The Fed Is Doing a Lot of Talking But What Is It Actually Doing?

The markets have obsessed over what the Fed is saying while almost completely ignoring what it’s actually doing.

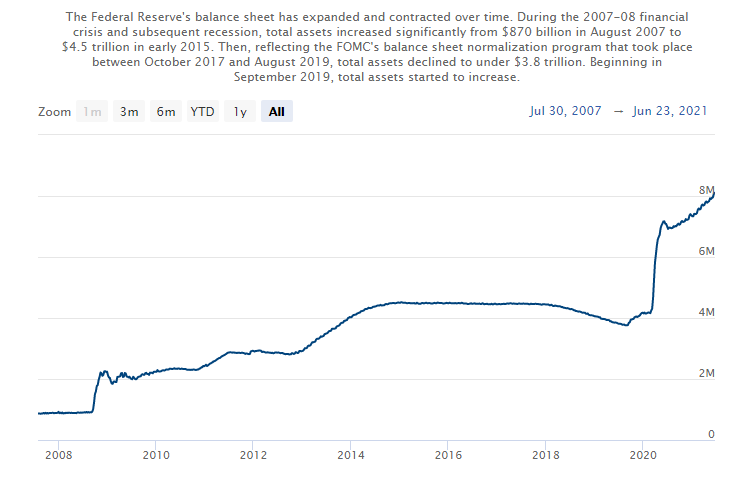

After the June FOMC meeting, markets reacted to the hint that the Fed might start raising interest rates in 2023 instead of 2024. But of course, it didn’t move rates up from zero. And while the Fed apparently talked about talking about tapering its quantitative easing bond-buying program, it continues to expand its balance sheet at a torrid pace.

Earlier this month, the Fed balance sheet pushed above $8 trillion for the first time ever. In one week between June 16 and June 23, the Fed increased its balance sheet by $37.69 billion. As of June 23, the balance sheet stood at $8.102 trillion.

The Fed may be thinking about thinking about talking about tapering its asset purchases, but its actions speak much louder than its words.

Looking at the bigger picture, one must wonder how anybody thinks the Fed will ever be able to unwind this extraordinary monetary policy. It couldn’t do it after 2008. How can it possibly do it now?

The Fed balance sheet has nearly doubled in just a little over one year. It stood at a mere $4.159 trillion on Feb 24, the cusp of the COVID-19 pandemic.

When Ben Bernanke launched quantitative easing during the Great Recession, he swore the Fed wasn’t monetizing the debt. He called it a temporary emergency measure. Bernanke said the difference between debt monetization and the Fed’s policy was that the central bank was not providing a permanent source of financing. And he promised the Treasurys would only remain on the Fed’s balance sheet temporarily. He was obviously wildly mistaken or outright lying.

The Fed balance grew from $898.6 billion in August 2008 to a peak of just over $4.5 trillion in Jan. 2015. The Fed didn’t get around to significantly shrinking the balance sheet until 2018. The central bankers claimed balance sheet reduction was on autopilot, but that didn’t last long. The balance sheet dipped to $3.76 trillion in late August of 2019. From there it took an upward trajectory. Although they didn’t call it quantitative easing, the Fed had already pivoted back to QE in 2019, long before coronavirus reared its ugly head. In the fall of that year, the stock market tanked. The over-indebted economy couldn’t even handle a modest move toward monetary policy normalization. Once the stock market threw its taper-tantrum, the Fed pivoted back toward loose monetary policy.

Since the onset of the pandemic, the Federal Reserve balance sheet has grown nearly twice as large as it was at its peak in the wake of the Great Recession. Debt has skyrocketed. The US government alone added more than $4 trillion to its debt-load over the last year and a half. If history provides any indication, the notion of a serious pivot to monetary policy normalization is nothing but a fantasy. The Fed can talk about it as much as it wants. But as the saying goes, talk is cheap. What will the central bank actually be able to do?

Even the mainstream acknowledges that tapering may be easier said than done. A recent Bloomberg article proclaimed, “No matter what the Fed does or when it does it, there are forces that should keep the cost of money near-record-low levels not just in the immediate future, but long past the end of tapering.”

And Bloomberg assumes the Fed will actually start a taper. It’s difficult to see that happening.

Bernanke’s claims notwithstanding, the Fed has monetized US government debt. In fact, the central bank monetized more than half of the massive pandemic debt. And there is more borrowing and spending coming down the pike.

President Biden has proposed a $2 trillion-plus infrastructure plan. He has proposed the “American Families Plan.” And there will undoubtedly be more spending plans in the future. The administration claims it can pay for all this through tax hikes. This certainly won’t happen. These programs will cost more than projected and tax revenue will come in under forecasts. That means the government will have to borrow even more money and the Fed will have to monetize more debt. That means more bond-buying, not less.

If the central bank takes its thumb off the bond market, interest rates will spike. That’s not a viable option when your entire economy is built on borrow and spend.

The Fed faces a conundrum. It has an inflation problem, despite its efforts to downplay rising prices and transitory. It needs to tighten to fight inflation. But it can’t tighten without wrecking the economy. The Fed is in a box.

Ultimately, talk is just that – talk. The real question is what will the Fed do?

Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […]

Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […] The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […]

The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […] The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […]

The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […] The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […]

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […] What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.

What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.