Are we in the early stages of a gold bull market? Incrementum thinks so and offers three key reasons for this assessment in its most recent In Gold We Trust Report.

At the moment we are at the turning point towards a gold bull market. The macroeconomic and geopolitical factors support this tendency. One of the things we notice across the bull markets of the past 50 years is that, even in its weakest period of increase, gold gained more than 70%. This record supports our optimism for future developments. From our point of view, stronger inflation tendencies or the abandoning of the rate-hike cycle in the US could trigger an increase in momentum of the gold price. We regard these scenarios as realistic.”

It looks like the Federal Reserve may have another excuse to slow or even stop hiking interest rates if it so desires.

According to the conventional wisdom, the Federal Reserve is in the process of “normalizing” interest rates and will continue to push rates up into the foreseeable future. But could the Fed be close to the end of its tightening cycle? Peter Schiff made that case during a recent podcast.

Americans have loaded themselves down with debt and some are struggling to pay the bill.

Total household debt hit a record $13 trillion in 2017, eclipsing levels seen on the eve of the Great Recession. Americans have been burning up the credit cards. Revolving debt grew by $26 billion in the fourth quarter of 2017 alone, a 3.2% increase. Americans have run up a nearly $1 trillion credit card tab. Meanwhile, flows into serious delinquency have increased steadily since the third quarter of 2016.

The delinquency level for subprime credit cards is particularly concerning, having risen to a level higher than at the peak of the financial crisis.

In his most recent podcast, Peter Schiff hit a number of subjects including oil prices, bond prices, Bitcoin, the dollar and tariffs. Peter said he thinks we’re seeing a lot of movement in a number of markets that are counter to the long-term trends. For instance, oil dropped late last week, but he expects it’s long-term trend to continue upward. The dollar has picked up strength, but the broader trend is toward a weaker dollar. And bond yields fell, but the overall trajectory for interest rates is up.

Last week, we explained how economic sanctions on Iran could boost the price of gold as Iranians turn to the yellow metal as a way to skirt restrictions. In a recent article published by the Daily Reckoning, financial expert Jim Rickards put this in a broader context. He described an evolving “axis of gold” as a number of countries, including China, Russia, Turkey and Iran increasingly use physical metal to create an offensive counterweight to the dollar.

This gold-based payments system will dilute and ultimately eliminate the impact of US dollar-based sanctions.”

Earlier this week, I shared a story about my wife finding a bag of change in the attic of her grandparent’s old house that turned out to be worth over $2,000. The dimes, quarters and half-dollars in the bag were all minted before 1965. In other words, they were all made primarily of silver. The value of the metal in these so-called junk silver coins is now worth far more than their face value. This demonstrates just how much the Federal Reserve has devalued your money.

One way we measure this devaluation of money is by the inflation rate. Practically speaking, rising inflation simply means we are losing purchasing power. Our dollar buys less and less as time moves on. This puts the squeeze on all of us – even the Tooth Fairy.

The US economy is now technically in the second-longest recovery in history. If it continues another 14 months, it will eclipse the longest recovery, which took place in the 1990s.

As Peter Schiff pointed out in his latest podcast, the Federal Reserve pulled out all the stops in the 1990s to keep the recovery going. That set the stage for the dot-com crash and ultimately the Great Recession.

Now the Fed is doing it again.

The World Gold Council described overall demand for gold as “soft” in its Global Demand Trends Q1 2018 report. Global demand was down 7% year-on-year.

The WGC said the drop was primarily due to weak investment demand. Investors added to their holdings of gold coins and bars, as well as gold-backed ETFs, but at a slower pace than Q1 2017.

There were some bright spots in the report. Gold demand in the technology sector marked its sixth consecutive quarterly gain. Jewelry demand held steady. And not all investors are spurning the yellow metal.

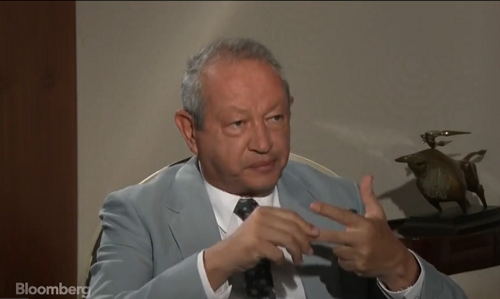

The second richest man in Egypt has put half of his $5.7 billion net worth in gold.

During an interview with Bloomberg, Naguib Sawiris said he expects gold to rally above $1,800 per ounce as “overvalued” stock markets crash.

The US government has hit borrowing levels not seen since the peak of the financial crisis.

The US Treasury’s net borrowing totaled $488 billion from January through March, according to a statement released Monday. That was $47 billion more than the department’s estimate. It was also a record for first quarter borrowing, according to Bloomberg.