The price of silver is at extremely low levels compared to gold. That makes this a perfect time to invest in the white metal.

Indians seem to recognize this buying opportunity. According to the Economic Times, silver demand was up 15% during this Dhanteras and Diwali festival season on increased purchases of coins, idols, and silverware. Analysts attributed the surge in silver buying to lack of consumer confidence in the economy and silver’s relatively low price.

SchiffGold has the perfect way for you to take advantage of this silver buying opportunity. We have obtained a limited supply of 2013 and 2014 1-ounce Silver Britannia bullion coins minted by the British Royal Mint. These beautiful coins are ready to ship right now for as little as $1.49 over spot per coin.

This is a bullion coin at better than bullion coin price but has the upside of potentially garnering collectible value in the future. Because they have a mint privy mark on edge of the coin the 2013 has a snake on the edge and the 2014 year has a horse on the edge.

Australia is moving toward regulating cryptocurrencies like Bitcoin and Ethereum under new anti-money laundering legislation.

According to the Australian Broadcasting Corporation (ABC), Parliament will vote on the measure this week. If it passes, it will place Bitcoin and other cryptos under the auspices of Australia’s financial regulatory agency.

An increase in the import duty hasn’t dampened Indians’ appetite for gold. It’s just pushed the market underground.

Gold is such an important part of the Indian economy, people will do whatever they have to in order to get their hands on the yellow metal – including skirt the law. According to a recent report by the Hindu, occurrences of gold smuggling have risen rapidly in the wake of higher import taxes.

Ever since the import duty on gold was raised to 10%, the country has reportedly witnessed a rapid rise in the quantum of gold brought into the country illegally. Currently, government levies total 13%, including IGST of 3%.”

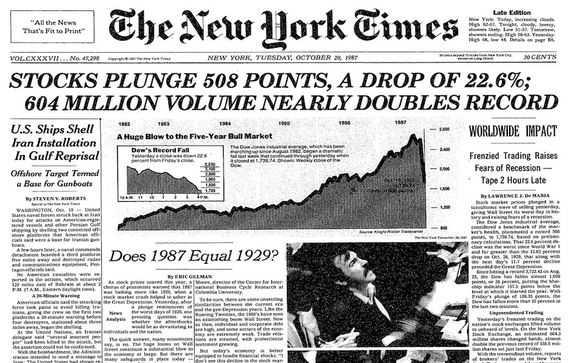

Thirty years ago today, the US stock market had its worst single day in history.

On Oct. 19, 1987, now known simply as “Black Monday,” the Dow Jones Industrial Average lost 508 points. That represented 22.6% of its value.

Over the last couple of year, stocks have enjoyed a meteoric rise. The Dow closed above 23,000 for the first time this week. But in recent months, bankers and investors around the world have expressed started expressing concern about the rapidly inflating stock market bubble and its future impact on the world economy. Just last month, Tiger Management co-founder Julian Robertson unequivocally called the US stock market a bubble and blamed it on the Fed’s interventionist monetary policy.

At some point, the soaring market will fall back to earth, and MarketWatch columnist Howard Gold says the next crash may prove worse than Black Monday.

A recent note to clients authored by Goldman Sachs analysts, including Jeffrey Currie and Michael Hinds, emphasized the continuing importance of gold and silver to investors, saying precious metals remain a relevant asset class in modern portfolios. The report focused on precious metals’ durability and intrinsic value, noting they are neither a historic accident nor a relic, even with new assets such as cryptocurrencies emerging.

The use of precious metals is not a historical accident – they are still the best long-term store of value out of the known elements.”

The note also focused on Bitcoin, saying investors shouldn’t consider cryptocurrencies the “new gold.”

News of hotter than expected inflation numbers caused gold to sell off Tuesday. The markets seem to think rising inflation is bullish for the dollar and bearish for gold.

But is it really? Is higher inflation really bad for gold?

As Peter Schiff points out in his latest podcast, this whole notion is rather absurd.

Speculation continues to swirl around the question of who President Trump will appoint as Federal Reserve Chair when Janet Yellen’s term comes to an end in February.

Trump will reportedly meet with Yellen this week to discuss the possibility of her staying on as the head of the central bank. During the presidential campaign, Trump was highly critical of Yellen, saying she is “obviously political,” and accusing her of “doing what Obama wants her to do.”

Palladium probably isn’t something you think about when you consider investing in precious metals.

Maybe you should.

Palladium broke through the $1,000 mark on Monday. The price of the metal has spiked nearly 50% in 2017 and is at its highest level in 16 years.

Could silver be set to soar?

Analysts Barron’s spoke with recently think so.

An article published on the business journal’s website last week predicted the white metal will emerge as a winner for the second straight year.

With a per-ounce price of $17.41 for silver futures as of Friday, analysts say the white metal is poised for a big climb, particularly as the gold-to-silver ratio stands well above historical averages.”

Australian gold output will peak in just four years and then begin a steep decline, according to a report issued by a Melbourne-based industry adviser.

According to MinEx Consulting analysis reported by Bloomberg Business, Australian mine output will max out in 2021 and then fall by half into the mid-2050s, as aging mines close down.