This “Strong” Economy Is a Facade Built Out of Debt

Retail sales surged in January, creating the impression that the economy is humming along nicely. After all, there can’t be a problem if consumers are out there consuming, right?

But a lot of people are ignoring a key question: how are people paying for this shopping spree?

As it turns out, they’re putting a lot of this spending on credit cards.

Even with a big 1.8% decline in retail sales in December, revolving credit, primarily reflecting credit card debt, grew by another $7.2 billion that month, a 7.3% increase.

To put the numbers into perspective, the annual increase in 2019, prior to the pandemic, was 3.6%. It’s pretty clear that Americans are still heavily relying on credit cards to make ends meet.

Meanwhile, household debt rose by $394 billion in the fourth quarter of 2022. It was the largest quarter-on-quarter increase in household debt in two decades. Debt balances have risen $2.7 higher than they were at the beginning of the pandemic.

Clearly, this isn’t a sign of a healthy economy. Americans are spending more on everything thanks to rampant price inflation that doesn’t appear to be waning, and they’re relying on credit cards to do it. Saving has plunged. This isn’t a sound economic foundation, and it isn’t even sustainable. Credit cards have a nasty thing called a limit. And with credit card interest rates at record-high levels, people will reach those limits pretty quickly.

I ran across something the other day that provides an even more striking example of just how reliant the US economy is on debt.

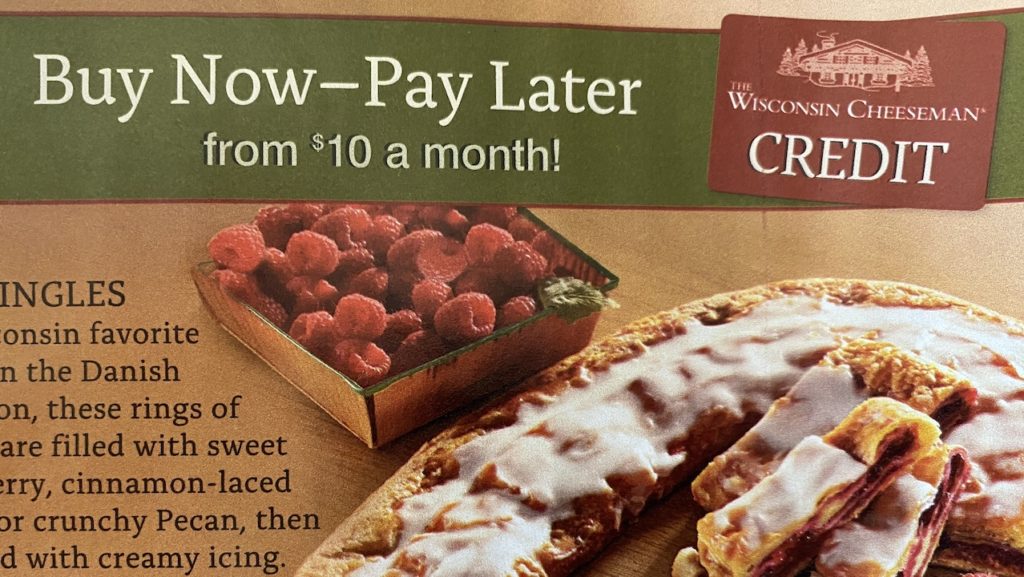

A company called the Wisconsin Cheeseman sells gift packs of cheese, candies and other treats. And you can buy the gifts on their in-house credit plan.

Let this sink in for a moment. A primary pitch from a gift company is that you can buy on credit.

The annual percentage rate will run you a modest 5.75% to a hefty 25.99% depending on the state. (Most states are currently above 20%. But don’t worry. Your payments can be as low as $10 a month.) Just don’t think about the fact that you’ll probably be paying for this cheese for years to come.

There are other companies facilitating borrowing this doesn’t even show up in the official debt figures.

The use of BNLP services such as Affirm, Afterpay and Klarna has exploded in the last couple of years. These services allow consumers to pay off purchases through installment payments, often interest-free. In a December 2021 report, Cardify CEO Derrick Fung said buy now, pay later has rapidly become more mainstream.

“The consumer over the last 12 months has become more compulsive and BNPL products are the result of us being locked up for too long and wanting more instant gratification,” he said.

Buy now, pay later is a convenient way to spread out spending, but there is a dark side. It encourages consumers to spend more. Nearly 46% of those polled said they would spend less if BNPL wasn’t an option.

The rise of buy now pay later (BNPL) is another sign of a deeply dysfunctional economy. Americans are piling up millions of dollars of additional debt using BNPL on top of their credit cards.

So, while the mainstream pundits tell you the economy is strong, they are looking at a facade. It’s a house of cards. And eventually, it will collapse.

American consumers continue to “support the economy” by spending money today despite rising prices. But they’re borrowing to do it. Tomorrow is fast approaching. And with it depleted savings, higher interest rates, and looming credit card limits. This is simply not a sustainable trajectory, no matter how the mainstream press tries to spin it.

Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […]

Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […] The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […]

The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […] The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […]

The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […] The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […]

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […] What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.

What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.