US Public Debt and Interest Payments Hit New Record

The US debt continues to skyrocket and it’s costing Uncle Sam more and more money just to make the interest payments.

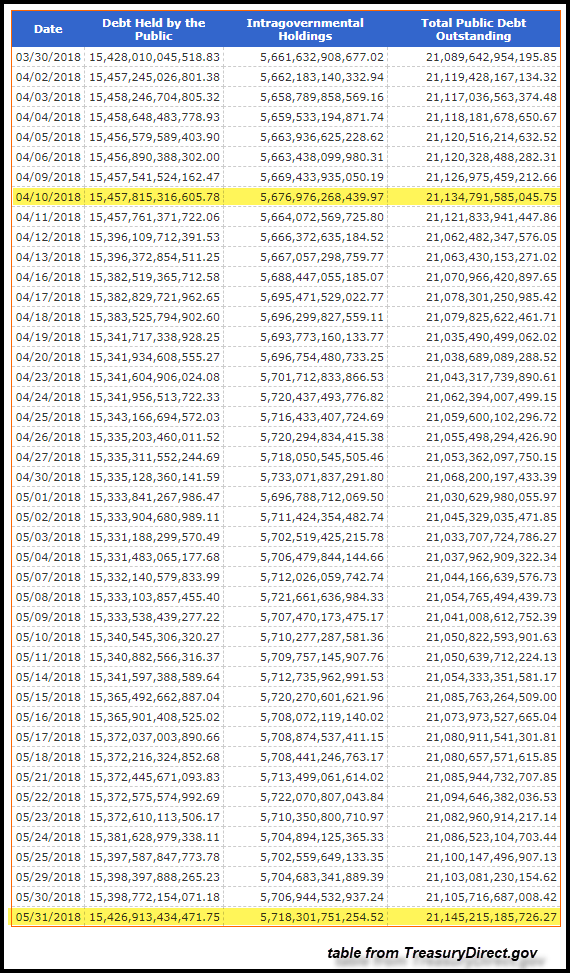

The US public debt hit a record high of $21.145 trillion on the last day of May. Meanwhile, the cost of servicing all that debt also spiked, increasing by $26 billion through the first seven months of the fiscal year (October-April) compared with the same period last year.

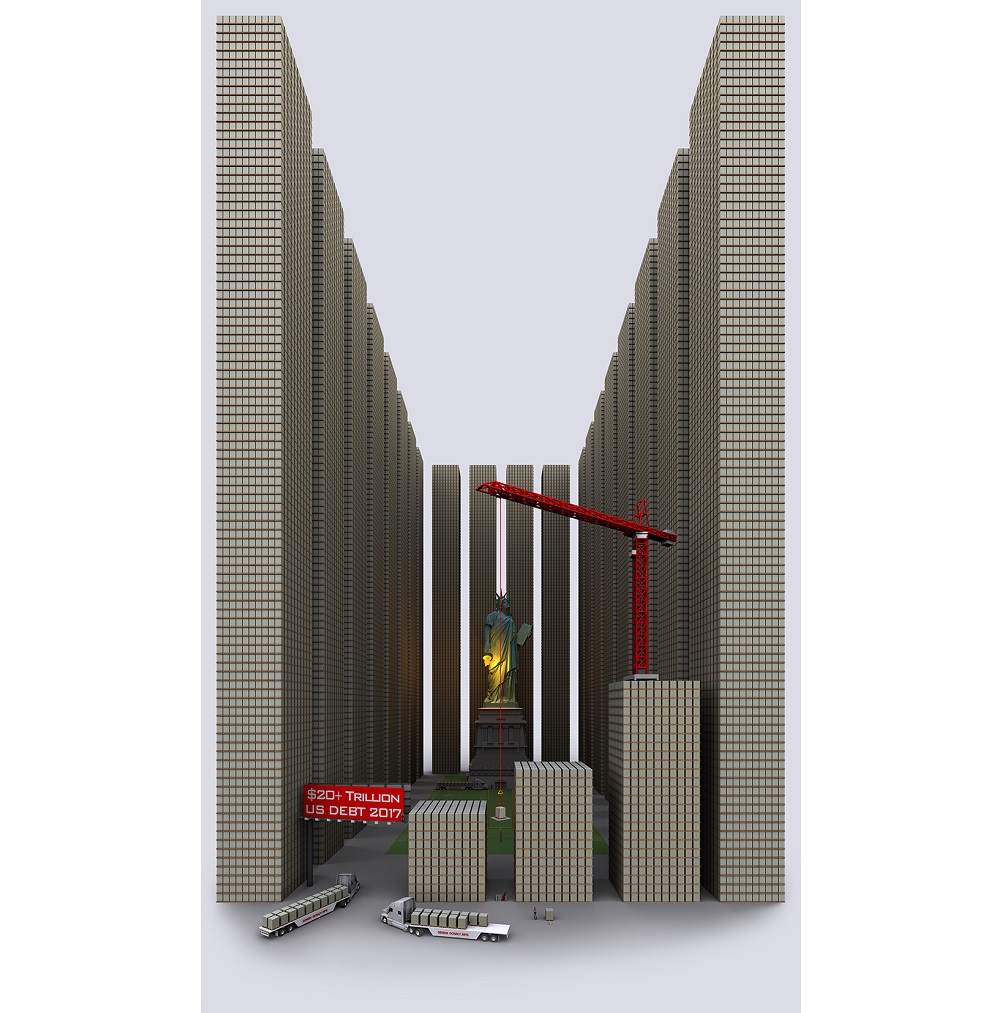

This is a staggering amount of money. Here’s a visualization of $20 trillion courtesy of VisualCapitalist.

Yet despite this staggering amount of debt, a lot of people continue to shrug and yawn. In fact, some people argue that the debt doesn’t even matter. But of course, it matters. As we’ve talked about before, skyrocketing debt suppresses economic growth.

There was actually a pause in the growth of the debt in the spring. The US government hit the previous high in early April. An influx of revenue into the Treasury during tax season put a pause on the debt climb. As SRSrocco noted, the debt doesn’t climb in a straight line. It actually falls some days and weeks. But the overall trend continues steadily upward.

That trend will only accelerate as interest rates climb. As we’ve discussed previously, rising rates will eventually crush the US budget under interest payments. Analysts have calculated that if the interest rate on Treasury debt stood at 6.2% – its level in 2000 – the annual interest payment on the current debt would nearly triple to $1.3 trillion annually.

So – do you really think the Fed is going to be able to “normalize” rates?

Even at a relatively modest 3%, we’re seeing the impact of rising rates with the interest expense growing from $257.3 billion in the first seven months of fiscal 2017 to $283.6 billion in the same period this year. When we’re talking about trillions of dollars in debt, a $26 billion increase in interest expense might start to sound like small potatoes. Of course, it’s a significant amount of money. SRSrocco calculated that it could buy the total global registered silver inventory:

Thus, the extra $26 billion paid by the US Treasury to service its debt would have purchased the 1+ billion ounces of silver held in the COMEX (270 million oz) and all the Global Silver ETFs.And, this would include the 138 million oz of silver supposedly stored at the JP Morgan vaults. However, with the remaining $10 billion ($26 billion minus $16 billion), the US government could have also purchased all the Silver Eagles minted since 1987. According to my figures, the US mint sold over 510 million Silver Eagles from 1987-2018. If we give a value of $20 for each, that would be roughly $10.5 billion.”

And that’s just the increase in interest cost over a seven month period.

In effect, the federal government is spending billions of dollars every month for absolutely nothing. And the more it has to spend to service its debt, the more that debt increases. It’s a vicious upward spiral that affords no practical benefit to anybody other than the holders of US debt (i.e. the Chinese, the Japanese and the Federal Reserve).

In other words, the federal government is a giant black hole sucking up money from the productive sectors of society.

But hey, the mainstream pundits say everything is great and there’s nothing to worry about.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […] The VIX, often referred to as ‘Wall Street’s fear gauge,‘ is currently portraying a sense of calm among investors, registering well below the 20 level.

The VIX, often referred to as ‘Wall Street’s fear gauge,‘ is currently portraying a sense of calm among investors, registering well below the 20 level.