Just What the Fed Ordered! CPI Comes In Lower Than Projections

The Federal Reserve got just what it needed – an even cooler-than-expected Consumer Price Index (CPI) report card for June. This could give the central bank a plausible excuse to back off its inflation fight.

But make no mistake, inflation isn’t dead or buried.

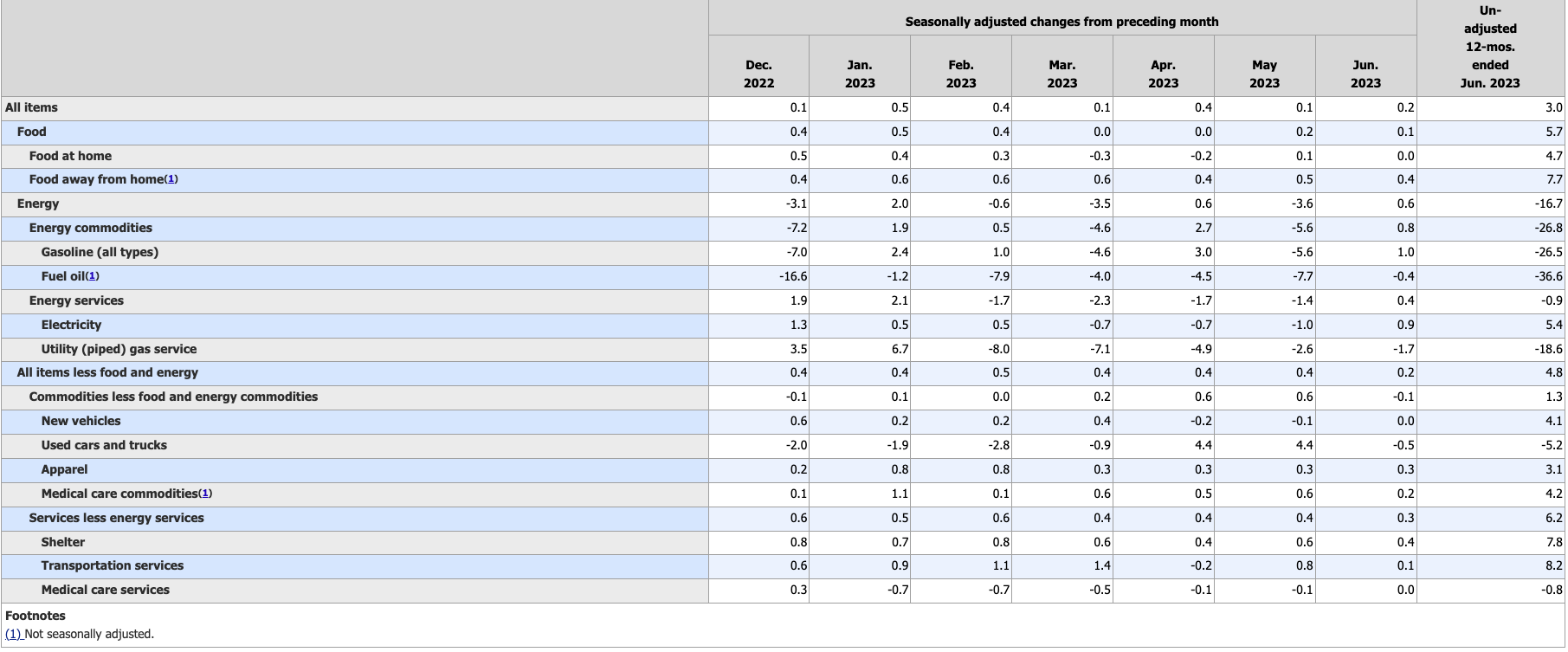

On an annual basis, CPI increased by 3% in June, according to the latest data from the Bureau of Labor Statistics. This was slightly lower than the 3.1% estimate and compares with a 4% reading in May.

On a monthly basis, prices increased slightly faster in June than they did in May — 0.2% compared to 0.1%.

Stripping out more volatile food and energy prices, core CPI remains in the hot category, but did show some signs of cooling. Month-on-month, core CPI rose 0.2% with an annual increase of 4.8%. Both numbers were slightly below projections.

The month-on-month core reading was the lowest of the year. It remains to be seen if this was a trend or an outlier.

Looking at the monthly increases so far in 2023 reveals that core CPI remains sticky, the June number notwithstanding. It rose on a monthly basis by 0.4% in January, 0.5% in February, 0.4% in March, 0.4% in April, 0.4% in May, and 0.2% in June. That averages to 0.38% per month or 4.56% annually – still more than double the Fed’s 2% target.

To put that number into perspective, the annual core CPI increase in June 2022 was 5.9%. If you go by the core CPI, and everybody swears it’s a better price inflation gauge because it is less volatile, then you have to conclude that price inflation hasn’t dropped nearly as much as the headline number indicates.

And you will notice that all of these numbers are above the Fed’s 2% inflation target.

Keep in mind, inflation is worse than the government data suggest. This CPI uses a formula that understates the actual rise in prices. Based on the formula used in the 1970s, CPI is closer to double the official numbers.

Big drops in energy prices have helped bring the overall CPI down. Broadly speaking, energy prices have dropped by 16.7% year-on-year. Gasoline prices are down 26.5%.

Outside of the energy category, the only prices that fell on a monthly basis were used cars and commodities.

The big drop in headline CPI is partially a function of math. A huge 1.2% month-on-month increase from a year ago dropped out of the calculation, bringing the yearly average way down.

As we explained after the release of the April CPI data, math is about to turn on the CPI calculation.

The CPI last April was 0.4% which means the drop is due to a bigger number coming off the board. This will likely play into the May and June CPI especially as 0.92% and 1.21% fall off the YoY calculation. This will greatly help the CPI YoY come down further over the next two months.”

Moving forward, the monthly increases dropping out of the calculation will be much smaller, meaning the headline annual numbers will not drop as quickly moving forward.

JUST WHAT THE FED ORDERED

This is exactly what the Federal Reserve needed. As CNBC summed it up, “The numbers could give the Federal Reserve some breathing room as it looks to bring down inflation that was running around a 9% annual rate at this time in 2022, the highest since November 1981.”

The central bankers at the Fed have been talking tough about staying in the inflation fight, but their actions undercut their rhetoric.

Just last week, Dallas Fed President Lorie Logan said the continued above-target inflation outlook and a stronger-than-expected labor market “calls for more-restrictive monetary policy.”

But if inflation is such a concern, why didn’t they raise rates at the June meeting? Nothing was different in terms of the economic picture in June. We were hearing the same rhetoric in June. But they stood pat and didn’t raise rates.

And why aren’t they shrinking the balance sheet faster? They haven’t hit the monthly target for shedding mortgage-backed securities one time since announcing the plan in May 2022. Not one time! And the plan wasn’t exactly ambitious to start with.

So, if inflation is the big fear, why this slow walk?

It’s almost like they want to talk about an inflation fight but they don’t really want to be in an inflation fight. It’s like Elon Musk and Mark Zuckerberg talking about getting in the Octagon. It’s cool to talk about, but I don’t think either one of those dudes really wants to start throwing punches.

I think this “big talk-little action” stance is because Jerome Powell and his minions realize high-interest rates will eventually break something in the economy. Even their own economists have warned about a looming catastrophe.

This reveals the ugly reality. The Fed is wedged between a rock and a hard place. It needs to appear to be fighting hot price inflation, but the central bankers also don’t want to wreck the economy. So, they’re talking tough and hoping against hope CPI will cool enough for them to back down.

They may have gotten their wish.

This CPI gives them some wiggle room to plausibly back out of the inflation fight. They can say, “Problem solved,” and begin the pivot back to more moderate interest rates.

But the problem isn’t solved no matter what the CPI data says.

As Peter Schiff pointed out in a tweet, declines in the CPI are weakening the dollar and raising the price of commodities, including oil.

Better than expected #inflation data is crushing the dollar, sending the Dollar Index to its lowest level since April 2022. A major dollar collapse will send commodity & import prices soaring, pushing U.S. trade deficits to record highs, causing future #CPI gains to spike higher!

— Peter Schiff (@PeterSchiff) July 12, 2023

More fundamentally, price inflation is just a symptom of the real problem – trillions of dollars created out of thin air and injected into the economy. While the money supply has contracted enough to precipitate a recession and suppress price increases for the time being, it hasn’t done anything to remove the $8 trillion the central bank has injected over the last decade-plus. Most of that money is out still sloshing around out there.

That’s inflation.

And when something does ultimately break in the economy, the Fed will almost certainly start creating even more inflation with rate cuts and quantitative easing.

To use Fed terminology, this cooling price inflation is transitory.

In reality, the end of the inflation problem means the beginning of a new inflation problem because the Fed hasn’t addressed the root cause – an economy addicted to easy money.

In 2009, 140 banks failed, and a recent report from financial consulting firm Klaros Group says that hundreds of banks are at risk of going under this year. It’s being billed mostly as a danger for individuals and communities than for the broader economy, but for stressed lenders across America, a string of small bank failures could quite […]

In 2009, 140 banks failed, and a recent report from financial consulting firm Klaros Group says that hundreds of banks are at risk of going under this year. It’s being billed mostly as a danger for individuals and communities than for the broader economy, but for stressed lenders across America, a string of small bank failures could quite […] Cocoa prices have dumped since rocketing to a dramatic peak last month as an El Nino cycle winds down and traders rush out of the illiquid market. For now, depreciating fiat currencies are still keeping the cocoa price still far above its 2023 levels. Coffee has had a similar rise and subsequent correction — but now, inflation and other factors are conspiring to […]

Cocoa prices have dumped since rocketing to a dramatic peak last month as an El Nino cycle winds down and traders rush out of the illiquid market. For now, depreciating fiat currencies are still keeping the cocoa price still far above its 2023 levels. Coffee has had a similar rise and subsequent correction — but now, inflation and other factors are conspiring to […] California’s government bet that they knew better than the free market. And now millions are paying the price. The story begins in 1919, when the city of Berkley, California instituted legislation setting aside districts that would only allow the construction of single-family housing. The idea spread, and soon much of California’s urban areas had adopted the zoning policy. Today, approximately 40% of the total land in Los Angeles is […]

California’s government bet that they knew better than the free market. And now millions are paying the price. The story begins in 1919, when the city of Berkley, California instituted legislation setting aside districts that would only allow the construction of single-family housing. The idea spread, and soon much of California’s urban areas had adopted the zoning policy. Today, approximately 40% of the total land in Los Angeles is […] The yen was once known as a safe-haven currency for investors to protect themselves when broader markets are shaky or other currencies are dropping, but those days are numbered. A stable government and consistent (and low) interest rates have been some of the driving factors, but it’s the unwinding of that ultra-low interest rate policy that will be the yen’s “safe […]

The yen was once known as a safe-haven currency for investors to protect themselves when broader markets are shaky or other currencies are dropping, but those days are numbered. A stable government and consistent (and low) interest rates have been some of the driving factors, but it’s the unwinding of that ultra-low interest rate policy that will be the yen’s “safe […] Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […]

Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […]