“Hotter than expected.”

This seems to be a recurring theme when it comes to price inflation.

The September CPI data gave us another variation on that tune. And it should once again remind us that the Federal Reserve is nowhere near its 2% target.

An important error in statistical analysis is that mathematical economists have lost sight of what their beloved statistics represent —none more so than with GDP.

In this analysis, I explain why GDP is simply the total of accumulating currency and credit which is wrongly taken to reflect economic progress — there being no such thing as economic growth, only the growth of credit. Once that point is grasped, the significance of this basic error becomes clear, and the fiat currency paradigm is revealed for what it is: a funny money game that will go horribly wrong.

This article looks at the collateral side of financial transactions and some significant problems that are already emerging.

At a time when there is a veritable tsunami of dollar credit in foreign hands overhanging markets, it is obvious that continually falling bond prices will ensure bear markets in all financial asset values leading to dollar liquidation. This unwinding corrects an accumulation of foreign-owned dollars and dollar-denominated assets since the Second World War both in and outside the US financial system.

I recently ran across a video produced by CNBC back in July 2020. It is titled “Why Printing Trillions of Dollars May Not Cause Inflation.”

That aged poorly, didn’t it?

And people wonder why I keep saying you should be skeptical of mainstream narratives.

Price inflation has been even worse than advertised.

Of course, you know that because you’ve lived it. But it is nice when the data crunchers swerve a little closer to reality.

The Bureau of Economic Analysis did just that, revising its Personal Consumption Expenditure (PCE) data higher for the entirety of this inflation cycle.

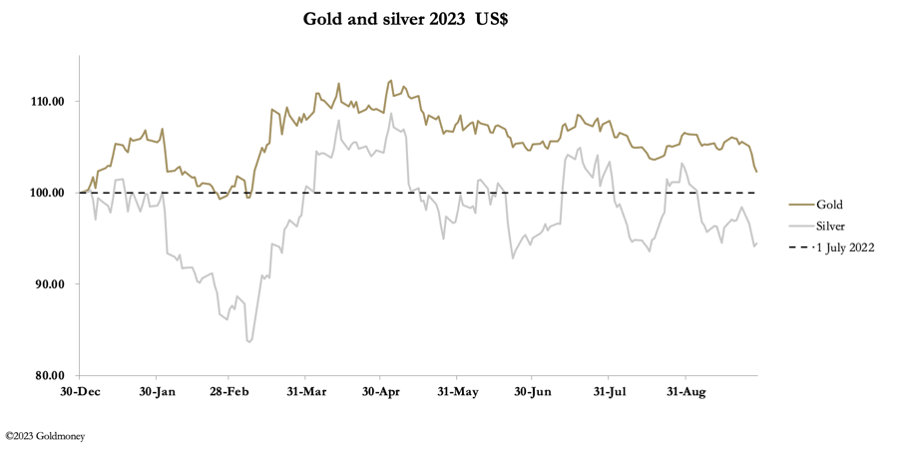

As the yield on the 10-year US Treasury note soared, gold and silver came under selling pressure this week. But ahead of the weekend, bear closing in precious metals is evident. In European trade this morning, silver rallied to $23.00, down a net 55 cents from last Friday’s close. And gold traded at $1871, down a net $53. The numbers in other currencies were not nearly so grim due to dollar strength. The chart below shows the dollar’s Trade Weighted Index:

With the Asian hegemons undoubtedly able to introduce gold standards, where does that leave the dollar?

This article describes just how precarious the fiat dollar’s position has become.

The Fed people insist the economy is strong. They upped their GDP growth projections at their last meeting. Joe Biden thinks the economy is strong. He keeps bragging about the marvelous achievements of “Bidenomics.” Mainstream economists keep telling us the economy is strong.

But the average American isn’t buying any of it. (Perhaps price inflation makes it too expensive?)

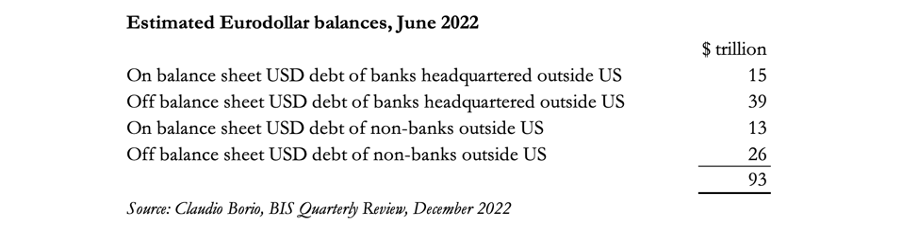

Among the many problems currencies the markets face, there is one that is undocumented: the eurodollar market. This is yet another very large elephant in the room.

This article quantifies eurodollars and eurodollar bonds, which are additional to US money supply and credit.

The Federal Reserve held interest rates steady at the September FOMC meeting, but the committee indicated that it plans to hold rates higher for longer than originally projected.

As you digest the Fed meeting, it’s important to remember that there is a big difference between “saying” and “doing.”