Wal-Mart announced yesterday that it is going to raise its minimum wage to $9 an hour, which will affect a half-million employees. Many are praising the company and saying this will improve the lives of low-wage workers, while also providing a boost to the American economy. However, Peter Schiff isn’t so optimistic. He explained to Yahoo! Finance why Wal-Mart’s minimum wage increase isn’t necessarily a net positive for the economy.

The wage increase will cost Wal-Mart about $1 billion this year. Who knows if Wal-Mart will pass along the cost of higher wages to its customers by raising prices? More importantly, Wal-Mart will probably cut back on hiring, which means low-income Americans will have that much more difficulty finding a job.

The dollar dropped while gold rose early this morning as the markets reacted to the release of the Federal Reserve’s minutes from its January meeting. The minutes show that Fed officials are more worried about raising interest rates than most of the markets thought. In fact, there was even talk of easing their monetary policy even further. Quoting from the minutes:

A few (members) expressed concern that in some circumstances the public could come to question the credibility of the Committee’s 2 percent goal… Indeed, one participant recommended that, in light of the outlook for inflation, the Committee consider ways to use its tools to provide more, not less, accommodation.”

Last week, Peter Hug said that about 25% of all physical gold buyers are “crazies.” The comment is remarkable, because Hug is an executive at Kitco, one of the largest precious metals dealers in North America. In fact, Hug is the Director of Kitco’s Precious Metals Division.

Hug’s reasoning is that a lot of the people who buy physical gold believe that the United States financial system is headed for a dire crisis. Many are worried about a complete collapse of the US dollar. The rationale for this belief is pretty simple and comes back to basic economics.

Analysts are expecting Indian Prime Minister Narendra Modi to cut the huge 10% gold import tax in his budget proposal at the end of February. Late last year, India scrapped its import rule that required 20% of all gold imports to be reexported. Premiums, and consequently smuggling, have both dropped since then. If Modi were to significantly cut the tax as well, India could see an additional 23 million ounces of gold demand in 2015. This would add significant support to global gold prices.

Europeans bought a lot more gold in January. Investors turned to the yellow metal to protect themselves economic turmoil that could result from Greece leaving the eurozone and the oncoming wave of European quantitative easing. The price of gold in euros has already risen 9% in 2015, putting it at a 21-month high.

Europeans are acting fast as the euro continues to lose value against the dollar. Banks and gold dealers around the continent are reporting a huge surge in sales.

The World Gold Council (WGC) has released its Gold Demand Trends report for the full year of 2014. Overall, gold demand was down 4% compared to 2013. The financial media often latches on to just this headline number, adding it to the list of factors it uses to discredit investment in physical gold and silver.

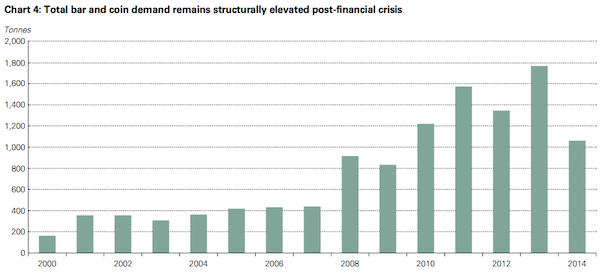

Once again, it’s important to emphasize that gold investment is a long-term strategy. Judging the strength of the physical gold market and investor interest in precious metals by simply comparing year-over-year statistics is a short-sighted game. 2013 saw an all-time record high for physical bar and coin demand, largely because investors rushed to take advantage of a lower price. It’s no wonder that 2014 couldn’t compete, with its relatively stable price of gold in US dollars.

However, compare total bar and coin demand in 2014 to 2004. It’s nearly 300% higher. As the WGC notes, “demand remains well above levels that were the norm in the pre-financial crisis world.”

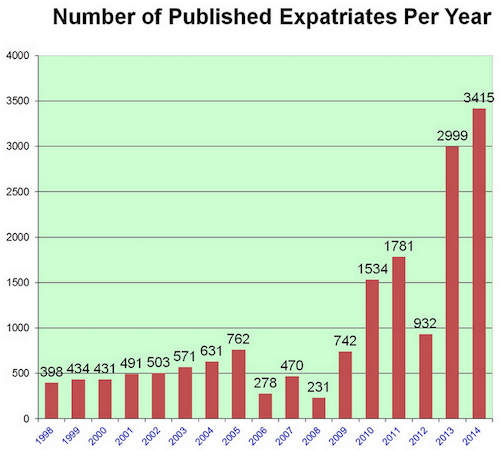

A record number of individuals renounced their American citizenship or residency in 2014, according to the Treasury Department – a total of 3,415 people. This number is 14% higher than last year, which was also a record year that clocked in 2,999 new expatriates. While there is no definite way to know why these numbers are ramping up, analysts are pretty sure it’s because the United States extended its draconian tax reporting requirements internationally a few years ago.

Alan Greenspan has predicted that Europe is not going to continue to loan money to Greece. He believes this will lead to Greece exiting the euro, and possibly the eventual dissolution of the euro entirely.

Axel Merk agrees that Northern Europe is ready to abandon Greece. He gives an excellent, in-depth explanation of the Greek situation in an interview with Greg Hunter of USAWatchdog. He explains that Greece’s situation is just one manifestation of the same problem faced by all developed economies: an inability to balance budgets and pay down debt. Ultimately, Merk warns that this will trigger massive inflation thanks to the meddling of central banks.

At the end of January, Senator Rand Paul re-introduced the “Audit the Fed” bill first promoted by his father, Ron Paul. If passed, the bill would hopefully make the Federal Reserve more transparent by opening it to a direct audit from the Government Accountability Office (GAO). The Fed has been legally exempt from GAO audits since 1978.

Of course, the Fed is terrified of opening its doors to the public. As Reuters reported:

Gallup CEO Jim Clifton caused big waves across the media on Tuesday when he published an article calling the official government unemployment number of 5.6% a “big lie.” Clearly the powers that be were not pleased with the criticism. The very next day, Clifton appeared on CNBC to qualify his statement.

In an almost Orwellian turn of events, Clifton hinted that he was afraid of the government if he didn’t disavow his written statement:

I don’t think that the government is misleading us at all. I think that the number that comes out of BLS (Bureau of Labor Statistics) and the Department of Labor is very, very accurate. I need to make that very, very clear so that I don’t suddenly disappear. I need to make it home tonight…”

As the interview continued, Clifton softened his condemnation of the official data by calling it “very, very misleading.”