’re not reshaping the trajectory of big government. They’re simply shuffling the deck chairs around. It’s tax reform without the reform.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]