Why Are US Treasury Bond Sales Are About to Spike?

The federal government has already run a $2.06 trillion budget deficit in fiscal 2021 with four months left to go. But somewhat surprisingly, over the last few months, the national debt hasn’t increased at nearly the pace you would expect considering the budget shortfalls. Given the level of spending, borrowing should be much higher. How has the federal government maintained its spending pace without borrowing at a much higher rate?

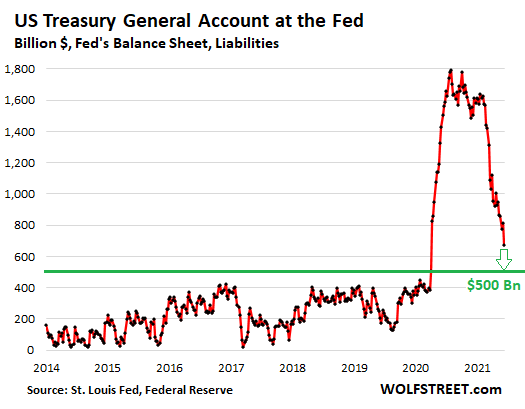

The US Treasury has been drawing down the balance in its Treasury General Account (TGA) at the Federal Reserve. But that maneuver is about to come to an end, so you can expect Treasury bond sales to spike in the coming months.

There has been talk of the Fed tapering its bond-purchase program to deal with hotter than expected CPI. But one has to wonder how the central bank could possibly accomplish this given the number of bonds the US government will have to sell to maintain its spending spree.

Money coming into the federal government, whether collected in taxes or raised through the sale of Treasuries, goes into the TGA. It is basically Uncle Sam’s checking account. The government also pays its bills from this account.

In just a few months last spring, the US government sold trillions of dollars in Treasury bonds. The national debt exploded by nearly $3 trillion. Meanwhile, the Federal Reserve monetized more than half the borrowing through its quantitative easing program. By July 2020, the balance in the TGA had ballooned to $1.8 trillion.

Last year, the Treasury Department began drawing down that balance by borrowing less than the government spent. Meanwhile, the pace of spending increased as the US government blew through two more rounds of stimulus. As of last week, the balance in the TGA had dropped to $674 billion. As WolfStreet put it, the government has “now unwound most of the monetized-but-unspent debt-binge spike from spring last year.”

The Treasury has said the plan is to allow the balance in the TGA to fall to $500 billion. At that point, the US government will have to sell enough Treasuries to cover the deficits. It will no longer be able to simply draw on its cash reserves.

Government spending shows no sign of slowing. President Biden has unveiled a $6 trillion spending plan for 2022. He has proposed a $2 trillion-plus infrastructure plan. He has proposed the “American Families Plan.” And there will undoubtedly be more spending plans in the future. The administration claims it can pay for all this through tax hikes, but spending almost always ends up higher than expected and government revenues almost always come in under expectations. And the Biden administration has already had to back off some of its tax hikes due to political pressure. Ultimately, the US government will end up borrowing much of the money necessary to fund Biden’s ambitious spending spree.

In other words, the spending isn’t about to end. And with the TGA depleted, the US Treasury is about to have to go back to selling trillions of dollars in Treasury bonds to cover the deficit.

Ultimately, the central bank makes all of this government and spending possible by creating artificial demand in the bond market. The Federal Reserve buys Treasuries on the open market with money created out of thin air. This supports bond prices and keeps interest rates artificially low. Without this central bank intervention, there wouldn’t be enough demand in foreign and domestic markets to absorb all of the bonds the US Treasury needs to sell. Interest rates would skyrocket.

And that brings us to the big question.

A lot of people think the Fed will start talking about tapering QE in the near future. With inflation heating up, conventional wisdom tells us the Fed will tighten monetary policy in order to relieve the inflationary pressure. But given that the US government is about to sell a lot of bonds, how can the Fed stop buying? The central bank has been the biggest buyer of Treasuries over the last year.

The answer is it can’t.

This is why the Fed isn’t about to clamp down on its monetary policy. The Fed has to pretend inflation is transitory because they have no ability to do anything about it.

They can’t contain inflation because they put themselves in that box. The country now has so much debt thanks to their prior monetary mistakes; we now have all this debt because rates have been so low for so long that if the Fed were to actually raise interest rates to fight inflation, they would create a much worse financial crisis than the one that they helped to create in 2008. Only this time, there couldn’t even be any bailouts because the Fed would be fighting inflation and therefore raising rates, and therefore unable to finance any government bailout effort for any segment of the economy. So, obviously, that’s politically off the table. So, since the Fed can’t fight inflation, it has to pretend that inflation is not a threat.”

Politicians parrot on about small businesses being the backbone of the economy, only to pass the regulations that stifle them. In 2024, several federal agencies instituted new regulations on small businesses. These agencies included the Financial Crimes Enforcement Network, the IRS, and the Consumer Financial Protection Bureau. The new restrictions add to an exponentially increasing mountain of […]

Politicians parrot on about small businesses being the backbone of the economy, only to pass the regulations that stifle them. In 2024, several federal agencies instituted new regulations on small businesses. These agencies included the Financial Crimes Enforcement Network, the IRS, and the Consumer Financial Protection Bureau. The new restrictions add to an exponentially increasing mountain of […] The US national debt is so out of control that, ironically enough, even the Federal Reserve chair has expressed concern about the problem. And while America is among the top contributors, it isn’t just the US that’s spending money it doesn’t have: after briefly declining in 2023, the global debt-to-GDP ratio is again at an all-time high.

The US national debt is so out of control that, ironically enough, even the Federal Reserve chair has expressed concern about the problem. And while America is among the top contributors, it isn’t just the US that’s spending money it doesn’t have: after briefly declining in 2023, the global debt-to-GDP ratio is again at an all-time high. The percentage of U.S. adults holding an advanced degree increased by over 3% from 2011-2021. This increase in education is assumed to have a crucial role in America’s increasing economic strength over that time period. The expertise gained from such degrees is supposed to be valuable enough to outweigh the time and money put into grad degrees, […]

The percentage of U.S. adults holding an advanced degree increased by over 3% from 2011-2021. This increase in education is assumed to have a crucial role in America’s increasing economic strength over that time period. The expertise gained from such degrees is supposed to be valuable enough to outweigh the time and money put into grad degrees, […] Platinum is entering its second year of substantial deficit, according to the Platinum Quarterly report from the World Platinum Investment Council (WPIC).

Platinum is entering its second year of substantial deficit, according to the Platinum Quarterly report from the World Platinum Investment Council (WPIC). American car owners are facing a wall of bad debt to finance vehicles they can’t afford — especially pandemic buyers who took on huge loans to buy overpriced used vehicles that are now depreciating in value. With inflation running hot and poised to get even hotter if the Fed is forced to cut rates, it turns out that Americans can’t afford to insure those cars […]

American car owners are facing a wall of bad debt to finance vehicles they can’t afford — especially pandemic buyers who took on huge loans to buy overpriced used vehicles that are now depreciating in value. With inflation running hot and poised to get even hotter if the Fed is forced to cut rates, it turns out that Americans can’t afford to insure those cars […]