Back in the fall, former Federal Reserve Chairman Alan Greenspan stirred things up by making some public statements about the importance of gold, calling it “the premier currency, where no fiat currency, including the dollar, can match it…” Greenspan also indicated that he believes the Fed’s balance sheet will eventually catch fire and ignite some serious inflation. A good reason, he argued, to buy gold.

Well, now Greenspan is back in the news throwing a “wet blanket” on hopes for US growth, as Bloomberg puts it.

While few are as blunt as Peter Schiff in warning of another bubble in real estate, mainstream analysts are starting to worry that the US housing market isn’t as strong as many believe. Peter warns that rising home prices are a product of extremely low interest rates suppressed by the Federal Reserve. Robert Shiller, Nobel Laureate economist, seems to agree in a recent interview on CNBC:

There’s also the worry that the very low interest rates that we’ve had, with the 10-year just above 2%. That has also been driving this [housing] market. That is fragile… I’m not calling a turning point yet, but I feel a little bit of anxiety about the market.”

Shiller plays it cool, but admits that he thinks the market is looking like a bubble in San Francisco and possibly Miami:

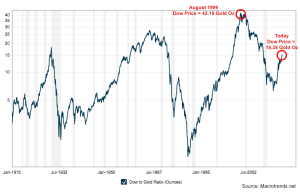

The Dow Jones Industrial Average broke through another record high yesterday, closing at about 18,030. A record high in United States dollar value, that is. When valued in ounces of gold, the Dow is nowhere near its historical high, which we saw in 1999. Take a look at this chart, showing the Dow to gold price ratio:

MarketWatch published an article reviewing the growing gold repatriation movement throughout Europe. While the author tries to take a “balanced” mainstream view and even throws in a few swings at gold bulls, he is forced to admit that the trend is troubling. There’s only one reason so many countries would want their gold back on sovereign soil – fears of a massive currency crisis. Matthew Lynn writes:

The point about having gold on your own soil is that it is an insurance policy against a chaotic return to national currencies. The fact that so many countries seem to want that insurance tells you something important about the euro — and it is hardly comforting. They still think there is a real possibility of collapse.”

SchiffGold is pleased to announce that we now feature junk silver bags amongst our product offerings. These bags contain United States dimes, quarters, or half dollars minted in or prior to 1964. That was the last year the US Mint used real silver to mint its circulating coins. These coins are 90% silver and worth much more than their face value (not to mention much more than their modern counterparts minted with base metals). A pre-1964 Washington quarter is worth a little under $3 at today’s silver price!

Junk silver coins make a great holiday gift for your friends and family. Not only will you give them something of real value to add to their savings, but you can also use the opportunity to educate them about the value of sound money.

Click Here to See Our Junk Silver Offerings

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Lots of smart people are wondering if Russia might adopt a gold backing for the ruble to strengthen its ailing currency and economy. The idea is even getting traction in mainstream news with a new article from CNBC. Alasdair MacLeod, an expert precious metals analyst, explains why Russia would favor a gold standard:

There is no doubt that Russia and China, plus the other Eurasian states in their sphere of influence are all accumulating gold and the indications are they see it as central to replacing the US dollar for cross border trade.

…

It is already in Russia’s interest to cast itself off from inflating western currencies and to base their economy on sound money, aka gold.”

Financial markets are watching the Federal Reserve this week to see if they change any of their language regarding monetary policy going into 2015. Janet Yellen will give a statement on Wednesday, and how she addresses interest rates is of particular interest. Economists are expecting the Fed to drop the phrase “considerable time” from their statement, which could indicate an interest rate hike in the first half of next year. This would be the rational course of action if the US economy is actually improving, as the Fed claims.

However, as Peter Schiff has been saying for some time, the economy is not really improving. Peter expects that the Fed will find more excuses to not only keep interest rates down, but to actually start up another round of quantitative easing before too long.

Enter renowned financial manager Bill Gross. Last week, he suggested that the plummeting price of oil might be that very excuse.

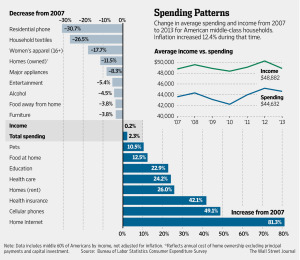

In spite of the government’s ongoing narrative of a US economic recovery, major news outlets continue to remind us that life isn’t getting easier for most Americans. The Wall Street Journal recently published a lengthy expose on the rising cost of basic necessities. This chart shows how much more middle-class American households are spending thanks to 12.4% inflation since 2007.

The Silver Institute forecasts that demand for industrial silver will increase by 142 million ounces by 2018 – a 27% rise from 2013 levels. The majority of this growth will come from the electronics sector, where silver is used as one of the most reliable and efficient electrical conductors on earth.

However, every major application of industrial silver will experience considerable growth by 2018. These include batteries, ethylene oxide (EO), photovoltaic power, automative, brazing and alloys, bearings, printed silver inks, medical, and water purification. Here’s a break-down of silver demand by geographical region:

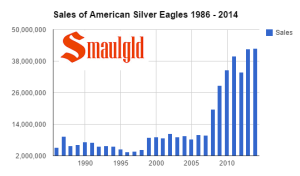

The United States Mint has officially sold a record amount of silver two years in a row. As of Monday, US Mint sales of American Silver Eagles for 2014 reached 42,864,000, surpassing the total annual sales of 42,675,000 in 2013. The US Mint temporarily sold out of Silver Eagles earlier this year and had to begin offering them on an allocated basis.

As you can see in this chart from Smaulgld, US Mint silver sales really took off seven years ago and have remained robust. We have every reason to believe that this record demand will continue in the coming years.