Gold Price Action Observations and a Look Ahead

This article was written by Joel Bauman, SchiffGold Senior Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold. The article focuses on the gold market through the lens of technical analysis. Technical analysis is a subjective form of study based on historical price patterns. The analysis offered is for educational purposes and is not a recommendation to buy or sell.

This article was written by Joel Bauman, SchiffGold Senior Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold. The article focuses on the gold market through the lens of technical analysis. Technical analysis is a subjective form of study based on historical price patterns. The analysis offered is for educational purposes and is not a recommendation to buy or sell.

Gold’s First Quarter of 2018

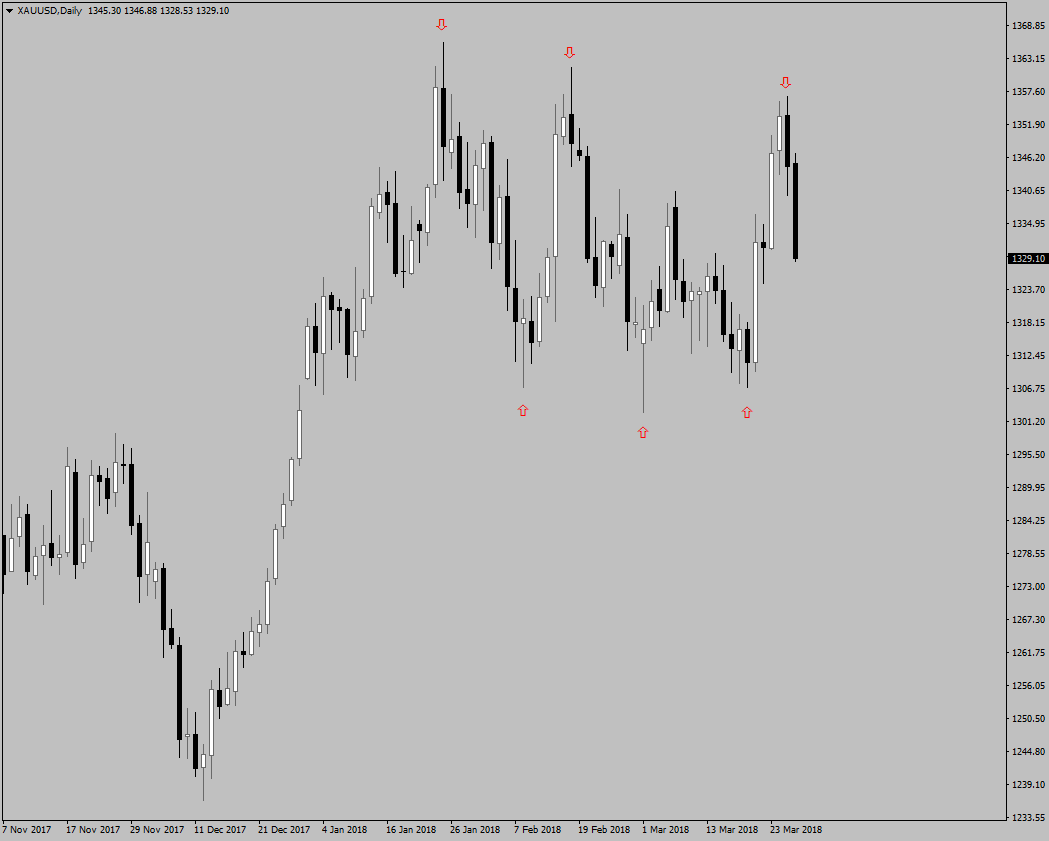

The gold price has been indecisive, to say the least. The 2018 price range has been set between $1,300 and $1,365.

Three swing-highs tested the upper $1,365 range. The first was on January 25, followed a by a retest a few weeks later on February 16. March 27 was the most recent stab at breaking the $1,365 price resistance.

Comparably there were three noticeable swing-lows made on February 8, March 1, and March 20 respectively.

These six price pivots are denoted by the red arrows on the daily gold chart below.

Looking more closely at the 2018 price range of $1,300 to $1,365, gold has been trading mostly below $1,332.50 – the midpoint between the $1,300 and $1,365 price range. The lower $1,300 price level has been the stronger price magnet compared to $1,365.

There were two sharp selloffs following the two most recent swing-highs, February 16 and March 27.

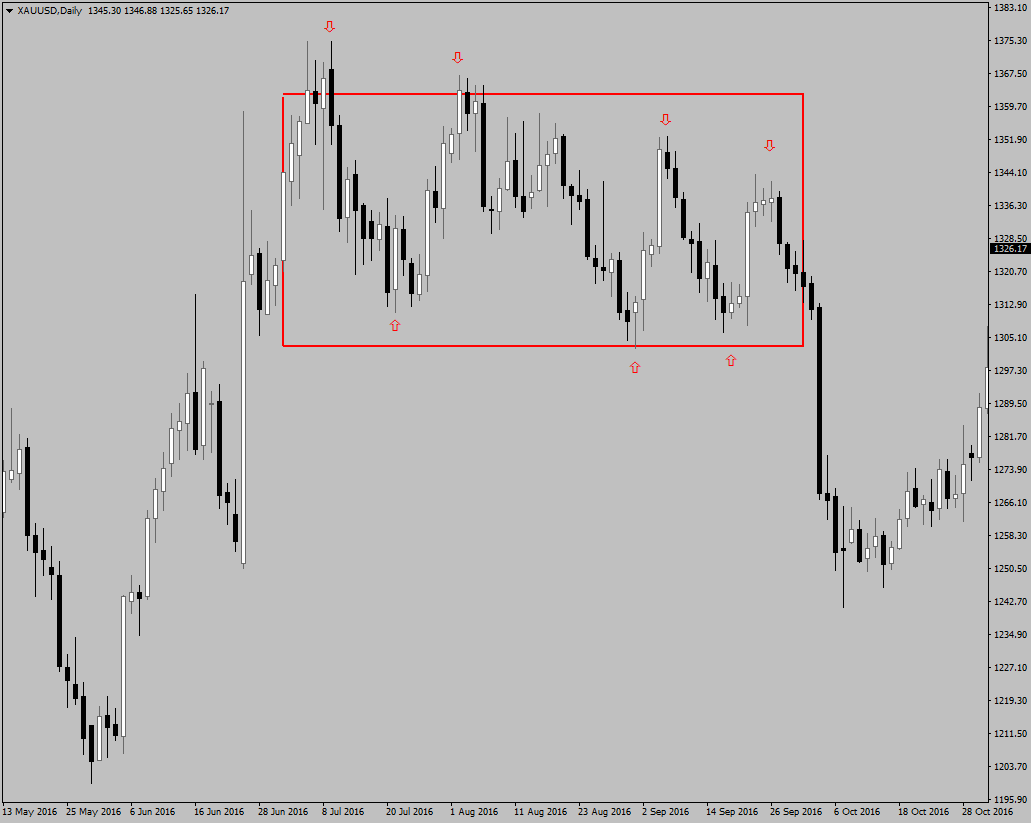

This first quarter of 2018 was comparable to the third quarter of 2016, which also seemed to find support around $1,300 and resistance around $1,365.

Here is a daily chart for the middle of 2016 (Q3 highlighted in the red box).

In both Q1 of 2018 and Q3 of 2016, the swing highs were descending in price, “lower highs,” and the last two swing highs of Q3 also were followed by a sharp decline.

On October 4, 2016, gold’s price eventually broke the $1,300 support level and subsequently sold off for following two months to a low of $1,122 in December.

Outlook for the Next Quarter of 2018

Going into the next few months, we will most likely see a retest of the magnet/support level of $1,300. This is based on 2018’s lower swing-highs followed by sharp selloffs and historic price consolidation around this $1,300 level.

It will be interesting to see how gold’s price action reacts to the $1,300 level if we retest. The question is will it quickly bounce and return to the $1,365 highs? Or maybe it will break the $1,300 support level and make a large price move to the downside similar to October 4, 2016. I anticipate we’re going to see something in between these two scenarios, with the price consolidating around the $1,300 level.

Considering the recent selloffs and lower swing-highs, I believe there is enough short-term selling pressure to retest and potentially break below $1,300.

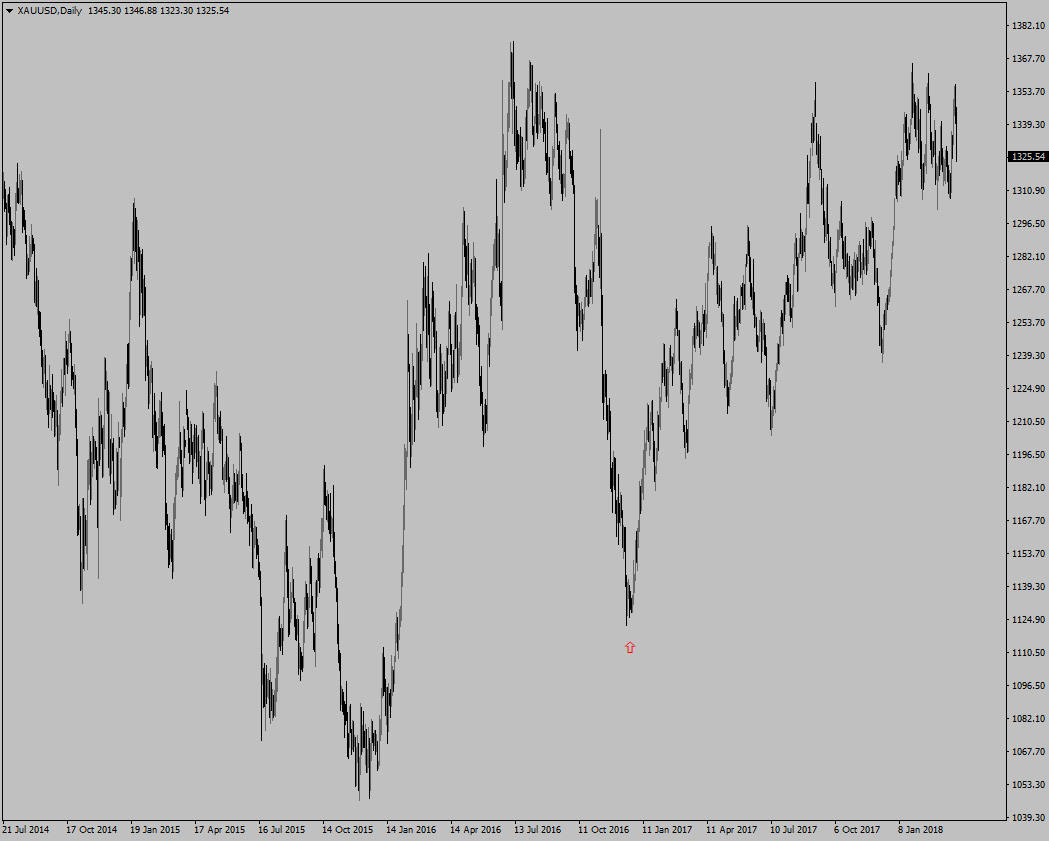

If we break below $1,300, I do not believe we will see gold’s price freefall dramatically like we did from October through December of 2016. There are some well-established technical support levels that exist now that did not exist in the middle of that year.

For example, the price swing-low of $1,122 that was formed in December of 2016 created the long-awaited multi-year higher swing-low that many traders look to confirm a change in trend (The multi-year higher swing-low is marked by the red arrow in the graph above).

Traders are looking to buy dips. There are a number of lesser support levels that formed between $1,122 and $1,300 during the uptrend of 2017. Traders will gladly use these 2017 support levels to set their buy limit orders.

In other words, if we see gold break below $1,300 it probably won’t be long before the price returns to $1,300 or higher because of all the support. Hence, I believe we are going to see at least another quarter of consolidation in 2018.

Conclusion

- This first quarter of 2018 is looking very similar to 2016’s Q3.

- We have support at $1,300 and resistance at $1,365

- Gold currently is on its way back down to test the $1,300 support level

- Gold may hold or break below $1,300

- Lastly, I expect gold to consolidate around $1,300. Even if breaks below $1,300 it probably won’t drop far because of the strong support levels.

You can contact Joel directly at 1-888-GOLD-160 ext. 117 or via email at: jbauman@schiffgold.com

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […]

The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […] The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […]

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […] What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.

What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them. With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […]

With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […] America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures.

America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures.