The price of gold is up 26% for the year so far. Overall, the price increase is beginning to change investor portfolios, as more people consider buying gold and other precious metals. However, the hike in gold prices is also starting to influence governments and cultures all over the world, from Japan scouring the ocean floor for gold to Egypt changing its long-held marriage rites.

Lately, there’s so much gold stockpiled by governments and investors, someone should pitch a new reality TV show called Gold Hoarders. But rather than poor agoraphobics maddeningly piling up old newspapers and canned food, the show would feature smart individuals like Bill Gross who have the foresight to see the writing on the wall. The message is simple, “Look out for a collapsed dollar and low-yielding assets.”

Bill Gross is all straight talk when it comes to his preference for precious metals investment. “I don’t like bonds; I don’t like most stocks; I don’t like private equity,” the Janus Capital portfolio manager told investors this week.

What’s his reasoning? It’s pretty straightforward. Central banking policy has eliminated a healthy, open market atmosphere where high-yield opportunities are no longer readily available.

Your weekly dose of the Fed’s latest antics.

Bank of England Slashes Rates, Gold Surges Forward

It’s important to remember that it’s not just the US Federal Reserve that launches the price of gold upwards with every misguided decision. As we predicted on Wednesday, the Bank of England dropped their interest rate to record lows in order to combat their struggling post-Brexit economy. The main result for the precious yellow metal was nearly a half-point surge in value overnight, bringing it closer to the $1,400 mark.

At Freedom Fest last month, Peter Schiff appeared on AMTV discussing how the Fed’s monetary policy has created an impending economic crisis to rival the 2008 housing crisis.

“The problems were created by the Fed,” he states. “They were created by monetary policy being too loose. Rates were too low when they were at 1%. That’s what inflated the housing bubble. But by keeping them at zero for seven years, the damage the Fed has done to the economy this time is much greater than what was done prior. So, I think we’re headed for a much worse economic crisis than what we went through in 2008”

In case you missed it, here’s what the Fed’s been up to this week.

Gold Prices Spike after Fed Announcement

It was a big week for being fed up with central banking. The Fed’s July meeting and the FOMC’s statement were on Wednesday. As expected, the plans for a rate increase were put on hold, and the markets had little response with the S&P closing flat. However, investors poured into gold futures, which rallied to their highest level in two weeks on Wednesday, according to MarketWatch.

Last week, we reported on an oft-ignored fundamental in the gold market – the shrinking supply.

Mining.com analyzed the data and concluded there are no more easy gold discoveries. In fact, the number of major gold discoveries is shrinking. This week we have further evidence that the supply of gold is being squeezed. In fact, MarketWatch asserted that we’re heading for “an impending gold production cliff” based on analysis by Sprott Asset Management.

Analysts say gold discoveries peaked in 2007, and a production peak will soon follow. Since that high-point in ’07, discoveries have collapsed, this “despite exploration budgets increasing by 250% from 2009 to 2012,” Sprott’s gold team said in a recent note.

Mining companies have begun to consider upping exploration budges with the price of gold on the rise, but there’s a “lead time to transition a discovery to production,” Sprott analysts said. As a result, “production is forecasted to decline over the next number of years.”

Once again, the Federal Reserve came, saw, and did nothing.

This has become modus operandi for the Fed over the last two years. As each FOMC meeting approaches, speculation about a possible rate hike ramps up and then the Janet Yellen does…nothing. The one exception was last December, and that turned out to be a complete disaster.

The pundits and analysts are already talking about the possibility of a September hike. Odds are, we’ll witness a repeat performance – or should I say non-performance.

Interestingly, the mainstream is starting to catch on to the game.

Sunny Pannu, director of corporate development for Defiance Silver, a silver explorer and developer, recently sat down with Silver Institute executive director Michael DiRienzo for a wide-ranging discussion about the fantastic world of silver.

The discussion focused on the present state of the silver market and its future. Topics ranged from an explanation of how the silver price-fix works to the dynamics of supply and demand.

DiRienzo emphasized the dual nature of silver, noting that it serves as both an industrial metal and a precious metal for investment. He echoed the same themes as a prominent mining CEO did in a recent interview with Kitco News, saying both investor and industrial demand for the white metal is strong.

DiRienzo said silver coin sales are on a record pace, as are inflows of silver into ETFs. On the industrial side, it’s interesting to note that the demand for silver has been steady despite general sluggishness in the global economy. DiReinzo said this was due in part to the expanding and diversifying uses for the metal.

Silver is basically all around you. It’s contained in your automobile, your cell phone, your computer, solar panels, PDP televisions, and many, many, many medical uses. So, on the industrial side, you’ll find silver’s use not only a mainstay, but also its growing in many other areas as well.”

The Federal Reserve stayed pat on interest rates in its most recent meeting, but speculation continues to percolate that the central bank will possibly raise rates in September.

Peter Schiff has been saying for months that the Fed won’t raise rates. He reiterated this on his most recent podcast. (Scroll down to listen to the full podcast.)

The Fed continued to say that they believe the economy is evolving in a way that will warrant gradual rate hikes. And of course, by gradual they mean no more rate hikes…So they raised rates once in December and they haven’t raised rates since. That’s about as gradual as you can possibly get. I mean, if a snail was raising rates they would have blown past Janet Yellen…I think, again, the rate-hiking cycle ended when they raised rates. It began when they started talking about tapering. That was the whole rate cycle, and whether people want to admit it or not, we are now in the easing cycle.”

In fact, Peter has said on numerous occasions the next move for the Fed will be lowering rates back to zero and launching another round of quantitative easing.

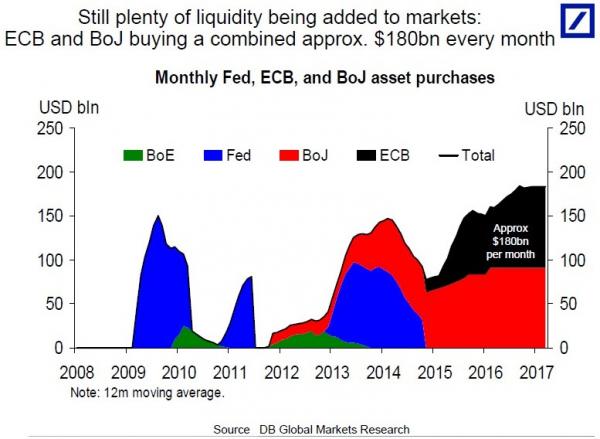

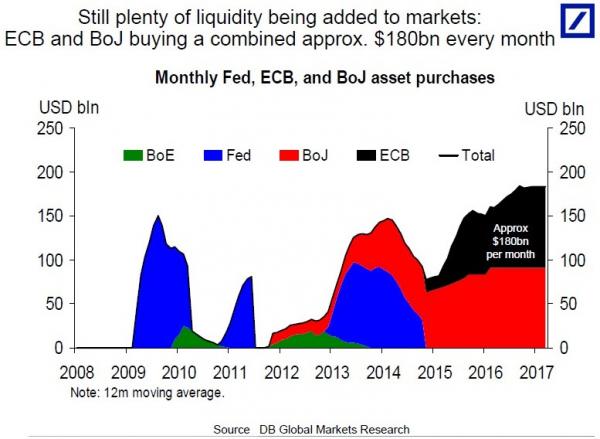

If the actions of central banks in the rest of the world serve as any example, Peter will certainly be proven right because the world is awash in QE. In fact, Reuters reported that the amount of quantitative easing is at record levels:

Over the last year, we’ve reported extensively on the growing influence of China on the world gold market, and the flow of gold from the West to the East. But with uncertainty created by Brexit, economic stagnation, and the proliferation of negative yielding bonds, it appears investors in the West have rediscovered the beauty of gold.

Western gold demand hit unprecedented levels through the first half of 2016, and according to a major precious metals research firm, that trend will continue through the second half of the year.