Silver Tech News from the Silver Institute

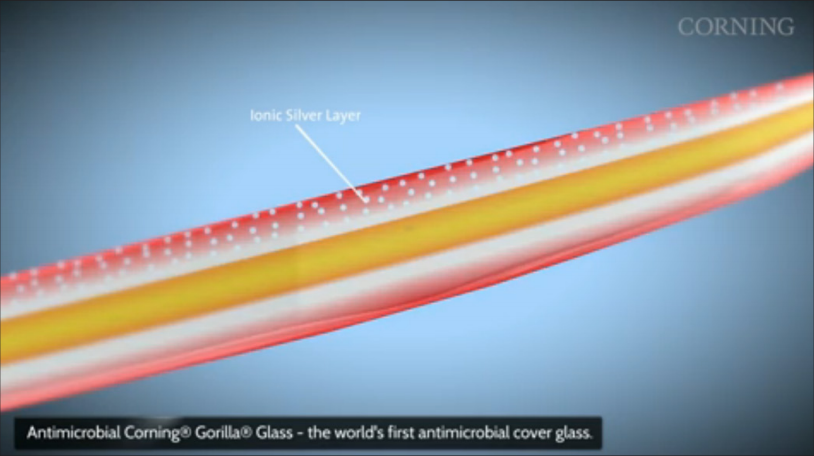

The Silver Institute has released its February Silver News, jam-packed with stories on the latest developments in silver technology. This issue includes an interview with an industry insider about the recent American Eagle coin shortage, as well as articles about silver in hard drives, spark plugs, and the Gorilla Glass used on smartphones.

‘Corning’s Antimicrobial Gorilla Glass inhibits the growth of algae, mold, mildew, fungi, and bacteria because of its built-in antimicrobial property, which is intrinsic to the glass and effective for the lifetime of a device,’ said James R. Steiner, Senior Vice President and General Manager of Corning Specialty Materials, in a prepared statement for CES 2014. He added: ‘This innovation combines best-in-class antimicrobial function without compromising Gorilla Glass properties. Our specialty glass provides an excellent substrate for engineering antimicrobial and other functional attributes to help expand the capabilities of our Corning Gorilla Glass and address the needs of new markets.'”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

While in office, Trump blamed the Fed for tightening monetary policy. Now members of Trump’s team allegedly plan to give a re-elected Trump more power over the Fed, igniting panic from mainstream economists about a politicized Fed. Our guest commentator explains why the real risk, from the establishment’s perspective, is not that Trump will turn the […]

While in office, Trump blamed the Fed for tightening monetary policy. Now members of Trump’s team allegedly plan to give a re-elected Trump more power over the Fed, igniting panic from mainstream economists about a politicized Fed. Our guest commentator explains why the real risk, from the establishment’s perspective, is not that Trump will turn the […] While gold bullion is most often sold in bar or 1oz coin form, the Korean retail market is benefitting from gold’s latest success with a very atypical marketing strategy. It has been traditionally thought that investors prefer larger increments of bullion because they simplify calculations and have a lower transaction cost than buying the same amount of gold in smaller increments. Demand for traditional bars and coins in South […]

While gold bullion is most often sold in bar or 1oz coin form, the Korean retail market is benefitting from gold’s latest success with a very atypical marketing strategy. It has been traditionally thought that investors prefer larger increments of bullion because they simplify calculations and have a lower transaction cost than buying the same amount of gold in smaller increments. Demand for traditional bars and coins in South […] With the eventual introduction of central bank digital currency (CBDCs) now seemingly inevitable, there are a lot of directions central banks could take with their digital currency projects that would have dramatic implications for the price of gold.

With the eventual introduction of central bank digital currency (CBDCs) now seemingly inevitable, there are a lot of directions central banks could take with their digital currency projects that would have dramatic implications for the price of gold. In April, the U.S. economy added a disappointing 175,000 jobs, falling short of expectations and nudging unemployment up to 3.9% (see current trends here). This signals a slowing economy that might force the Federal Reserve to put the guard rails back on. Our guest commentator gives a deeper look at a worrisome trajectory: while part-time […]

In April, the U.S. economy added a disappointing 175,000 jobs, falling short of expectations and nudging unemployment up to 3.9% (see current trends here). This signals a slowing economy that might force the Federal Reserve to put the guard rails back on. Our guest commentator gives a deeper look at a worrisome trajectory: while part-time […] Beneath the sweet surface of our favorite treats lies a bitter reality: inflation has sent cocoa prices soaring to unprecedented heights. Once deemed the food of the gods and now a daily indulgence for millions, chocolate is facing a dramatic upheaval as wholesale cocoa prices have rocketed past $11,000 per ton. Our guest commentator explains […]

Beneath the sweet surface of our favorite treats lies a bitter reality: inflation has sent cocoa prices soaring to unprecedented heights. Once deemed the food of the gods and now a daily indulgence for millions, chocolate is facing a dramatic upheaval as wholesale cocoa prices have rocketed past $11,000 per ton. Our guest commentator explains […]

The gold price all time high is $1895 per oz. A 2013 mining statistic stated gold needs to reach $1950 per oz. to cover mining costs…Question, are mining companies exploring and mining at a current top line revenue loss or are these numbers incorrect ?

Thanks, Charlie J.

Observation ///// Question:

Per the inimitable Eric Sprott :: China bought 16% of the total world gold production in 2013. Yes 16% and the price of gold still declined. Obviously no other commodity would have reacted similar. What market force or activity dictated the pricing behavior?

Thanks, Charlie J.