Jim Grant appeared on Bloomberg and offered some advice to the Fed when prompted by the hosts.

Do less!

I think they should do less of almost everything they now do. They pretend to things they can’t know, and they undertake actions that are mainly unhelpful.”

Grant went on to explain why interventions into economies by central bankers ultimately fail. He also agreed with Peter Schiff, saying that the Federal Reserve has painted itself into a corner. It wants to raise rates, but it can’t because the economy is bad and getting worse. Grant closes out the discussion by pointing out the absurdity of “data dependence.”

Peter Schiff appeared with Alex Jones on InfoWars Friday and made the case that the real economic earthquake is in our future, not in the past.

Peter said that despite all of the positive spin coming out of the mainstream media, the Federal Reserve, and the Obama administration, the US economy is weak and spiraling toward trouble.

If you look at most of the economic indicators out there, they’re flashing recession.”

Peter went on to analyze some of the recent economic data that supports his case, and emphasized that the great 2008 recession was just a tremor:

I saw 2008 coming, and unfortunately, I also saw how the government responded to 2008, and they did exactly what I feared they would do and what I warned they would do. That is exactly why the real earthquake is still in our future and not in our past, and people have to prepare for that.”

Here’s some free advice for the Federal Reserve.

It’s OK. You can tell them. They already know.

The economy is not good.

As Peter Schiff pointed out on CNBC yesterday, the Fed doesn’t really want to raise interest rates. We just witnessed what even a small nudge upward did to the stock markets after years of low rates and monetary policy artificially pumped them up. But on the other hand, the Fed doesn’t want to admit the US economy really isn’t in great shape:

The Fed is trying to walk a fine line, because they don’t want to admit how weak the economy is when President Obama is trying to elect Hillary Clinton based on the strength of the economy.”

Recognizing that large investments require tailored, individualized service, SchiffGold has developed a special desk for its institutional and high net-worth investors.

The SchiffGold Institutional and High Net-Worth Desk provides discreet, personalized, one-on-one service for clients investing $250,000 or more. It also offers the type of heavily discounted pricing that high net worth and institutional investors are entitled to receive. Click here to learn more.

SchiffGold offers several exclusive features through the Institutional and High Net-Worth Desk:

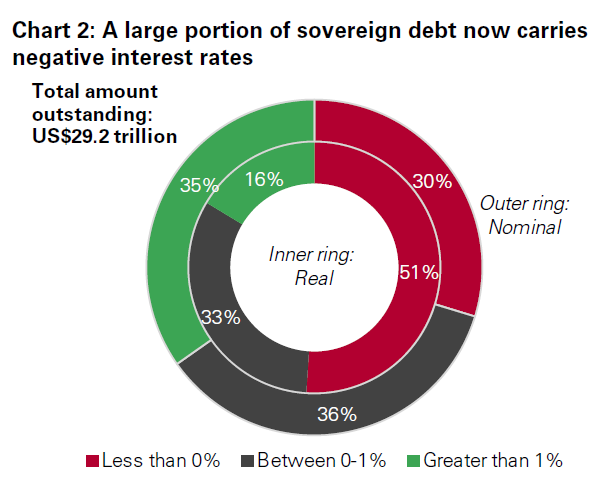

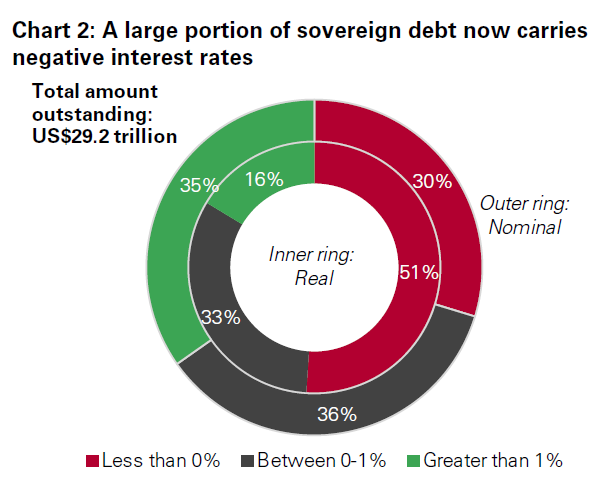

More than half the world’s sovereign debt now carries negative interest rates, and data keeps coming in confirming that it is driving demand for gold.

A couple of weeks ago, CNBC reported central bank action appears to be rejuvenating gold in Europe, as the entrenchment of negative interest rates makes depositing cash in banks less and less rewarding. Now we have hard data reported by Bloomberg confirming a similar spike in Japanese gold demand since that country’s central bank plunged interest rates into negative territory earlier this year:

Gold sales surged in Japan through March after the country’s move to set negative interest rates sent investors scurrying for a shelter, a further sign that global central bank policy of keeping borrowing costs low or below zero is stoking demand for bullion. Bar sales climbed by 35% to 8,192 kilograms in the three months ended March 31 from a year earlier, Tanaka Kikinzoku Kogyo K.K., the country’s biggest bullion retailer, said in a statement Thursday.

The surge in gold purchases since the Bank of Japan’s interest rate move comes on top of a significant increase in demand last year. Consumer demand for the yellow metal almost doubled to 32.8 tons in 2015, up from 17.9 tons a year earlier.

More than half of the world’s sovereign debt now carries negative interest rates. The European Central Bank, Denmark, Switzerland, and Sweden, along with Japan, all currently have negative interest rates, and there is no sign that they will rise any time soon. Janet Yellen has even said that the US Federal Reserve will consider negative rates if economic conditions dictate:

On Tuesday, the Obama administration announced that the federal government will open the door to forgive nearly 400,000 student loans. According to a MarketWatch report, if every eligible debtor takes advantage of this pathway to forgiveness, it will total more than $7.7 billion:

The Department of Education will send letters to 387,000 people they’ve identified as being eligible for a total and permanent disability discharge, a designation that allows federal student loan borrowers who can’t work because of a disability to have their loans forgiven. The borrowers identified by the Department won’t have to go through the typical application process for receiving a disability discharge, which requires sending in documented proof of their disability. Instead, the borrower will simply have to sign and return the completed application enclosed in the letter.”

According to MarketWatch, about 179,000 of the borrowers eligible for discharge under the program are already in default. A group of about 100,000 are at risk of having their tax refunds or Social Security checks garnished to pay off the debt.

It’s important to keep in mind this money doesn’t just disappear into thin air. The US taxpayer is ultimately on the hook for every forgiven dollar.

Last month, hackers managed to get into the Federal Reserve Bank of New York’s computer system and swipe some $100 million from a Bangladeshi government account.

As James Rickards pointed out in an interview last week on Fox Business, the vulnerability of digital wealth to hacking and cyber manipulation provides yet another reason to own gold. It is a tangible, physical asset that you can keep in your personal possession:

There are new reasons to have gold…21st century reasons. Vladimir Putin has a 6,000-member cyber brigade working night and day to erase digital wealth. So many billionaires will say, ‘what do you have, stocks, bonds?’ No you don’t; you have electrons. Putin can wipe those out. The thing about gold, you can’t hack it, you can’t erase it, you can’t delete it. It’s tangible,”

The World Gold Council’s first quarter report is a bunch of bull. Or perhaps it would be more accurate to say it projects a very bullish outlook for gold.

The report confirms what we already knew – gold got off to a glittering start in 2016 – and it predicts the rally will likely continue and evolve into a genuine, long-term bull market.

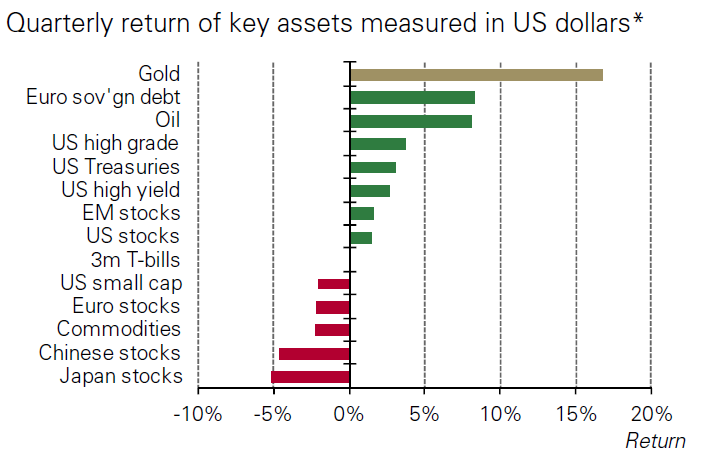

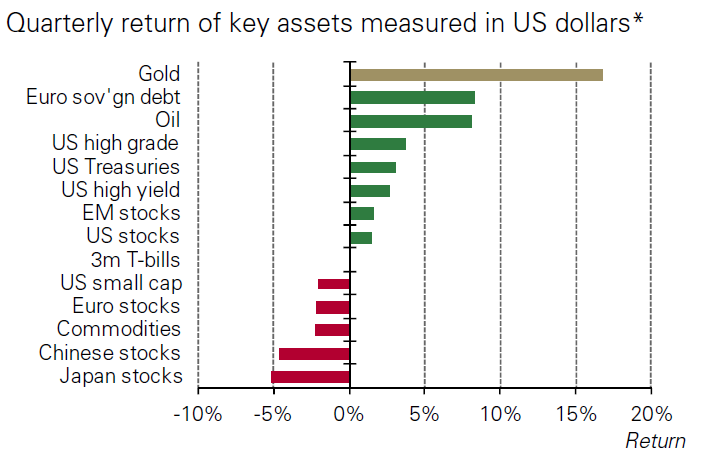

Gold rose nearly 17% in US dollar terms through the first three months of 2016, and the return on the yellow metal significantly outperformed most other major stock, bond, and commodity indices. Analysts at the World Gold Council say they don’t think it was just a flash in the pan. They say market dynamics indicate the rally will continue:

JP Morgan Chase Bank just fired another salvo in the “war on cash.”

The bank recently capped ATM withdrawals for non-Chase customers at $1,000 per day. The move came after the bank began installing new ATMs that dispense $100 bills. Some people were reportedly pulling tens of thousands of dollars out at one time, according to a report in the Wall Street Journal. A spokeswoman said the bank “felt it was prudent to set withdrawal limits on all of our ATMs.”

Chase claimed the move was primarily to fight fraud. This is always the justification used when banks and government agencies slap limits on access to cash. But according to the WSJ report, there haven’t been signs of criminal activity in the recent big-dollar cash withdrawals from Chase ATMs:

The bank said there doesn’t appear to be fraud involved. But partly due to heightened regulatory scrutiny, banks are paying more attention to large cash transfers that could be a sign of money laundering or other types of shady activity. Typically, the card-issuing bank sets withdrawal limits, not the bank owning the ATM.”

In the last seven years, China has acquired more than 4,000 tons of gold – more than 10% of the official gold in the world. Why?

Jim Rickards delves into this question in an interview on Albert K Lu’s latest Gold Videocast:

Are they stupid? No…if the Americans don’t like gold, the Chinese know something the Americans don’t.”

Central bankers and the financial elite have good reasons why they don’t want you to buy gold. They perpetuate many myths about the yellow metal to dissuade the public from owning gold. In this interview, Rickards and Lu knock down some of those myths and begin building a new case for gold.