Stock markets rallied to close out March and ended up in the black for the holiday-shortened week, but markets were down on the month and also for Q1 2018. In fact, it was the first quarter in the red for stock markets in 10 quarters.

During his most recent podcast, Peter Schiff said he thinks this was just the first of many down quarters to come, reiterating a theme he hit on last week.

Remember, the market action that I’ve been observing really, to me, looks like a bear market.”

Indians are hoarding their gold despite an increase in the price during the first quarter of 2018. Analysts say they are holding onto their gold in anticipation of bigger price increases.

Gold was up around 1.5% in dollar terms in the first quarter of this year. According to the Economic Times of India, the yellow metal appreciated 4.41% in rupees.

Even with that healthy increase, old gold sales in India fell by 35-40% in Q1 2018 compared to the previous quarter. According to the paper, analysts and traders think Indians are holding back selling in anticipation of further price increases, especially if the US and China get into a full-blown trade war.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

I used to work in local news. We covered “breaking news,” which roughly translates to “robbery, wreck, fire!” Not necessarily in that order. Becuase of our razor-sharp focus on flashy lights and screechy sirens, police scanner chatter was a ubiquitous presence in the newsroom. You gotta know where the cops and firefighters are going if you’re going to chase them.

Anyway, it was pretty common to hear about break-ins at liquor stores. Sometimes the thieves would get some cash, but regardless, they almost always made off with beer, or liquor or both. You can kind of figure why. Booze is expensive. It’s hard to hold a job when you’re a drunk. So, robbing the local liquor store is one way to keep that whistle wet.

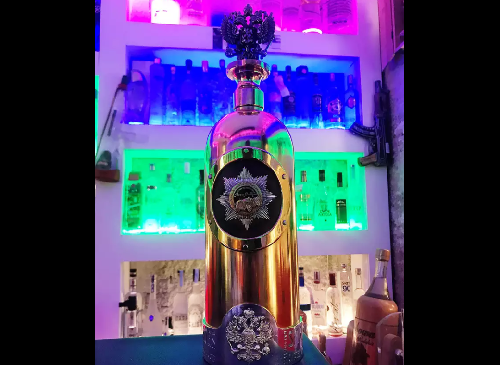

But a thief in Denmark got more than he bargained for. He made off with the world’s most expensive vodka bottle.

The Federal Reserve manipulates interest rates, creates money out of thin air, blows up asset bubbles and generally wreaks havoc on the economy. But some people have found an even more insidious problem with the Fed.

It’s not “diverse” enough.

Historian Tom Woods offered up some pretty sharp observations about this latest “outrage” in a recent email. And lest you think this is just a screed against left-wing social justice warriors, he has some sharp words for Republicans too. There’s pretty much bipartisan agreement when it comes to the “indispensable” nature of the Fed.

This article was written by Joel Bauman, SchiffGold Senior Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold. The article focuses on the gold market through the lens of technical analysis. Technical analysis is a subjective form of study based on historical price patterns. The analysis offered is for educational purposes and is not a recommendation to buy or sell.

This article was written by Joel Bauman, SchiffGold Senior Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold. The article focuses on the gold market through the lens of technical analysis. Technical analysis is a subjective form of study based on historical price patterns. The analysis offered is for educational purposes and is not a recommendation to buy or sell.

Over the last several weeks, we’ve spotlighted a lot of data indicating the economy isn’t nearly as strong as the mainstream pundits keep telling us. We’ve focused on the collapsing retail sector. We’ve looked at household debt and US consumer stress. We’ve talked a lot about the US federal debt and its potential impact on the economy.

There’s another factor that indicates there may be some cracks in the global economy – the silver-gold ratio.

Stocks rebounded Monday after their precipitous fall late last week. The Dow Jones rose 669 points. Then on Tuesday, it tanked again, falling over 300 points.

In his latest podcast, Peter Schiff said the increase in stock market volatility is another sign things are different. He reiterated what he said last Friday. He thinks we are in a bear market. All of the flashing warning signs are there. It’s just that nobody can seem to see them.

Yesterday, we reported that some of the big mainstream players in the investment world, including Goldman Sachs, have suddenly gone bullish on gold. They aren’t alone. US Global Investors CEO Frank Holmes said he thinks the yellow metal might hit $1,500 per ounce this year.

Even with the headwinds caused by Federal Reserve monetary tightening, gold has had a pretty good start to 2018. It’s up close to 3% on the year. In fact, gold is one of the best-performing assets so far this year. As of March 23, gold had outperformed the dollar index, the S&P 500, US Treasuries and the Bloomberg Commodity Index.

Twitter has announced a ban on cryptocurrency ads.

The social media company’s announcement is more bad news in what has turned into several bad months for cryptocurrencies.