Low interest rates are a boon to borrowers. Thus the Federal Reserve’s quest to hold interest rates artificially low during the current economic crisis. We’re told easy money will bolster the economy as consumers and businesses take advantage of low rates and spend.

But if you’re trying to save money, this anything but a boon. In fact, it’s nearly impossible to save for retirement in the current interest rate environment. Today, your average Joe is forced to invest in increasingly riskier assets in order to generate enough money to retire on.

So… It’s Friday the 13th — 2020.

Should we really be tempting fate like this?

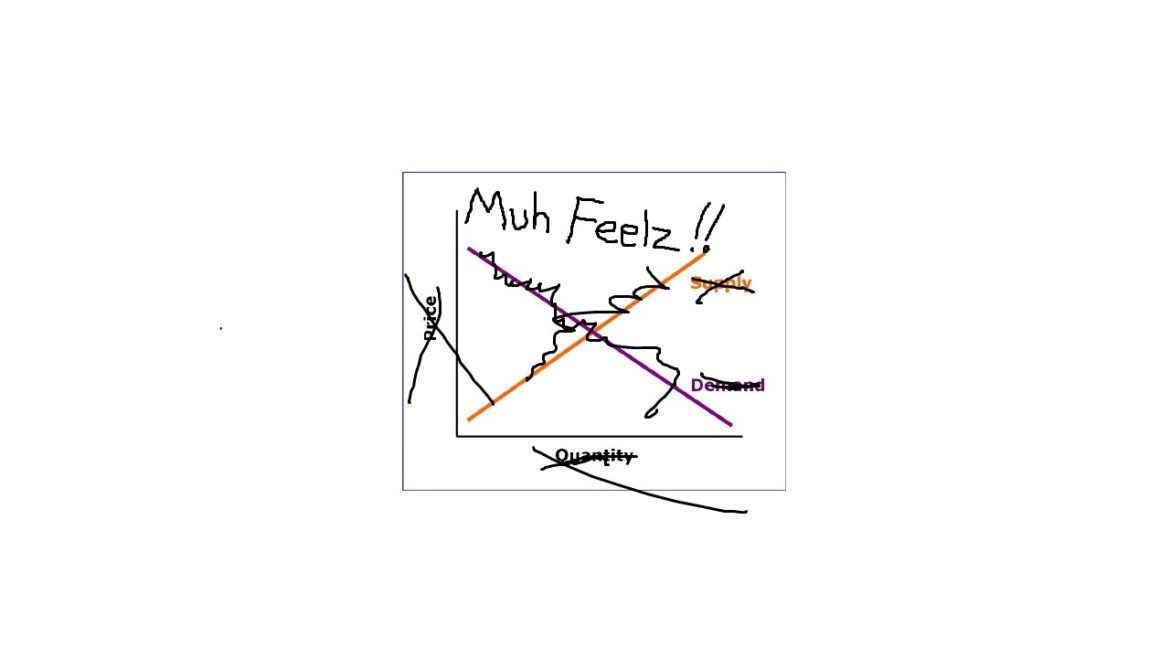

I get really frustrated by people arguing vociferously about things they don’t know anything about. And on no subject is this more prevalent than the debate over the minimum wage. Bring up the “fight for $15” and you will suddenly get high school dropouts who can’t do basic multiplication yelling at you emphatically about the benefits of government-imposed wage floors. Because, you know, they feel like it should work.

How will the outcome of the US election impact the price of gold moving forward?

Of course, there is no way to know for sure. US politics is just one of the myriad factors that influence the gold market and you never know how things will play out. But there are reasons to believe the future will remain bullish for the yellow metal no matter who ends up sitting in the Oval Office.

The Federal Reserve balance sheet could be heading to $40-50 trillion or higher as the central bank continues to monetize US debt.

To borrow a phrase from the movie “Pretty Woman,” this is the fork they know. If the economy turns sour, the government borrows money and the Fed backstops it by buying Treasuries. The problem is there is no conceivable exit strategy.

Halloween tomorrow. Seems like a good time for a spooky gold story.

It looks like March all over again.

Pretty much everything except dollars sold off yesterday. The Dow Jones was down 943 points. The S&P 500 dropped by 3.53%. The Nasdaq plummeted by 426 points. It was panic selling as markets fretted about the rise in COVID-19 cases, new lockdowns in Europe, and the lack of progress on a stimulus deal in the US.

We’ve been saying for months that the stock market has completely disconnected from economic reality. The markets have hit record highs despite the economic chaos caused by the government response to COVID-19. As Peter Schiff put it in a podcast back in May, the markets are on a Fed-induced sugar high.

In a recent article, David Stockman put the stock market bubble into perspective and asked a poignant question: how could the S&P 500 be trading at its highest multiple in 70 years when the growth rate of corporate earnings has been sinking for more than two decades?

People will do just about anything to avoid paying taxes. Case in point – a man from Dubai shoved about 2 pounds of gold — where the sun don’t shine — in order to avoid paying customs taxes in India.

Yes. I said two pounds.

Well-known management consultant Peter Drucker perfectly described the predicament faced by central bankers.

You can’t manage what you can’t measure.”

So why do we put so much faith in central bankers?