The World Gold Council’s first quarter report is a bunch of bull. Or perhaps it would be more accurate to say it projects a very bullish outlook for gold.

The report confirms what we already knew – gold got off to a glittering start in 2016 – and it predicts the rally will likely continue and evolve into a genuine, long-term bull market.

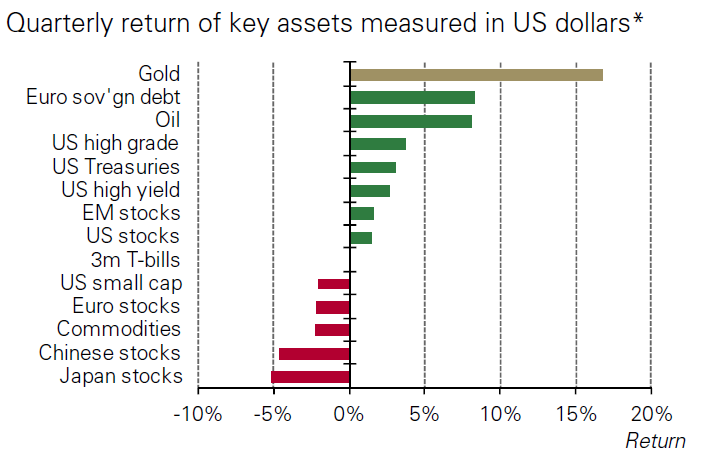

Gold rose nearly 17% in US dollar terms through the first three months of 2016, and the return on the yellow metal significantly outperformed most other major stock, bond, and commodity indices. Analysts at the World Gold Council say they don’t think it was just a flash in the pan. They say market dynamics indicate the rally will continue:

JP Morgan Chase Bank just fired another salvo in the “war on cash.”

The bank recently capped ATM withdrawals for non-Chase customers at $1,000 per day. The move came after the bank began installing new ATMs that dispense $100 bills. Some people were reportedly pulling tens of thousands of dollars out at one time, according to a report in the Wall Street Journal. A spokeswoman said the bank “felt it was prudent to set withdrawal limits on all of our ATMs.”

Chase claimed the move was primarily to fight fraud. This is always the justification used when banks and government agencies slap limits on access to cash. But according to the WSJ report, there haven’t been signs of criminal activity in the recent big-dollar cash withdrawals from Chase ATMs:

The bank said there doesn’t appear to be fraud involved. But partly due to heightened regulatory scrutiny, banks are paying more attention to large cash transfers that could be a sign of money laundering or other types of shady activity. Typically, the card-issuing bank sets withdrawal limits, not the bank owning the ATM.”

In the last seven years, China has acquired more than 4,000 tons of gold – more than 10% of the official gold in the world. Why?

Jim Rickards delves into this question in an interview on Albert K Lu’s latest Gold Videocast:

Are they stupid? No…if the Americans don’t like gold, the Chinese know something the Americans don’t.”

Central bankers and the financial elite have good reasons why they don’t want you to buy gold. They perpetuate many myths about the yellow metal to dissuade the public from owning gold. In this interview, Rickards and Lu knock down some of those myths and begin building a new case for gold.

The market for silver jewelry grew in 2015, mirroring an overall surge in demand for the white metal, according to a survey report released yesterday by the Silver Institute:

Silver jewelry sales in the United States were solid in 2015 with 60% of jewelry retailers reporting increased sales, according to a survey conducted on behalf of the Silver Institute’s Silver Promotion Service (SPS). This marked the seventh consecutive year of growth for silver jewelry sales and confirmed that silver jewelry is an increasingly important category for many retailers.”

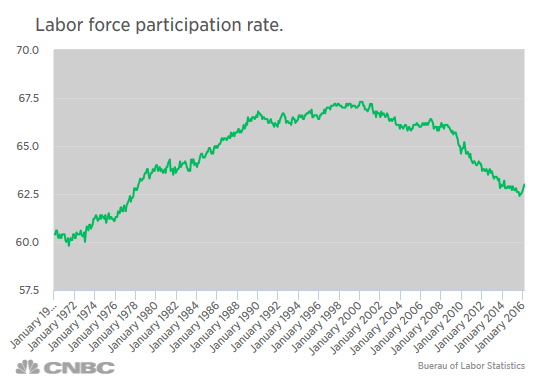

Donald Trump managed to shove his way into the spotlight again last week, claiming the US is heading for “a massive recession.” Unsurprisingly, the mainstream media scoffed at Trump’s assertion, pointing to the “great jobs report” that came out Friday.

The report did show the US economy added some 215,000 jobs, slightly more than expected. But once again, the headlines only tell a little piece of the story. And once again, most mainstream media and financial analysts are ignoring the bigger picture. In fact, all of the positive spin about a great employment outlook is nothing more than an April snow job. As Peter Schiff succinctly put it in his recent podcast, this was not a good jobs report:

We added the jobs we don’t want; we lost the jobs we do want. That is the real story. It’s the story nobody wants to tell. Everybody wants to talk about the number as if this is some kind of economic miracle.”

This article was written by Nelson Gilliat, a millennial supporter of sound money and Austrian economics. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

During March 16th’s FOMC meeting, the Fed announced that it would leave interest rates unchanged and scaled back its December projections for higher rates in 2016, 2017, and 2018. The Fed’s backtracking comes just three months after raising interest rates 25 basis points, its first hike since June 2006.

While the Fed’s backtracking on higher interest rate projections was the big news of the meeting, another emerging trend also deserves attention – – the Fed’s backtracking from being US data dependent and toward being global data dependent.

Global factors are playing an increasingly larger role in the Fed’s decision to raise interest rates.

According to last week’s FOMC statement, “economic activity has been expanding at a moderate pace despite the global economic and financial developments of recent months” and warned that “global economic and financial developments continue to pose risks.”

This is not an April Fools’ Day joke!

These are the winners in Peter Schiff’s Gold Giveaway.

Winners collected more than $4,500 worth of prizes, including gold coins, silver bars, and books signed by Peter Schiff.

These lucky people were drawn at random from all of the entries submitted.

This article was submitted by Addison Quale, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

This article was submitted by Addison Quale, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

Perhaps you are familiar with David Stockman and his mind-bogglingly long in-depth economic analyses topped off with blustery bombastic titles. Clearly, he’s an incredibly smart guy, and he’s produced some great stuff. But something is off in this recent article, and unfortunately, it betrays a fundamental lack of understanding of what’s really going on in the financial system.

It only took the first two paragraphs of his tirade for him to go astray:

Simple Janet should have the decency to resign. The Fed’s craven decision last week to punt on interest rate normalization is not merely a reminder that she is clueless and gutless; we already knew that much. That’s right. In the midst of vastly inflated and combustible financial markets, the all-powerful Fed is being led by a Keynesian school marm stumbling around in an explosives vest. She apparently has no idea that a 38 bps money market rate is not a pump toggle on some giant bathtub of GDP; it’s an ignition fuse that is fueling the greatest speculative mania in modern history.”

Essentially, Stockman is calling for Yellen’s resignation because all the economic data is pointing toward the appropriateness of a Fed rate hike after almost a decade of ZIRP. Instead, at the latest Fed meeting Yellen, “paused” the rate normalization, and, as such, is merely fanning the flames of the current speculative bubbles at work in the economy that will inevitably burst.

Stockman makes two errors in his analysis.

The Russians have launched into a gold buying spree.

Based on recently released International Monetary Fund numbers reported at Mining.com., the Russian central bank ranked as the world’s leading gold buyer in February, adding 356,000 ounces to its reserves:

Last December, Russia announced plans to increase its gold reserves to $500 billion within the next five years. As a Russian publication put it, “Gold is considered to be a buffer against external economic risks and is currently in favor in Russia.”

When we talk about increasing gold demand, the focus tends to fall on Asia. Earlier this week, we reported surging investor demand for the yellow metal in China. The Japanese have also gone on a gold buying spree since that country’s central bank plunged interest rates into negative territory. But it isn’t just Asians who are bullish on gold. Analysts say they see signs of growing demand for the metal in Europe as well.

According to an article published at CNBC, central bank action appears to be rejuvenating gold in Europe, as the entrenchment of negative interest rates makes depositing cash in banks less and less rewarding. UBS strategist Joni Teves said European central bank policy could become increasingly influential on the gold market:

Although gold is very much driven by US Federal Reserve policy, the impact of European Central Bank (ECB) policy decisions may become increasingly relevant for gold price action, as concerns about negative interest rates gain traction among investors.”