Beware of Impending Gold Production Cliff

Last week, we reported on an oft-ignored fundamental in the gold market – the shrinking supply.

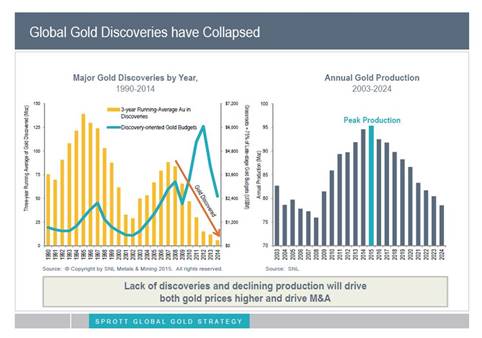

Mining.com analyzed the data and concluded there are no more easy gold discoveries. In fact, the number of major gold discoveries is shrinking. This week we have further evidence that the supply of gold is being squeezed. In fact, MarketWatch asserted that we’re heading for “an impending gold production cliff” based on analysis by Sprott Asset Management.

Analysts say gold discoveries peaked in 2007, and a production peak will soon follow. Since that high-point in ’07, discoveries have collapsed, this “despite exploration budgets increasing by 250% from 2009 to 2012,” Sprott’s gold team said in a recent note.

Mining companies have begun to consider upping exploration budges with the price of gold on the rise, but there’s a “lead time to transition a discovery to production,” Sprott analysts said. As a result, “production is forecasted to decline over the next number of years.”

Last year may well have been the peak production year at around 95 million ounces. Sprott analysts expect production in 2024 to fall to 78 million ounces. That represents about a 2.2% decline per year.

Charles Jeannes, former CEO of Goldcorp, echoed Sprott’s findings in an interview with the Daily Reckoning:

There are just not that many new mines being found and developed.”

Pierre Lassonde, chairman of the gold royalty and streaming company Franco Nevada, told the Daily Reckoning the number of “super-giant” discoveries (more than 20 million ounces) has plunged in recent years:

Lassonde also says the quality of most recent gold discoveries is second- and third-rate. Ore grades averaged 12 grams per ton in the 1950s. Now they’re only about 3 grams per ton. And he says many gold finds are only yielding one lonesome gram per ton. Never before has so much time and money been spent… by so many producers… to fetch so little gold.”

This once again raises an important question: is the world nearing or beyond “peak gold?” That’s the point when the amount of gold mined each year will begin to shrink. In September 2014, Chuck Jeannes announced that he believes the world will reach “peak gold” either in 2015 or 2016. Last April, Goldman Sachs analysts predicted gold production would peak in 2015, saying there are “only 20 years of known mineable reserves of gold and diamonds.”

It remains to be seen if technology or new finds can boost production, but it seems certain that supply will be constrained in the years to come, even as demand continues to surge. And there is certainly the possibility that the world will never again see the kind of gold production it once did.

Photo by Ramón Cutanda López via Flickr.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

I believe the silver situation is even more dire than gold.