Sunny Pannu, director of corporate development for Defiance Silver, a silver explorer and developer, recently sat down with Silver Institute executive director Michael DiRienzo for a wide-ranging discussion about the fantastic world of silver.

The discussion focused on the present state of the silver market and its future. Topics ranged from an explanation of how the silver price-fix works to the dynamics of supply and demand.

DiRienzo emphasized the dual nature of silver, noting that it serves as both an industrial metal and a precious metal for investment. He echoed the same themes as a prominent mining CEO did in a recent interview with Kitco News, saying both investor and industrial demand for the white metal is strong.

DiRienzo said silver coin sales are on a record pace, as are inflows of silver into ETFs. On the industrial side, it’s interesting to note that the demand for silver has been steady despite general sluggishness in the global economy. DiReinzo said this was due in part to the expanding and diversifying uses for the metal.

Silver is basically all around you. It’s contained in your automobile, your cell phone, your computer, solar panels, PDP televisions, and many, many, many medical uses. So, on the industrial side, you’ll find silver’s use not only a mainstay, but also its growing in many other areas as well.”

The Federal Reserve stayed pat on interest rates in its most recent meeting, but speculation continues to percolate that the central bank will possibly raise rates in September.

Peter Schiff has been saying for months that the Fed won’t raise rates. He reiterated this on his most recent podcast. (Scroll down to listen to the full podcast.)

The Fed continued to say that they believe the economy is evolving in a way that will warrant gradual rate hikes. And of course, by gradual they mean no more rate hikes…So they raised rates once in December and they haven’t raised rates since. That’s about as gradual as you can possibly get. I mean, if a snail was raising rates they would have blown past Janet Yellen…I think, again, the rate-hiking cycle ended when they raised rates. It began when they started talking about tapering. That was the whole rate cycle, and whether people want to admit it or not, we are now in the easing cycle.”

In fact, Peter has said on numerous occasions the next move for the Fed will be lowering rates back to zero and launching another round of quantitative easing.

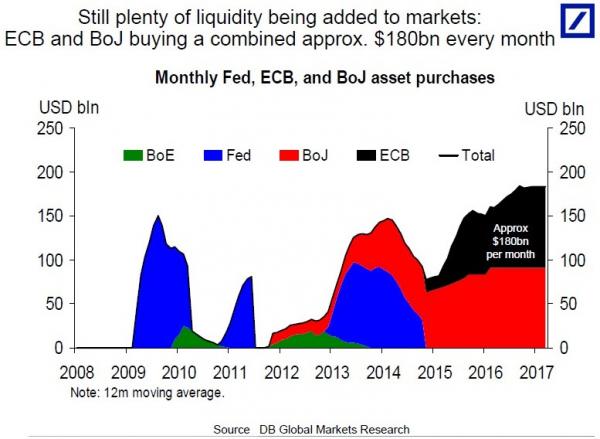

If the actions of central banks in the rest of the world serve as any example, Peter will certainly be proven right because the world is awash in QE. In fact, Reuters reported that the amount of quantitative easing is at record levels:

Over the last year, we’ve reported extensively on the growing influence of China on the world gold market, and the flow of gold from the West to the East. But with uncertainty created by Brexit, economic stagnation, and the proliferation of negative yielding bonds, it appears investors in the West have rediscovered the beauty of gold.

Western gold demand hit unprecedented levels through the first half of 2016, and according to a major precious metals research firm, that trend will continue through the second half of the year.

The highly-anticipated Rio Olympics begins next week (August 5th), and with it, a race for the gold. Soon, Olympic winners will be standing on the podium donning their gold, silver, and bronze medals and waving towards a roaring crowd. Nothing is more iconic of the Games than these medals draped around the winners’ necks. But have you ever wondered if the Olympic medals are actually made of gold at all? It turns out today’s gold medals actually contain very little gold at all.

Gold Medal History

During the Ancient Olympic Games, winners didn’t receive medals at all. Instead, they won a wreath made from olive leaves from a sacred tree near the temple of Zeus at Olympia. It wasn’t until the 1896 Summer Olympics that winners were awarded with actual hardware. However, at that time top performers didn’t win gold; they took home silver. Second place received bronze.

1896 Olympic Silver Medal

Between Jan. 1 and July 11, the price of silver increased 44.7%. But can the white metal maintain its bull run?

A prominent mining CEO thinks it can – and will.

Mining, Inc. CEO Mitchell Krebs told Kitco News that he expects the precious metals sector to attract even more investor interest through the second half of this year. Krebs, who also serves as president of the Silver Institute, went on to say he thinks silver sits in a unique position to outperform as it benefits both as a monetary metal and an investment metal:

I think, right now, silver is in this sweet spot and I think this trend can continue.”

After a brief pause in May, the Chinese and Russian central banks resumed their gold buying spree in June.

The People’s Bank of China added about 15 tons of gold to its stash last month. The Chinese central bank now officially holds about 58.62 million ounces of gold. China has bought gold in 11 of the past 12 months and has increased its hoard about 165 tons over the past year.

A year ago this month, the Chinese central bank announced its gold holdings had grown by 57% to about 1,658 tons. It was the first official update to China’s gold reserves since 2009. Many analysts believe the Chinese actually own more gold than the official numbers indicate – possibly a lot more.

As the saying goes: “Keep your friends close, and your enemies closer.” Here’s a quick look what the Fed’s been up to this week.

Philly Fed Shows Drop in Manufacturing

This week the Federal Reserve Bank of Philadelphia released the results of its Manufacturing Business Outlook Survey. The Survey of regional manufacturers showed general activity falling from 4.7 to -2.9 for July. According to Market Watch, this is the “ninth month of declining activity of the past 11 months and the slowest pace in six months” for the region. These numbers represent what Peter’s said about the economy in the past: “The Actual picture [the Fed paints] is an economic recovery that is over, if it ever happened.”

Fed Officials Tell WSJ Rate Hike Likely this Year

Some centrist Fed officials told the Wall Street Journal a rate hike is likely this year if the economic outlook continues to look positive. Timelines were thrown out, with a possible hike as soon as the September meeting. But that’s eight weeks away, and there are two job reports and other economic data to consider. A slim majority of surveyed economists are betting on a December hike instead.

Peter Schiff recently participated in a panel discussion in Las Vegas with Goldmoney co-founder, Josh Crumb and CEO Darrell MacMullin, along with best-selling author George Gilder.

During the discussion, Peter got down to the very basics, answering the question: what is money? He explained the important distinction between currency and money, pointing out that gold is money. Paper backed by gold is true currency. The government prints fiat currency – which is nothing but paper backed by nothing.

Peter said the time to return to gold has arrived:

Today, in the 21st century, this is going to be the real century of gold. And it’s not going to be because governments decide to go back to the gold standard…but because the public rebelled against fiat money and reclaimed honest money – money that holds its value and in fact gains value.”

Efforts to solve the Puerto Rican debt crisis have already run off the rails.

Late last month, Congress passed a bill allowing Puerto Rico to restructure its debt. Under the plan, the US territory essentially declared bankruptcy. The US government won’t expend funds to bail out Puerto Rico, but will allow the island’s government to pay back debtors at less than 100%. Although the bill doesn’t say so explicitly, for all practical purposes it created a bankruptcy process for the island.

Even with the agreement, Puerto Rico still defaulted on a $1.9 billion payment in principle and interest that was due July 1. Under the Puerto Rican constitution, bondholders were supposed to get first claim on government funds. At the time, Puerto Rico Governor Alejandro Garcia Padilla said the commonwealth could not raise enough money to cover the payment even if he completely shut down the government.

Fast forward to today and we find the Congressional fix has already started to unravel. The congressional plan put Puerto Rico under the guidance of a federal oversight board. But the law featured a built-in lag of at least two months before the board is put in place. Meanwhile a group of hedge funds have sued the country. They claim Gov. Alejandro García Padilla is exploiting the lag by spending hundreds of millions of public dollars on “purposes that apparently enjoy political favor,” According to the New York Times:

When we talk about gold and its future prospects, we tend to focus on the latest event, economic news, or central bank pronouncement. We debate whether the Fed will raise or lower rates. We try to project the impact of Brexit on the price of gold. And we pour over the latest job numbers and other economic data to gauge the health of the economy.

Of course, all of these things do affect the price of gold, but oftentimes these factors only have short-term impacts. There are fundamentals that affect the price of gold in the long-term that often get drowned out by the noise of squawking talking-heads.

The gold supply is one of those fundamentals often lost in the shuffle. Every indication is that it’s poised to shrink, and that could be more significant for the future price of gold than whatever latest news we’re obsessing over.