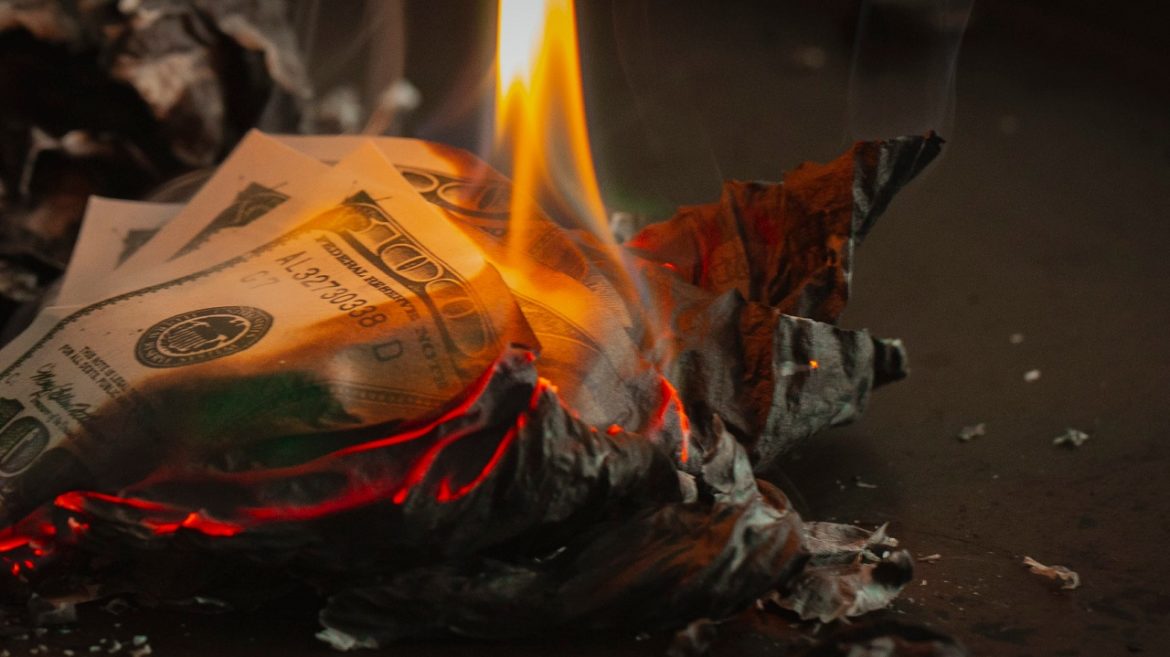

Are “greedy” corporations driving inflation? Could taxing billionaires solve the federal government’s fiscal problems?

According to President Joe Biden, the answer to both questions is yes.

And the correct answer is no.

No one is talking about the US trade deficit in the current fiscal year, but it is likely to be another record, bringing with it new rounds of trade sanctions and protectionism.

In this article, I explain why the twin deficit hypothesis will apply, bearing in mind a likely budget deficit outturn of $3 trillion and a negative savings rate.

Deutsche Bank economists say the Federal Reserve will create more inflation in 2024.

OK, that’s not exactly what they said. But that is the implication of their latest forecast.

This article concludes that the current downturn in bond yields is part of a continuing market manipulation by central banks in order to restore confidence in the global economic outlook.

There is a long history of government intervention in markets. In the nineteenth century, it was by legal regulation, the most notable of which was the 1844 Bank Charter Act, which had to be suspended in 1847, 1857, and 1866.

Inflation robs you of purchasing power by driving up the price of everything you buy. You see the impacts of inflation every time you go to the store. But sometimes inflation hits you in a more subtle way that’s difficult to see – through “shrinkflation.”

I experienced shrinkflation first-hand last weekend.

The technical position for gold is looking very positive for higher prices. But technical analysis should be backed by fundamentals.

To a large extent, fundamentals are in the eye of the beholder, whose opinions in any situation can vary from positive to negative and everything in between. But even for the economic optimists, there are gathering clouds on the horizon likely to continue undermining the global economic outlook, the dollar, and all financial asset values. Fiat currencies are being downgraded relative to real money, which is gold.

The Great Game of Geopolitics faces a new challenge. The new hotspot is Israel and the Muslim Middle East. Ukraine is all but over, and the US is likely to abandon her to her fate — like Afghanistan.

We shall have to see how both will play out. Meanwhile, energy prices are set to keep inflation and interest rates high, undermining governments, banking systems, and businesses dependent on cheap credit.

Mainstream pundits and government officials keep talking about the strong economy and resilient consumers while ignoring what’s driving them – borrowing. To listen to them, you would think the road to prosperity is paved with credit cards. In this episode of the Friday Gold Wrap host Mike Maharrey breaks down the recent household debt data and explains why this isn’t the sign of a strong economy. He also highlights some interesting silver demand news.

Is war and military spending really good for the economy?

A lot of people seem to think so. In fact, President Joe Biden is selling the latest proposal to send military aid to Israel and Ukraine as an economic stimulus plan. But this notion that spending money for war somehow boosts the economy is rooted in a pervasive economic fallacy.

The day of reckoning for unproductive credit is in sight.

With G7 national finances spiraling out of control, debt traps are being sprung on all of them, with the sole exception of Germany.