On a Knife’s Edge: 3 Reasons the Next Crash Could Be Worse than Black Monday

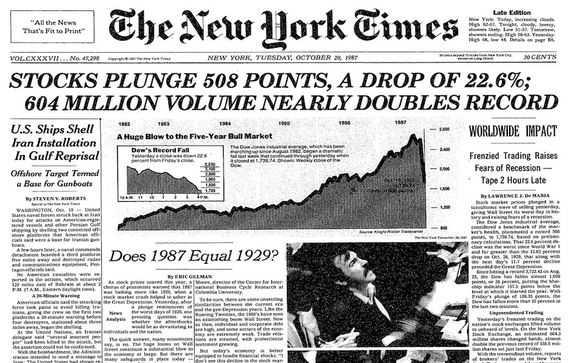

Thirty years ago today, the US stock market had its worst single day in history.

On Oct. 19, 1987, now known simply as “Black Monday,” the Dow Jones Industrial Average lost 508 points. That represented 22.6% of its value.

Over the last couple of year, stocks have enjoyed a meteoric rise. The Dow closed above 23,000 for the first time this week. But in recent months, bankers and investors around the world have expressed started expressing concern about the rapidly inflating stock market bubble and its future impact on the world economy. Just last month, Tiger Management co-founder Julian Robertson unequivocally called the US stock market a bubble and blamed it on the Fed’s interventionist monetary policy.

At some point, the soaring market will fall back to earth, and MarketWatch columnist Howard Gold says the next crash may prove worse than Black Monday.

As Gold points out, in the aftermath of the 1987 crash, the recession didn’t officially kick off until 1990. That was nearly three years after Black Monday. As a result, a lot of people dismiss the 1987 crash as a mere blip on the radar. But Gold cites a book by Diana B. Henriques to make the case that Black Monday was more than just one bad day. Henriques argues it was a painful bear market that lasted three months and included a nearly 35% drop in the Dow Jones.

In A First-Class Catastrophe: The Road to Black Monday, the Worst Day in Wall Street History, Henriques calls Black Monday a near-systemic crisis that was a precursor for much that came later.

Black Monday was the contagious crisis that the system nearly didn’t survive. All the key fault lines that trembled in 2008 … were first exposed as hazards in 1987.”

Henriques maps out several basic causes behind black Monday, including “breakneck automation, poorly understood financial products fueled by vast amounts of borrowed money, fragmented regulation, [and] gigantic herdlike investors.”

Gold recently interviewed Henriques. She told him that not much has fundamentally changed since 1987. Based on the interview Gold offers three key reasons why the next crash could be even worse than Black Monday.

The market is much more fragmented.

In 1987, the only two major players were the New York Stock Exchange and the Chicago Mercantile Exchange. As Gold put it, the two chairmen could institute the first “circuit breakers” giving traders “timeouts” in the midst of a sell-off with a mere handshake. Today, the market is much more fragmented with multiple players. The NYSE only handles about 30% of all trades today. That compares to 90% in 1987. As Henriques points out, “we’ve got 12 regulated stock exchanges, we’ve got 30 [alternative trading systems] where stocks can trade and [who knows] how many dark pools — members-only trading venues.” She said coordinating everybody in the midst of a meltdown today would be like herding cats.

Regulators live in their own little worlds

Henriques said Dodd-Frank created rigid rules where flexibility was needed. She told Gold, “We’ve moved so far from any realistic approach to market regulation, I don’t know where you would start.” Gold wrote, “The SEC and CFTC are like tugboats passing in the fog, even as financial innovation continues apace. Efforts to rationalize the structure after the financial crisis were killed by Congress’ competing fiefdoms.”

Nearly instantaneous computerized trading is more pervasive than ever

JP Morgan estimates passive and quantitative investing accounts for 60% of stock trading, double its share a decade ago. “You have trading strategies that are algorithm-driven by giant investors using not billions but trillions of dollars,” Henriques said. Henriques told gold that the 24/7 news cycle and social media could spread panic further and faster than in 1987.

I think we’re on a knife’s edge.”

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]