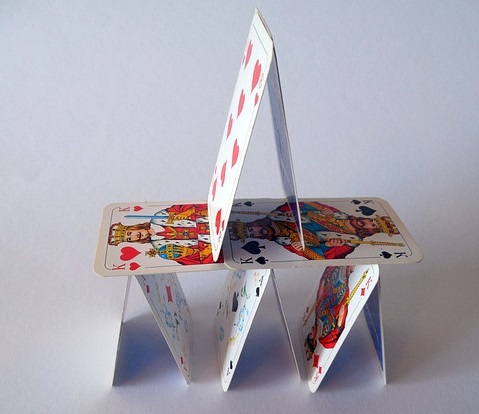

The House of Cards the Central Bankers Built

Over the last two years, the Federal Reserve has been nudging interest rates higher and their efforts are starting to bear fruit in the marketplace. Bond yields are beginning to climb.

The question is how high can rates go before the house of cards the central bankers built comes tumbling down?

In a podcast last week, Peter Schiff talked about the bond rate that could break the camels back, arguing that yields of around 4% could spark the next economic crisis.

The last time we had a 4% yield on the 10-year was before the 2008 financial crisis. Basically, that was the yield that broke the camel’s back. Remember, the financial crisis was triggered by rising interest rates on the debt that had been accumulated in the years prior as a result of Alan Greenspan keeping interest rates at 1% for a year-and-a-half and then slowly raising them back up over the course of another year-and-a-half. So, as the Fed was moving interest rates up at a measured pace, by the time they got to the point where rates had gone back up to about 5%, the yield on the 10-year was about 4%. That’s about as high as it was able to go. Then the market all fell apart.”

Economist Dr. Thorsten Polleit recently published an article at the Mises Institute that delves into why the “new economy” created by the central bankers cannot endure even modestly higher interest rates. As Peter alluded to, it has to do with the ever-increasing levels of debt their easy-money, low interest rate policies encourage.

Artificially depressed borrowing costs are fueling a ‘boom.’ Consumer loans are as cheap as never before, seducing people to increasingly spend beyond their means. Low interest rates push down companies’ cost of capital, encouraging additional, and in particular risky investments – they would not have entered into under ‘normal’ interest rate conditions. Financially strained borrowers – in particular states and banks – can refinance their maturing debt load at extremely low interest rates and even take on new debt easily.”

We also get a psychological effect from central bank policy. The Fed, along with the world’s other central banks, have effectively draped a safety net under the markets.

Investors feel assured that monetary authorities will, in case things turning sour, step in and fend off any crisis. The central banks’ safety net has lowered investors’ risk concern. Investors are willing to lend even to borrowers with relatively poor financial strength. Furthermore, it has suppressed risk premia in credit yields, having lowered firms’ cost of debt, which encourages them to run up their leverage to increase return on equity.”

Of course, as debt piles up, any increase in the interest rate will strain borrowers. For instance, normalization of interest rates would crush the US budget under interest payments. Analysts have calculated that if the interest rate on Treasury debt stood at 6.2% – their level in 2000 – the annual interest payment on the current debt would nearly triple to $1.3 trillion annually. And it’s not just governments that will feel the effect. Highly leveraged corporations and individuals will also struggle in a higher interest rate environment. And they can’t print money in order to kick the can down the road.

The central banks have created a vicious cycle, as Polleit points out. Coming out of the 1990s, the Federal Reserve pushed up rates and ended the “new economy boom,” better-known as the dot-com bubble. In order to “fix” the problem, the Fed slashed rates and created another massive credit boom, primarily centered on the housing market. That bubble burst in 2007/2008. In the years since, the Fed has repeated the process and we now have a world full of bubbles just waiting to pop.

With every cycle, the Fed has had take rates to lower levels and keep them there longer. And with each recovery, the peak interest rate that popped the bubble has been increasingly lower. Polleit explains the dynamics in easy to understand terms.

A destructive side effect of fiat money is that the economy’s level of debt keeps rising over time: The growth of credit keeps outpacing production gains. This is because in a fiat money regime, credit-financed investments fall short of their expected profitability, and credit-financed consumption is unproductive. Quite a few investments turn out to be flops. The economy gets caught in a debt trap. Credit-financed consumption and government spending make it even worse. To be sure: it has become a problem on a global scale.”

“In an attempt to prevent the day of redemption, central banks slash interest rates to ever lower levels to keep the system going. Once interest rates are lowered, however, they typically cannot (for political reasons, I should hasten to say) be brought back to pre-crisis levels – as this would make the debt pyramid, and with it the economy and the financial system, come crashing down. It is this economic insight that explains why interest rates show a marked trend decline over the last decades in all countries that have adopted fiat money.”

As economist Ludwig von Mises said, “There is no means of avoiding the final collapse of a boom brought about by credit expansion.” This house of cards will collapse. It’s not a question of “if,” but “when.”

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]