Last week, Peter Schiff defended the intrinsic value of gold by briefly explaining how many uses it has beyond bullion investment. Many people have no idea how integral gold is to products they rely upon every day, not to mention exciting technologies of the future.

People who argue that gold is becoming less useful in the modern world simply don’t understand the basic fact that the applications of gold are expanding every year, not shrinking. Either that, or they expect the human race to abruptly curtail its exploration of space, stop making high-end electronics, and find a more stable element for use in medicine. On top of that, gold detractors must assume that the age-old association of gold with prestige, success, and wealth is going to suddenly vanish from the earth.

So what makes gold so valuable outside of its monetary value?

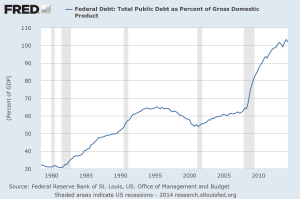

The national debt of the United States officially surpassed $18 trillion this past week. The news has been making the rounds of every media outlet, with many economists reminding us of the very shaky footing of the US economy. However, there are other analysts who play down this outrageously irresponsible amount of debt.

In his latest in-depth commentary, David Stockman explains the larger narrative of US fiscal policy that delivered this growing debt load. Stockman should know something about the topic. He was Director of the Office of Management and Budget under Reagan back in the early 1980’s, which is when US debt passed $1 trillion for the first time.

Think about that – it took more than 200 years for US debt to reach $1 trillion. But as Stockman points out, the last $1 trillion of debt accumulated in about 1 year.

China has officially surpassed the United States as the largest economy in the world, based upon economic output as measured by the International Monetary Fund. China’s production of real goods and services will touch about $17.6 trillion this year, while the US will produce $17.4 trillion.

This gap will continue to grow, according to the IMF. By 2019, China is projected to produce about $26.8 trillion, while the US will produce about $22.1 trillion. That translates to a growth rate of more than 52% in the next five years for China, while the rate of US economic growth will be nearly half of that – just 27%.

An article on MarketWatch explores this news in more detail, and touches on the profound implications of this trend. :

Yes, all statistics are open to various quibbles. It is perfectly possible China’s latest numbers overstate output — or understate them. That may also be true of U.S. GDP figures. But the IMF data are the best we have.

Make no mistake: This is a geopolitical earthquake with a high reading on the Richter scale. Throughout history, political and military power have always depended on economic power. Britain was the workshop of the world before she ruled the waves. And it was Britain’s relative economic decline that preceded the collapse of her power. And it was a similar story with previous hegemonic powers such as France and Spain.“

This is, of course, a long-term development. The US will continue to dominate the world for some time, but the winds are changing. Those winds are blowing East, to a land where the government and people still inherently understand the value of real money – physical gold.

More than three years ago, a jury found Bernard von Nothaus guilty for “making, possessing and selling his own coins,” which Nothaus had dubbed the Liberty Dollar. This week, a judge has passed a very lenient sentence on Nothaus despite pleas for a long prison term from the prosecution. More importantly, the judge ruled that the $7 million worth of confiscated silver be returned to Nothaus.

Nothaus was selling silver bullion coins that the government claims too closely resembled American silver coins. Therefore, Nothaus was a counterfeiter in the eyes of the government. The prosecuting attorney even went so far as to claim that Nothaus was attempting to “undermine the legitimate currency of this country,” and that this was “a unique form of domestic terrorism.”

Here’s a picture of the coin – anyone familiar with US Mint silver coinage can clearly see that the Liberty Dollar is different.

The truth is that Nothaus simply wanted to get physical silver into the hands of Americans, while simultaneously educating them about the loss of purchasing power in the dollar.

India – once the world’s largest gold consumer – has eased restrictions that had limited its gold imports and allowed China to overtake it in gold consumption. The so-called “80:20 rule” has been dropped, which required gold importers to reexport at least 20% of their imported gold. The rule was supposed to shrink a high current-account deficit, but it also led to a surge in illegal smuggling across the country.

In the immediate future this is positive news for gold investors – the second largest consumer of gold in the world will likely very soon begin to officially buy more gold.

Swiss Vote “No” on the “Save Our Swiss Gold” Initiative

Wall Street Journal – Swiss voters voted down the Swiss gold referendum that would have forced the Swiss National Bank to hold 20% of its assets in gold. About 78% of voters were against the initiative, which was heavily opposed by the SNB and much of the Swiss parliament. Opponents said the measure would have made it too difficult for the bank to maintain its monetary policy that depends on pegging the Swiss franc to the weaker euro. Advocates for the initiative hoped it would strengthen the weakening Swiss franc. The measure would have also prevented the SNB from selling gold and required it to repatriate its gold. The SNB currently has 1,040 metric tons of gold, only about 7.5% of its assets.

Read Full Article>>

Netherlands Repatriating Gold Reserves from US

Wall Street Journal – The Dutch central bank (DNB) will be moving some of its gold reserves held at the New York Federal Reserve back to the Netherlands. The DNB currently holds 11% of its 612 metric tons of gold reserves domestically and wants to increase that to 31%. Currently, 51% of its gold reserves are stored at the NY Fed, but this will drop to 31% after the repatriation. The DNB is the latest European central bank to express concerns about the safety of its gold reserves held abroad, following the example of the German gold repatriation effort begun in 2013. According to the DNB, the repatriation will have “a positive effect on public confidence” by distributing its gold reserves in “a more balanced way.”

Read Full Article>>

Switzerland will vote on the “Save Our Swiss Gold” initiative this Sunday, and the news is reminding everyone just why the financial world is watching so closely. USA Today and the Wall Street Journal can give you a good summary of how the Swiss gold initiative would affect the policies of the Swiss National Bank (SNB). The Guardian explains why a “yes” vote on the initiative would be extremely bullish for gold in this article published yesterday:

Its supporters come from the populist right-wing Swiss People’s party (SVP), which says in its mission statement: ‘Most Swiss don’t even know that part of the nation’s gold is stored abroad and that the SNB has already sold over half of the gold reserves.’

This post was submitted by Erik Oswald, SchiffGold Precious Metals Specialist.

While financial commentators continue to bash gold as an asset that produces nothing and should be left to the pages of history, the real story of the gold market is found at the macro economic and fundamental level. Central banks the world over have been net buyers of physical gold since 2011. On top of this, many sovereign nations have been requesting and taking delivery of their gold holdings from the New York Federal Reserve and London, where a majority of central banks’ gold holdings are stored.

Major news hit today on this front. The Netherlands has become the most recent Western European nation to take delivery of their physical holdings from the NY Fed. The Dutch central bank located in Amsterdam has increased its domestic holdings of physical bullion from 11% of total gold reserves to 31%. The official domestic Dutch gold horde has increased from about 67 tons to nearly 190. While this number is small in comparison to the reserves held by countries like China, Russia, and (allegedly) the US, the act of removing physical bullion from an international depository and returning it to the country of origin represents yet another vote of no confidence in the US financial system.

The price of gold in US dollars was up 1.5% this morning, boosting it to a 2-1/2 week high. Although the financial media continues to be bearish on precious metals, central banks around the world are starting to look more closely at the yellow metal as an important asset. Their reasons for buying or considering to buy gold vary widely from one bank to the next, but analysts are starting to expect a boost to the gold price in December thanks to central banks.

The 3rd quarter of 2014 marked the 15th consecutive quarter that central banks were net purchasers of gold, according to the World Gold Council. Here’s a brief rundown of some of the notable international gold news this week:

This post was submitted by Erik Oswald, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

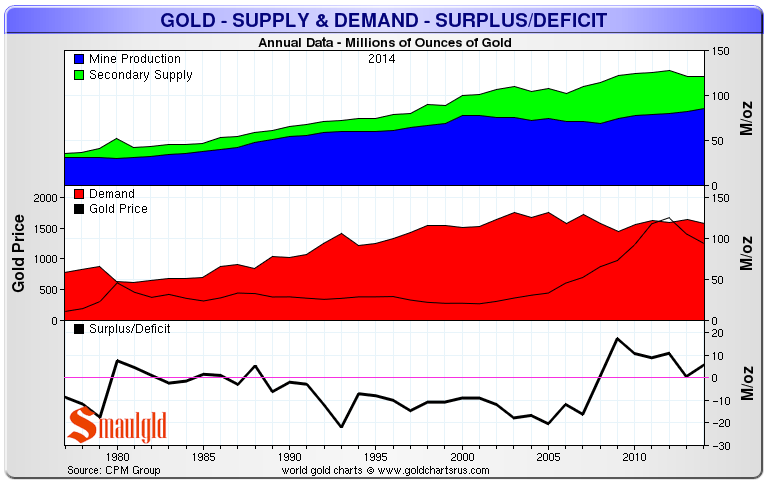

In this article from Smaulgld, Louis Cammarosano examines the fundamental supply and demand figures for the gold market. Demand for physical gold has been increasing year over year since 2008, despite rising prices up until 2012. Following the correction from $1900 per ounce, market demand for physical bullion really took off. While many in the West do not appreciate the monetary significance of precious metals, the East has been consuming physical gold and silver at an unprecedented rate. This is evident in the official reserves reported by central banks. On the whole, Western central banks have been decreasing their holdings of physical bullion while Eastern central banks have been all too eager to purchase the surplus.

Countries like China are all too familiar with the dangers of paper monetary systems and have a much longer view of history than most Western central banks. The United States has never experienced a hyper inflationary environment in which the dollar has dropped to its intrinsic value of zero. Because we have exported inflation to our trading partners since World War II, we have been able to stave off the destructive effects of circulating irredeemable paper notes as real money in ever increasing quantities. Meanwhile, the developing BRICS countries have been cementing various trade and financial agreements with one another over the last several years. Their appetite for physical gold and silver is but one of many steps being taken to prepare for a world without the US dollar as a reserve currency.