Peter Schiff spoke briefly with Ben Bernanke at the SkyBridge Alternatives (SALT) Conference yesterday. Approaching the former Federal Reserve Chairman, Peter warned, “In full disclosure, I’m your biggest critic.” Bernanke didn’t miss a beat: “You have a lot of competition.”

What do precious metals experts know about silver that you don’t? The white metal has far more upside potential than gold.

Silver’s unique qualities are convincing many investors to allocate a large portion of their precious metals holdings into the white metal.

And with the silver price touching cyclical lows, now is a great time to buy. Learn everything you need to know in the newly revised edition of The Powerful Case for Silver. This exclusive special report has just been updated with the latest industry statistics and news affecting physical silver. Now you can invest in silver with confidence.

Swiss Gold Exports to China & India Doubled

Bloomberg – Exports of Swiss-refined gold to China and India doubled in March to 46.4 metric tons and 72.5 tons respectively. This is the highest monthly data since January 2014, according to the Swiss Federal Customs Administration. Much of the gold is coming from the United Kingdom, which increased its Swiss exports sixfold last month. This is a continuation of a trend that started in 2013, when China and India began buying the gold sold by gold-backed funds that had attracted Western investors. These funds sold the largest amount of the metal in March since 2013, totaling 55.7 tons.

Read Full Article>>

The war on cash is a growing collection of laws and banking regulations that discourage or prevent citizens from doing business in physical currency. Last month, we reported on new laws in France that will limit the size of cash transactions. On a smaller scale, the state of Louisiana has recently made it illegal to use cash when transacting secondhand goods. For years now, American banks have been required to file “Suspicious Activity Reports” when cash transactions or withdrawals of more than $5,000 occur.

According to lawmakers, these regulations ostensibly ensure that business transactions are properly reported and taxed. They don’t want any potential tax revenue slipping through the cracks. They tell the public that these laws will help to prevent white collar crime, organized crime, and terrorism.

However, the privacy of financial transactions is simply the tip of the iceberg when it comes to the war on cash.

Yesterday a British stock trader was arrested on criminal fraud charges for stock market manipulation. The Commodity Futures Trading Commission and the United States Department of Justice accused Navinder Singh Sarao of single-handedly triggering the “flash crash” of May 2010. During this crash, the Dow Jones Industrial Average plunged about 600 points in just minutes, representing a loss of almost $1 trillion in market value.

According to Bloomberg Intelligence, China’s gold bullion reserves may have tripled since its last official report in 2009. Bloomberg estimates that the People’s Bank of China could now own as much as 3,510 metric tons of the metal. If true, China now has the second largest store of gold in the world, following the United States with 8,133 tons.

While there has been a lot of speculation in the past few years that the Chinese government has been stockpiling more gold, this is the first mainstream American news source that we have seen seriously look into the possibility. Bloomberg reached its estimate by analyzing China Gold Association data, as well as domestic production and trade figures.

Why this sudden attention to China’s gold hoard?

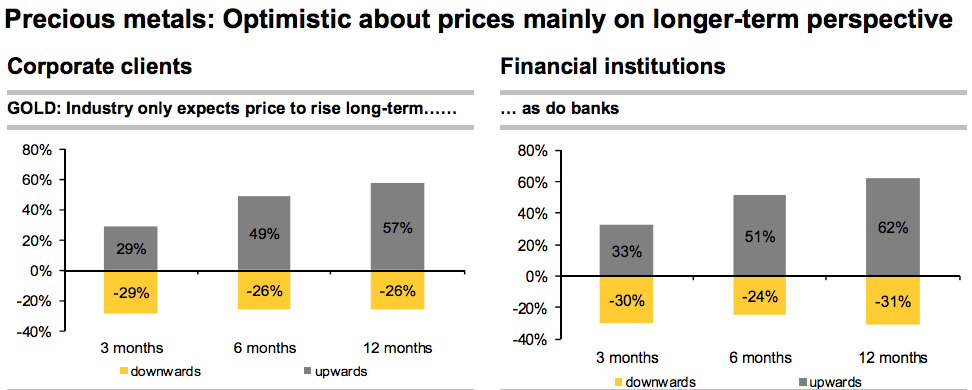

Many global banks and precious metals analysts are now forecasting that gold has seen its bottom and will be moving higher in the coming years. The timeframe varies from institution to institution, but the consensus seems to be that the price of gold in dollars will rise significantly after 2015. Very few expect it to move dramatically lower this year.

The German Commerzbank published the results of a commodity survey at the beginning of April, showing overwhelming bullishness for precious metals in the long-term. For investment bankers, “long-term” means next year. For investors interested in buying physical gold, that means they should make plans for investing in bullion very soon.

In a report ironically titled “A Better Monetary System for Iceland,” government officials in the small North Atlantic nation are considering a policy that would strip commercial banks of the power to increase the money supply through lending. Instead, they would hand all money creation to the central bank – in essence, completely nationalizing the banking sector. If this proposal were to pass, it could restrict credit available for entrepreneurs and politicize who is able to get loans.

Under fractional reserve central banking, commercial banks create money when they offer a line of credit to consumers. When a bank decides to make a loan, it creates a credit in the borrower’s account. This credit is new money in the economy.

The US markets are closed today, but the March jobs numbers were release this morning — 126,000 non-farm payroll jobs were created last month. The forecast was for 245,000 new jobs, so this is a terrible report that falls nearly 50% short of expectations.

Taking into account all the economic data thus far in 2015, it’s no wonder that the Atlanta Fed’s GDPNow metric puts 1st quarter GDP growth at 0%.

None of this comes as a surprise to Peter Schiff, who has been predicting this slow descent into another recession for some time. His podcast from earlier this week reviews the latest awful economic data and predicts the poor jobs numbers that we saw this morning.

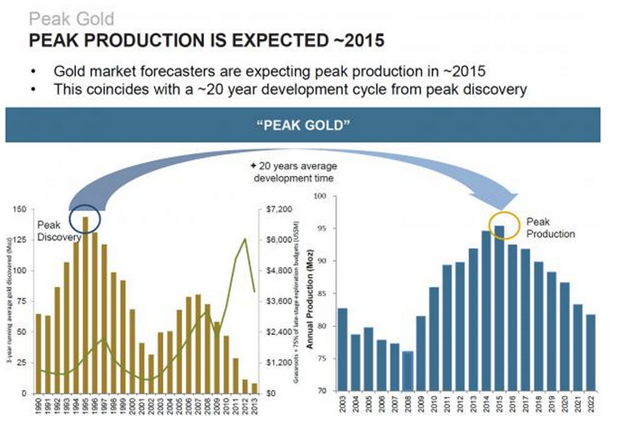

A new report from Goldman Sachs warns that mineable reserves of rare commodities like gold may dwindle to extreme scarcity within two decades. This means that easily-mined gold is getting harder and harder to find. With less gold being pulled out of the earth, less gold is being refined and produced for consumers. In fact, 2015 may prove to be the peak year for gold production.

- Peak gold discovery occurred in 1995 with 160 million ounces, which means that after 1995, less and less mineable gold has been found.

- The rate of gold production tends to lag behind discovery by 20 years.

- Therefore, as you can see in the chart below, gold production is likely to steadily taper off after this year.