Everybody seems bullish on the economy. Nobody is worried about anything, even though there is everything to be worried about. Peter Schiff said he feels like he’s in Alice in Wonderland. In his most recent podcast, he referenced a Morgan Stanley analyst interviewed by CNBC.

She’s unquestioningly bullish on every front. Everything is bullish. There is nothing at all to worry about. In fact, the only thing she said that anybody is worried about is that there’s nothing to worry about. It’s that things are so good, they’re wondering what are we missing. Maybe we should be a little bit worried because nobody is worried because everything is good. I mean, there are so many things to worry about. That is the reality. But they’re not worried about any of them.”

Over the last two years, the Federal Reserve has been nudging interest rates higher and their efforts are starting to bear fruit in the marketplace. Bond yields are beginning to climb.

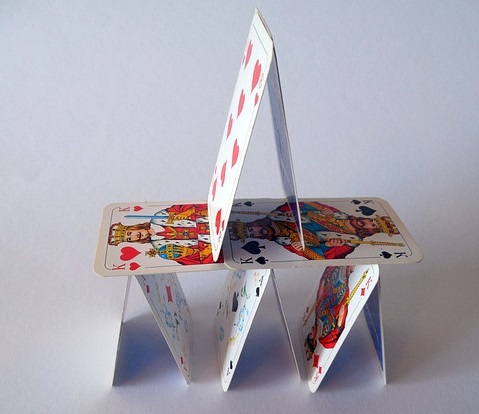

The question is how high can rates go before the house of cards the central bankers built comes tumbling down?

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

It seems Pres. Trump’s plan to borrow a Vincent van Gogh painting to adorn the White House went into the crapper. But it was a solid gold crapper – so the news wasn’t all bad.

Precious metals dealers are bullish on gold and silver in 2018.

According to an informal survey conducted by the nonprofit Professional Numismatists Guild, retailers anticipate gold will reach $1,460 this year, and perhaps climb even higher. They also like silver’s prospects, projecting the price to hit the $20 per ounce mark.

The dollar continued to tank Wednesday, hitting a 3-year low after Treasury Secretary Steven Mnuchin said he welcomed a weakening dollar.

The dollar index measuring the greenback against a basket of six major currencies slipped below 90 for the first time since December 2014. Meanwhile, gold climbed, hitting its highest level since August 2016.

The World Gold Council has weighed in on the cryptocurrency vs. gold debate. Unsurprisingly, the organization came down on the side of the yellow metal. But despite whatever bias you might perceive, the WGC report is certainly worth considering.

Peter Schiff recently appeared on InfoWars with Alex Jones and took on the notion that Pres. Trump is in the process of fixing the economy. In fact, Peter pushed back hard against Alex, saying we are on the verge of a crash and Trump is going to get the blame.

I agree with you. The economy is going to blow up. But it’s going to blow up like a bomb. It’s not a good thing. It’s a bad thing. Unfortunately, that’s what Trump has inherited from Obama. But it’s not even really just Obama. It’s the Federal Reserve. It’s the monetary policy that has been passed like a baton from Clinton, to Bush, to Obama, and now to Trump.

Peter predicted the collapse will happen under Trump’s watch. Peter has said in the past that Trump is not helping himself by taking credit for the soaring stock market. And when things go south, he’s going to get the blame.

He owns the stock market bubble. He and the Republicans own the economy now thanks to the tax cuts. They’re not going to make any difference, but they are going to give the Democrats a reason to blame it all on Trump and the Republicans.”

Why should you buy gold?

A report published this week by the World Gold Council pinpoints four key reasons.

Gold is a highly liquid yet scarce asset, and it is no one’s liability. It is bought as a luxury good as much as an investment. As such, gold can play four fundamental roles in a portfolio.

Many state legislatures kick off their 2018 sessions this month and that means continuing efforts to facilitate gold and silver ownership at the state level.

Bills introduced in Tennessee and Alabama would repeal state sales taxes on the sale of gold and silver bullion, and an Arizona bill would build on a foundation set last year and take another step toward treating gold and silver as money. These efforts not only help expand the market for gold and silver in the US, they also have the potential to undermine the Federal Reserve’s monopoly on money.