Silver Tech News from the Silver Institute

The Silver Institute has released its February Silver News, jam-packed with stories on the latest developments in silver technology. This issue includes an interview with an industry insider about the recent American Eagle coin shortage, as well as articles about silver in hard drives, spark plugs, and the Gorilla Glass used on smartphones.

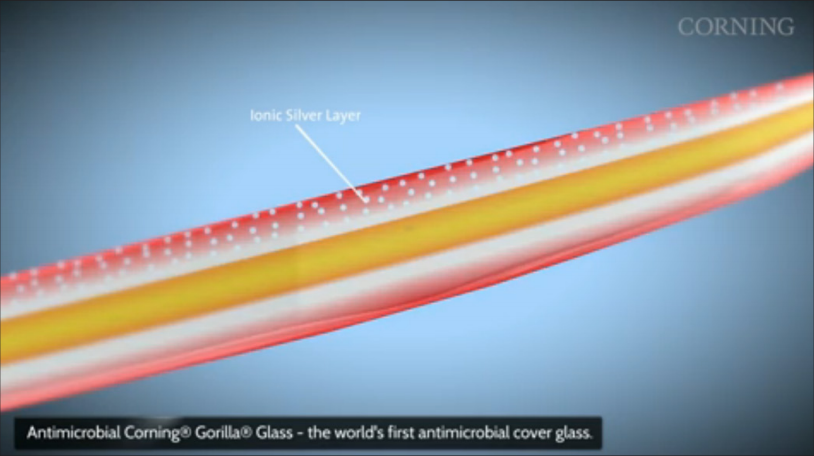

‘Corning’s Antimicrobial Gorilla Glass inhibits the growth of algae, mold, mildew, fungi, and bacteria because of its built-in antimicrobial property, which is intrinsic to the glass and effective for the lifetime of a device,’ said James R. Steiner, Senior Vice President and General Manager of Corning Specialty Materials, in a prepared statement for CES 2014. He added: ‘This innovation combines best-in-class antimicrobial function without compromising Gorilla Glass properties. Our specialty glass provides an excellent substrate for engineering antimicrobial and other functional attributes to help expand the capabilities of our Corning Gorilla Glass and address the needs of new markets.'”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

In April, the U.S. economy added a disappointing 175,000 jobs, falling short of expectations and nudging unemployment up to 3.9% (see current trends here). This signals a slowing economy that might force the Federal Reserve to put the guard rails back on. Our guest commentator gives a deeper look at a worrisome trajectory: while part-time […]

In April, the U.S. economy added a disappointing 175,000 jobs, falling short of expectations and nudging unemployment up to 3.9% (see current trends here). This signals a slowing economy that might force the Federal Reserve to put the guard rails back on. Our guest commentator gives a deeper look at a worrisome trajectory: while part-time […] Beneath the sweet surface of our favorite treats lies a bitter reality: inflation has sent cocoa prices soaring to unprecedented heights. Once deemed the food of the gods and now a daily indulgence for millions, chocolate is facing a dramatic upheaval as wholesale cocoa prices have rocketed past $11,000 per ton. Our guest commentator explains […]

Beneath the sweet surface of our favorite treats lies a bitter reality: inflation has sent cocoa prices soaring to unprecedented heights. Once deemed the food of the gods and now a daily indulgence for millions, chocolate is facing a dramatic upheaval as wholesale cocoa prices have rocketed past $11,000 per ton. Our guest commentator explains […] As fiscal imbalances persist, driven by coercive measures and artificial currency creation, the middle class faces erosion and purchasing power dwindles. But as the world hurtles towards a potential reckoning, the lingering question remains: can this precarious balance last, or are we teetering on the brink of a cataclysmic economic shift?

As fiscal imbalances persist, driven by coercive measures and artificial currency creation, the middle class faces erosion and purchasing power dwindles. But as the world hurtles towards a potential reckoning, the lingering question remains: can this precarious balance last, or are we teetering on the brink of a cataclysmic economic shift? Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy.

Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy.

The gold price all time high is $1895 per oz. A 2013 mining statistic stated gold needs to reach $1950 per oz. to cover mining costs…Question, are mining companies exploring and mining at a current top line revenue loss or are these numbers incorrect ?

Thanks, Charlie J.

Observation ///// Question:

Per the inimitable Eric Sprott :: China bought 16% of the total world gold production in 2013. Yes 16% and the price of gold still declined. Obviously no other commodity would have reacted similar. What market force or activity dictated the pricing behavior?

Thanks, Charlie J.