Jim Grant: The Fed Needs Some Grounding in Financial History and Common Sense

Will the Federal Reserve raise interest rates again? Or is this hiking cycle over? Will it really hold rates higher longer, or will it cut in the near future? Everybody in the financial world is trying to predict the central bank’s next move.

Fed members insist they are data-dependent and will go where the numbers lead them. But in an interview on CNBC, financial analyst Jim Grant said data alone isn’t enough. You need to put the data into context.

The whole “data-dependent” canard is questionable to begin with. How long did Jerome Powell and other central bankers insist that inflation was “transitory” despite the data indicating otherwise?

When the Federal Reserve could no longer pretend price inflation was “transitory,” it finally launched a war on inflation and rapidly hiked interest rates. Currently, rates are at between 5.25 and 5.5%. Many people in the mainstream think the hiking cycle is over. Paul Krugman even went so far as to say the war was over, and he declared, “We won.”

But if you believe the data, price inflation might be down, but it isn’t out.

So, has the Fed done enough?

Jerome Powell delivered a speech last week at the Economic Club of New York. Grant said like every “Delphic prophet,” the Fed chair was “just ambiguous enough.”

During the speech, Powell claimed that interest rates are currently restrictive. Grant said this “isn’t borne out by what the Fed likes to call the data.”

There are four or five indices of financial conditions, and four of the five say that notwithstanding this rise in rates and QT and the like, conditions in finance are generally accommodative. It makes you wonder what stringency would feel like because certainly on kind of a tactile basis it does feel as if things are rather taut.”

Grant noted that these indices were flashing “tight” when the Fed went to battle with the inflation of the 1970s.

Peter Schiff recently said the real problem isn’t the 5% interest rates of today. It was the zero percent interest rates the Fed maintained for more than a decade. That precipitated a “decade of reckless spending financed by debt.” Not only has the federal government run up a massive debt, so have corporations and American households.

“Everybody has gorged themselves on this debt feast that was served by the Federal Reserve,” Schiff said.

Grant put it another way, saying the long run of artificially low interest rates “introduced a fragility in the economy that 5% is now testing,” and he said we’re now seeing the characteristic consequences of very low, “money grows on trees” interest rates.

As an example, Grant pointed out the Bezos/Gates-backed trucking company Convoy that shuttered operations. In April 2022, Convoy was valued at over $3.5 billion. The Convoy CEO Dan Lewis cited contractionary credit markets as one of the reasons for the shutdown.

Grant said we’re not seeing this kind of situation far and wide, “but it is beginning to happen.”

I think as time goes on, you’ll see much more of it.”

Meanwhile, the Fed keeps insisting that it is “data dependent.” But the data is always backward-looking. And as Grant pointed out, it is also subject to revision.

One shouldn’t be utterly dependent on them [data]. Jay Powell at his summertime speech in Jackson Hole said something like, ‘The Fed is navigating by the stars under cloudy skies,” which I think is most apt.”

Data alone isn’t sufficient without a framework or a theory in which to contextualize it.

I would submit to you that a common sense approach might be helpful. For example, you can reason that if you’ve been repressing interest rates, you being the central banks collectively worldwide, but suppressing them for the better part of 10 years, and if at one point, an extreme point, some $16 trillion of securities were priced to yield less than nothing – the lowest rates in 4,000 years of recorded rate history – in those circumstances, you’d expect that the proverbial beach ball held underwater would pop up again and not just stop at the surface, but rather shoot a little bit up in the air.”

Grant concluded that one can’t be a prisoner to data.

You have to have some grounding in financial history and some grounding in common sense.”

Peter recently appeared on the Bald Guy Money show for a conversation on gold’s role in American and global politics, the influence of the BRICS coalition on metals markets, and, as always these days, the disastrous monetary policy coming out of the Fed.

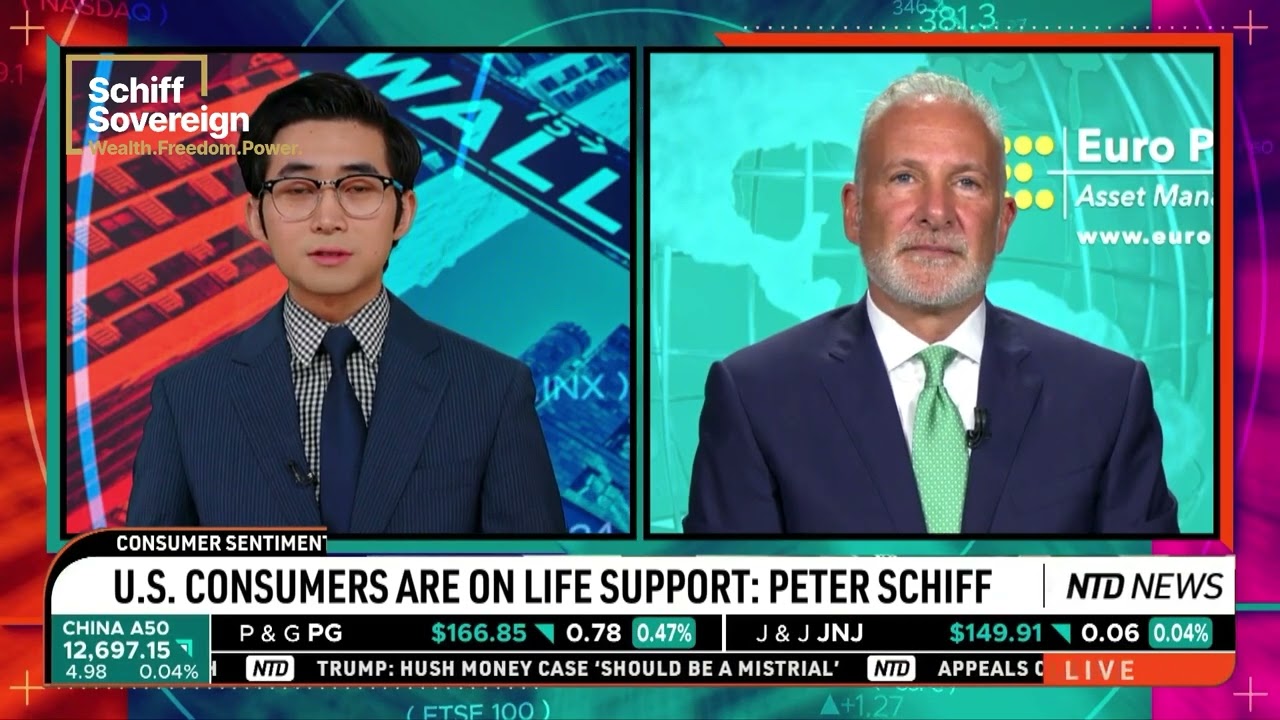

Peter recently appeared on the Bald Guy Money show for a conversation on gold’s role in American and global politics, the influence of the BRICS coalition on metals markets, and, as always these days, the disastrous monetary policy coming out of the Fed.  On Friday, Don Ma interviewed Peter on NTD’s Business Matters. Their conversation focuses on declining consumer sentiment. With GDP and unemployment figures also signaling a recession, a worsening consumer outlook bodes poorly for the economy.

On Friday, Don Ma interviewed Peter on NTD’s Business Matters. Their conversation focuses on declining consumer sentiment. With GDP and unemployment figures also signaling a recession, a worsening consumer outlook bodes poorly for the economy. On Wednesday, Peter appeared on This Week in Mining with Jay Martin. Jay and Peter discuss the state of the economy, the government’s assault on sound money, and why the mining sector constitutes a good investment.

On Wednesday, Peter appeared on This Week in Mining with Jay Martin. Jay and Peter discuss the state of the economy, the government’s assault on sound money, and why the mining sector constitutes a good investment. On Friday, Peter participated in an exhilarating debate over the merits of gold and Bitcoin. Professor of economics Nouriel Rabini joined Peter to debate Erik Voorhees and Anthony Scaramucci, two proponents of Bitcoin. They cover a lot of ground in their 2+ hour debate, so be sure to watch the full video on Peter’s youtube channel.

On Friday, Peter participated in an exhilarating debate over the merits of gold and Bitcoin. Professor of economics Nouriel Rabini joined Peter to debate Erik Voorhees and Anthony Scaramucci, two proponents of Bitcoin. They cover a lot of ground in their 2+ hour debate, so be sure to watch the full video on Peter’s youtube channel. Last week Scott Melker interviewed Peter on The Wolf of All Streets podcast. They have a friendly discussion about Bitcoin’s future, the differences between gold and crypto, and the overlap in the crypto and precious metals movements.

Last week Scott Melker interviewed Peter on The Wolf of All Streets podcast. They have a friendly discussion about Bitcoin’s future, the differences between gold and crypto, and the overlap in the crypto and precious metals movements.