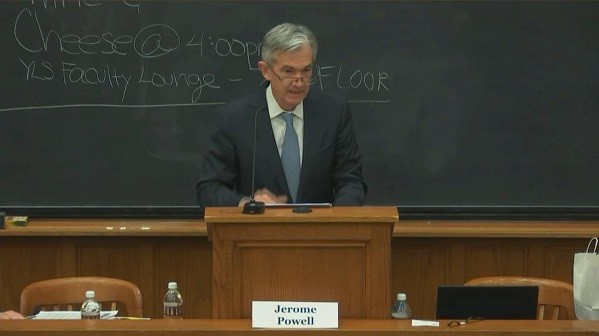

Jerome Powell will take the reins of the Federal Reserve next year. After all the speculation about big changes at the Fed with Trump in the White House, it appears the new boss is pretty much the same as the old boss.

So much for draining the swamp. Powell is a swamp creature. As Peter Schiff pointed out, “He has pretty much voted in lockstep with Janet Yellen the entire time she has chaired the Fed. The only real difference between the two is party affiliation. Powell is affiliated with the Republican Party, even though he was nominated to be on the Fed by Barack Obama. So, obviously not that strong a Republican if he was acceptable to Barack Obama.”

In an article published on the Mises Institute blog, Ryan McMaken expanded on this theme, echoing Hunter Lewis who said Powell is more like Chuck Schumer than Donald Trump.

If you’ve perused the mainstream headlines today, you’ve probably read that overall gold demand fell to an 8-year low last quarter. This was primarily due to a steep drop in inflows into gold ETFs compared to last year, and sagging jewelry demand in India after the implementation of a new tax scheme. But despite the gloomy-sounding headlines, investors are still buying physical gold.

Investment demand for physical gold grew in the third quarter by 17%, according to a report released by the World Gold Council.

During a recent interview with Investing News Network, Peter Schiff reiterated something he’s been saying for the last several months. The stock market is still a big, fat, ugly bubble, and misplaced optimism continues to blow it up.

[Pres Trump has] accomplished blowing more air into a stock market bubble that already existed before he was elected, as he rightly identified the market as a bubble as a candidate. But you know, his policies have not altered that. In fact, he’s now championing the stock market. He’s the biggest booster. He’s actually claiming credit for the market rising. And I do believe that part of the fuel that has caused the bubble to get bigger is the enthusiasm that Trump will reduce taxes and that these taxes will mean more corporate earnings – certainly after-tax earnings because they cut the taxes – a more robust economy, more growth. And so there’s a lot of optimism. But I think the optimism is misplaced because I believe the added deficits that will result from the tax cuts and the increased government spending will do more harm to the economy than whatever benefit we get from paying lower taxes.”

Some mainstream analysts agree with Peter, warning that the Republican tax cut proposal will balloon the deficit, minimizing its positive economic impact.

Last summer, US Global Investors CEO Frank Holmes called debt “the mother of all bubbles.” That bubble continues to blow up.

US consumer debt increased even more than expected in September. According to data released by the Federal Reserve, total credit rose by $20.8 billion, an annualized rate of 6.6%. Analysts had expected an increase in the neighborhood of $18 billion. It was the largest increase in overall consumer indebtedness since last year’s holiday season.

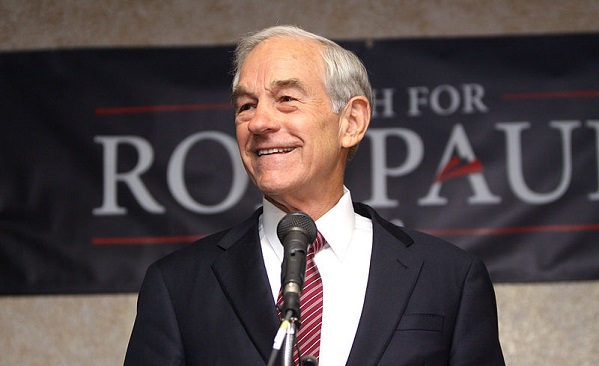

Ron Paul has identified an increase in what he calls the “most insidious tax” buried in the GOP tax reform bill.

A lot of Americans have put a lot of hope in tax reform. As Peter Schiff said in a recent Fox Business interview, the prospect of economic growth spurred by tax reform and other Trump policies have generated a great deal of optimism. But the question remains: can the GOP Congress deliver? And even if Congress does get a reform package passed, some question whether it will actually lead to the economic growth promised. Absent spending cuts, the tax plan will increase the federal debt even further. Evidence indicates high debt levels retard growth.

In a recent article published on the Mises Wire, Ron Paul identified another problem with the Republican tax plan. It actually increases the most insidious of all taxes – the “inflation tax.”

Turkey is buying gold.

The question is: why?

According to a Bloomberg report, the Turkish central bank added 3.8 million ounces of gold worth almost $5 billion to its reserves this year.

Gold exports from Australia surged from August to September, according to data released by the Australian Bureau of Statistics (ABS).

Non-monetary gold exports rose 17% in the period, an increase of $217 million in seasonally adjusted terms.

Trump said he was going to drain the swamp.

Apparently, the drain is clogged.

Trump picked another swamp creature to chair the Federal Reserve. Jerome Powell got the nod to replace Janet Yellen when her term as Fed chair ends in February. As Tho Bishop at the Mises Institute put it, “this means Trump will ensure that, while the stationary at the Eccles Building will change, the monetary policy guiding it likely will not.”

Indians are buying silver and this could have a major impact on the world market for the white metal.

The Silver Institute covers this story, and highlights several other technological innovations involving silver, in its latest issue of Silver News. It also features an interview with ICE Benchmark Administration COO Matthew Glenville. His company recently began administering the silver benchmark and operating the auction underlying the London Bullion Market Association Silver Price.

During the Denver Gold Forum last September, the chairman of the World Gold Council said he thinks the world may have reached peak gold. That is the point where the amount of gold mined out of the earth will begin to shrink every year, rather than increase, as it has done pretty consistently since the 1970s.

Randall Oliphant is not the only high-profile person in the gold industry expressing concern about gold supply over the long-term. Franco-Nevada chairman Pierre Lassonde also expects a significant dip in gold production in the coming years. During a recent interview with the German financial newspaper Finanz und Wirtschaft, Lassonde said we’re seeing a significant slowdown in the number of large deposits being discovered. The big question is how will the industry replace the massive gold mines that have produced large amounts of the yellow metal over the last 130 years or so?