Chinese Gold Imports at Highest Level Since 2019

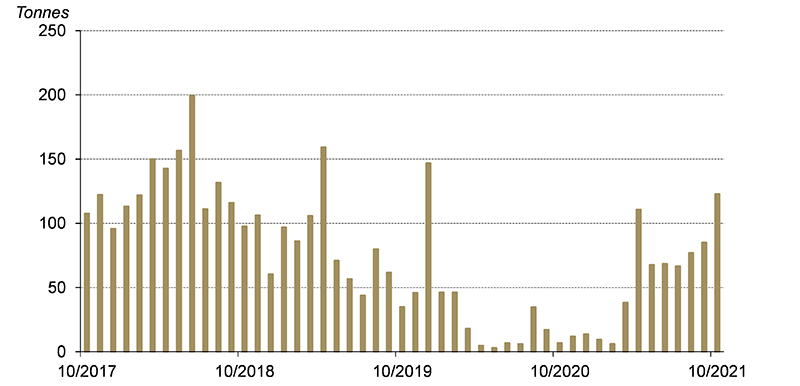

In October, Chinese gold imports reached the highest level since December of 2019 as the market continues to recover after taking a hard hit during the coronavirus pandemic.

According to the latest data from Chinese customs, the country imported 123 tons of gold in October. That was a 38-ton month-on-month increase.

China ranks as the world’s number one gold consumer.

Year-to-date, China has imported 651 tons of gold, a significant increase over 2020.

Total gold imports in Q3 totaled 228 tons. That represents a 171-ton year-on-year increase and it was 43 tons higher than 2019.

We’ve also seen a healthy rebound in Chinese retail and wholesale gold demand over the last several months.

Gold withdrawals from the Shanghai Gold Exchange (SGE) came in at 158 tons in November, a 22-ton month-on-month increase. To date, the SGE has recorded gold withdrawals of 1,552 tons, a significant year-on-year increase and 5% above the 2019 level.

According to the World Gold Council, inflation concerns, low opportunity cost and seasonal demand could support further growth in gold demand moving forward.

China is wrestling with inflationary pressure just like the US. The Producer Price Index (PPI) has surged and consumer prices appear poised to close the gap. To counter rising costs, many consumer goods companies have announced price increases, further fuelling local inflation.

Not only was Chinese gold consumption higher in Q3 2021 than both 2020 and 2019; Chinese mine output has also been squeezed. This has driven imports higher. China ranks as the world’s biggest gold producer. While gold demand rebounded in the first half of 2021, Chinese mine output did not. Gold production fell 10.2% to just 152.8 tons.

Overall gold demand was up 69.2%, coming in at just over 547 tons through the first 6 months of the year. China’s year-on-year gold consumption surged 93.9% in the first quarter alone.

According to the Global Times, the Chinese government implemented macroeconomic policies aimed at bolstering domestic gold consumption.

Last spring, China gave the green light for the import of 150 tons of gold. The report notes that China’s returning appetite for gold could potentially “support global prices.” Reuters called the size of the expected Chinese gold imports a “dramatic return to the global bullion market.”

With the eventual introduction of central bank digital currency (CBDCs) now seemingly inevitable, there are a lot of directions central banks could take with their digital currency projects that would have dramatic implications for the price of gold.

With the eventual introduction of central bank digital currency (CBDCs) now seemingly inevitable, there are a lot of directions central banks could take with their digital currency projects that would have dramatic implications for the price of gold. Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.