Chinese Gold Demand Charts Healthy Increase Through First Half of 2023

After hitting the highest level since 2019 in the first quarter, Chinese gold demand continued on a solid path through Q2.

Through the first half of the year, Chinese gold consumption surged by 16%, according to the latest data from the China Gold Association (CGA).

Chinese gold demand through H1 came in at 554.9 tons.

A CGA statement said, “With the normalization of the economy and the revival of the economy, China’s gold consumption shows an overall momentum of rapid recovery.”

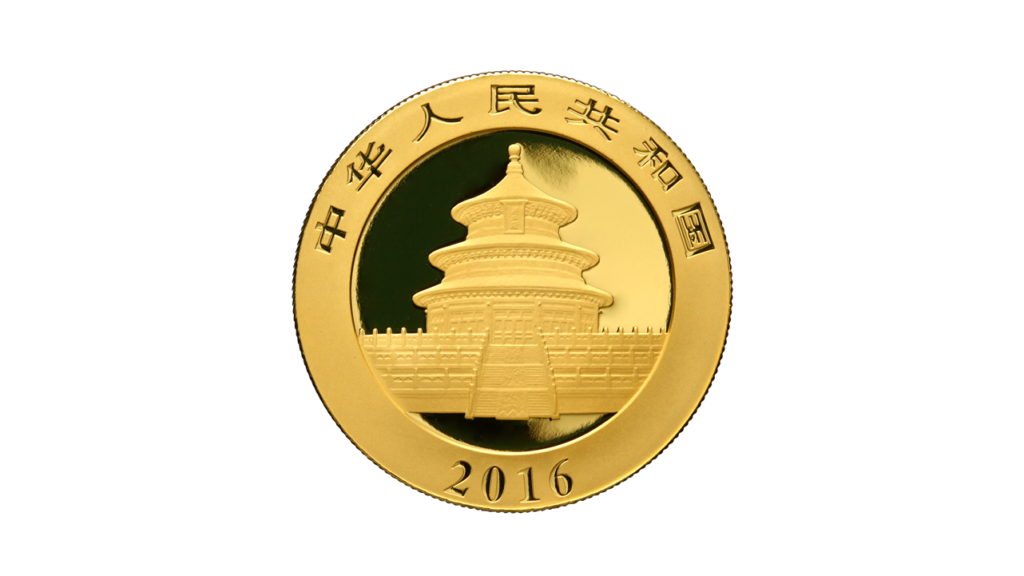

Breaking down the numbers, demand for gold bars and gold coins increased by 30.1% to 146.31 tons. Gold jewelry demand was up 14.8% to 368.3 tons.

While Chinese investors were eager to get their hands on physical gold, investment in Chinese gold ETFs fell slightly by 1.26 tons.

There was a 7.7% decrease in gold consumption for industrial and technological uses.

On the supply side, Chinese gold mine output was up a modest 2.2% to 178.6 tons over the first half of 2022.

To meet the growing demand, gold imports jumped by 17.5% to 65 tons.

The People’s Bank of China has been gobbling up gold as well. The Chinese central bank bought another 21 tons of gold in June. Since recommencing reports of purchases in November 2022, the Peoples Bank of China has added 165 tons to its official gold holdings. Officially, Chinese gold holdings stand at 2,113 tons.

There has always been speculation that China holds far more gold than it officially reveals. As Jim Rickards pointed out on Mises Daily back in 2015, many people speculate that China keeps several thousand tons of gold “off the books” in a separate entity called the State Administration for Foreign Exchange (SAFE).

Last year, there were large unreported increases in central bank gold holdings. Central banks that often fail to report purchases include China and Russia. Many analysts believe China is the mystery buyer stockpiling gold to minimize exposure to the dollar.

US Global Investors senior gold portfolio manager Ralph Aldis said China’s interest in gold is part of a broader de-dollarization theme.

China doesn’t want to hold dollars for trade as they have struck a number of trade deals with major commodity suppliers from pulp to oil around the world that are specified to trade and settle in renminbi.”

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]