Mongolia wants more gold.

Last week, the Bank of Mongolia launched a campaign dubbed the “National Gold to the Fund of Treasuries.” The goal of the five-month campaign is to encourage miners and individuals to sell gold to the central bank, along with commercial banks, in order to increase their gold reserves.

The Texas Bullion Depository officially opened for business this week. The creation of the facility represents a power-shift away from the federal government and sets the foundation to undermine the Federal Reserve’s monopoly on money.

Countries that stockpile gold create a foundation of stability for their monetary systems. This is precisely why China, Russia, Turkey and several over countries are increasing their gold holdings. But it’s not just countries looking to gold to provide political clout and economic power. Texas recently laid the groundwork for its own gold depository. The reason? To wrest some economic power from the Federal Reserve by bringing some monetary autonomy to the Lone Star State.

After hitting the highest level in more than a year last month, gold continued to flow into ETFs in May. But regional trends have reversed with European and Asian funds adding gold, as the yellow metal flows out of North American funds.

Global gold-backed ETF holdings added 15 tons of the yellow metal in May, boosting total holdings to 2,484 tons, according to the latest data released by the World Gold Council.

Are you depending on Social Security and Medicare for your retirement?

You might want to rethink that plan. These government retirement programs are going broke even faster than expected.

The US debt continues to skyrocket and it’s costing Uncle Sam more and more money just to make the interest payments.

The US public debt hit a record high of $21.145 trillion on the last day of May. Meanwhile, the cost of servicing all that debt also spiked, increasing by $26 billion through the first seven months of the fiscal year (October-April) compared with the same period last year.

A lot of seemingly positive economic data came out last week, but in his most recent podcast, Peter Schiff said it is just feeding into a delusional economic narrative that ignores the most fundamental storyline – debt. Everybody is talking about a new era of prosperity, but Peter said it’s a phony prosperity and it isn’t going to last.

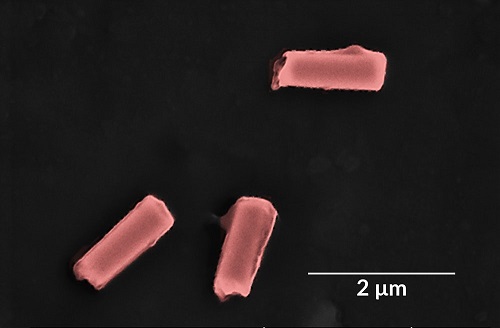

It’s like something out of a sci-fi movie – tiny robots zipping around through your veins zapping dangerous microbes. Except this isn’t some fictional scenario out of a Star Trek movie. It’s real-life technology thanks to gold.

Scientists have developed gold “robots” coated with a membrane that neutralizes dangerous pathogens such as MRSA.

This is just the latest in a growing list of technological applications for the yellow metal.

Not everybody in the mainstream is bullish on the dollar and expecting rate hikes as far as the eye can see. In fact, the global head of commodities at TD securities sounds a little like Peter Schiff.

In his podcast last week, Peter said that the recent dollar strength is nothing more than upside correction in the midst of a bear market, emphasizing that the primary trend is down. He also said he thinks the Fed may be near the end of its hiking cycle.

Investors spend a lot of time mulling over predictions and prognostications made by various mainstream analysts, economists and talking heads on TV news shows. As it turns out, you might be better off listening to monkeys.

As Jim Rickards put it, financial news TV is one big “prediction engine.” CNBC features as many as 120 guests in a single day. And most of those pundits are forecasting. They predict stock prices, interest rates, unemployment, bond prices, and on and on.

So, just how accurate are all of these predictions?

Climbing interest rates are putting the squeeze on the mortgage refi market. Applications to refinance home mortgages fell 5% last week, dropping to an 18-year low.

According to CNBC, mortgage application volume was nearly 27% lower than a year ago when rates were lower. The refinance share of total mortgage application volume fell to its lowest level since August 2008, at just 35.3%.

As Peter Schiff pointed out in a recent podcast, this is a bad sign for the broader economy. With rising rates, US consumers will no longer have the option of using their house as an ATM.