Jim Clifton of Gallup, CEO of one of the largest public polling companies in the world, has published a severe indictment of the official unemployment data reported by the United States Department of Labor. Obama and Wall Street cite the 5.6% unemployment rate as a triumph of the American economic recovery, while conveniently ignoring the raw data behind that number.

There’s no other way to say this. The official unemployment rate, which cruelly overlooks the suffering of the long-term and often permanently unemployed as well as the depressingly underemployed, amounts to a Big Lie.”

The London Gold Fix is a nearly 100-year-old price-setting system for the international price of gold. Beginning in March, one or more Chinese banks may be included in the pool of fix participants for the first time ever.

German Central Bank Continues Gold Repatriation

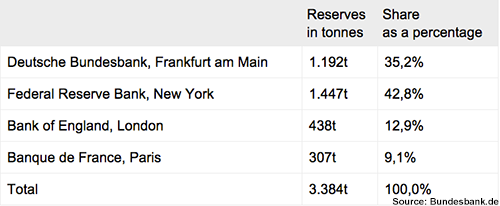

Bundesbank – Germany’s central bank, the Bundesbank, increased its transfer of foreign gold reserves back into Germany in 2014, bringing 120 metric tons to Frankfurt. 85 of those tons came from the New York Federal Reserve. This repatriation process began in January 2013, when the Bundesbank announced a plan to store half of its gold reserves at home by 2020. To achieve this goal, Germany will have to repatriate 300 tons from New York and 374 tons from Paris. It has now transferred 23% of that total 674 tons.

Read Full Article>>

The Chinese yuan became one of the top five payment currencies in the world in November, according to the latest data from SWIFT, one of the largest international interbank transaction companies. The yuan jumped from seventh to fifth place, overtaking the Australian and Canadian dollars. With the yuan accounting for 2.17% of global payments, it is not far behind the Japanese yen, which has a 2.69% share.

As Wim Raymaekers, Head of Banking Markets at SWIFT, puts it:

The RMB breaking into the top five world payments currencies is an important milestone. It is a great testimony to the internationalisation of the RMB and confirms its transition from an ’emerging’ to a ‘business as usual’ payment currency. The rise of various offshore RMB clearing centers around the world, including eight new agreements signed with the People’s Bank of China in 2014, was an important driver fueling this growth.”

Russia has added more gold to its foreign reserves, making December the ninth month in a row that it has bought the yellow metal. Russia’s gold holdings are now the largest they’ve been in two decades, according to the International Monetary Fund.

Smaller countries have also been stocking up on the yellow metal. Kazakhstan added to its reserves for the 27th straight month. Malaysia, Belarus, Greece, Kyrgyz Republic, and Serbia also bought gold.

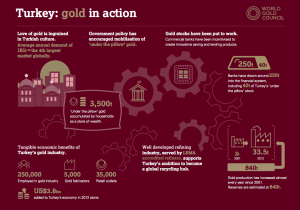

The World Gold Council has released a fascinating new report on Turkish gold demand and gold culture. Many gold investors are aware that China and India have been the top gold consumers in the world, but Turkey has a thriving gold economy as well. In fact, Turkey is the world’s 4th largest gold consumer, and in many ways, gold is even more integrated into the Turkish economy.

- At least 3,500 metric tons of gold is saved “under the pillow” of Turkish citizens.

- Turkey works actively to encourage wise investment and savings of this gold.

- Gold ATMs are common in Turkey, making it easy for consumers to buy high-quality physical bullion.

The World Economic Forum’s meeting in Davos ended this past weekend, and much of the mainstream news focused on the hypocrisy of the world’s wealthiest individuals discussing the plight of the global economy. Research released by Oxfam in the middle of the conference shows that the richest 1% own 48% of the world’s wealth. Politicians love broad statistics like this, which they can use to justify more government “solutions” to this inequality.

However, it’s these same successful (and rich) businessmen who are sounding the alarms about the destructive policies of global central banks. These monetary policies are the single biggest contributor to income inequality, because they enrich the financial elite while destroying the economic fundamentals that allow the lower and middle classes to prosper. Renowned business magnate George Soros made the news at Davos when he stated the obvious:

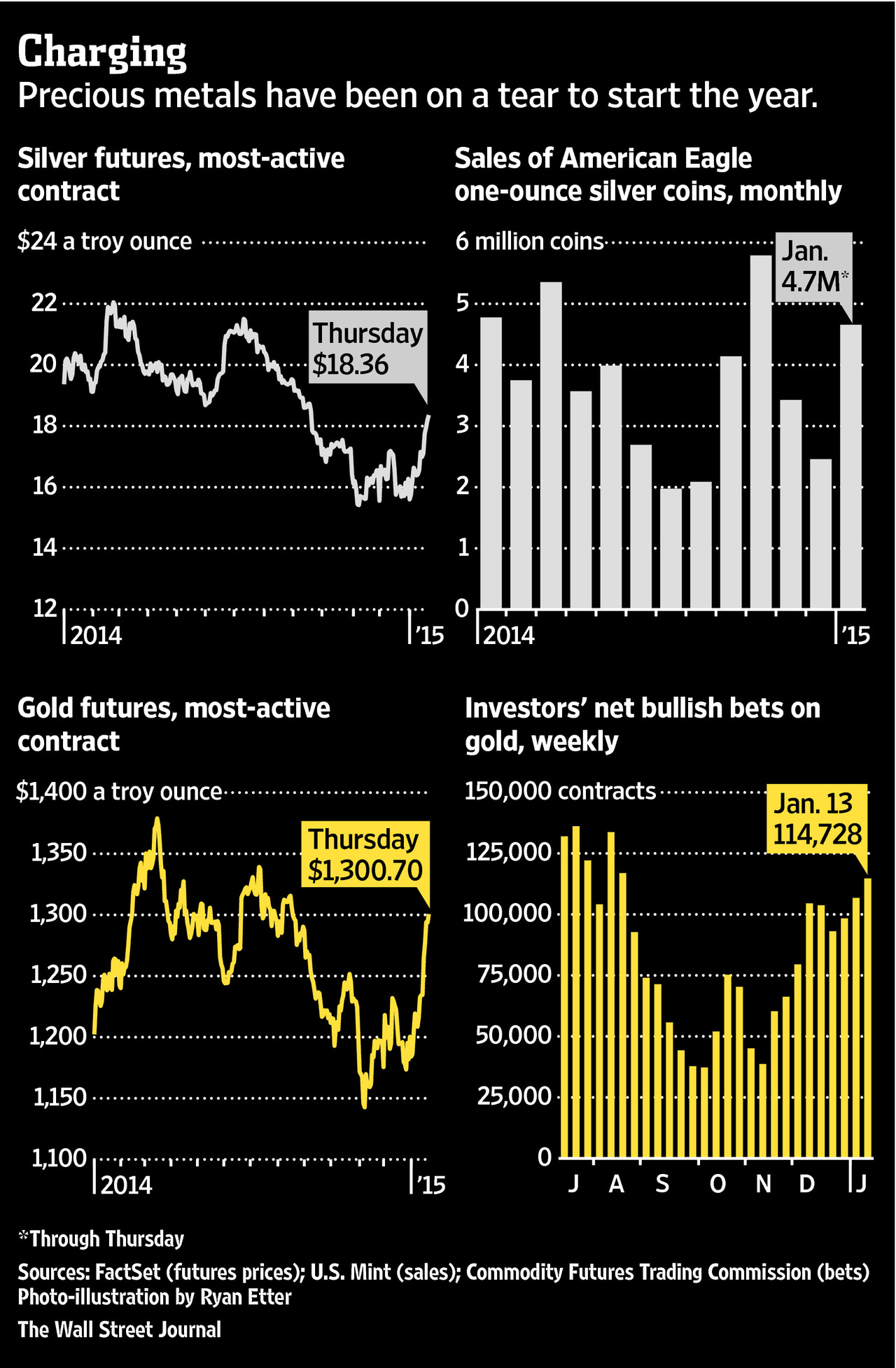

As of this morning, gold is up more than 10% and silver is up more than 16% since the beginning of the year. Gold stocks have also been strong, especially in the mining sector. While the S&P 500 has dropped about 1%, the Arca Gold Miners Index is up nearly 25%. Unsurprisingly, the mainstream financial media is starting to jump on the gold bandwagon.

In an article on the front page of its business section, The Wall Street Journal looks at all the factors influencing bullish sentiment for precious metals thus far in 2015. These include:

The European Central Bank (ECB) will begin a new quantitative easing (QE) program in March. The central bank announced this morning that it would buy at least 1.1 trillion euros worth of euro-denominated bonds from governments and private institutions across Europe. It will begin its monetary manipulation at the rate of €60 billion a month, which will last into the fall of 2016. If you’ve got a few minutes to waste, you can watch ECB President Mario Draghi deliver the news himself:

Like Janet Yellen, Draghi uses the bogus excuse of low inflation as one of the primary justifications for the program. This renewed commitment to creating European inflation boosted to gold, pushing it over $1,300.

The German central bank (Bundesbank) repatriated 120 metric tons of gold in 2014. 85 of those tons came from the New York Federal Reserve, which held nearly half of Germany’s gold at the time. This is in sharp contrast to repatriating just 37 tons in 2013 – only 5 of which came from New York. It would appear that Germany is quite serious about getting its gold back after all.

At the beginning of 2013, the Bundesbank announced that it would begin the process of repatriating massive amounts of its physical gold reserves back into Germany. The goal is to have half of its gold back in Germany by 2020. Currently, nearly 65% of its reserves are stored in the New York Federal Reserve, the Bank of England in London, and in the Banque de France in Paris. New York alone holds almost 43% of Germany’s gold: