Peter Schiff: We’re About to See a Sequel to ’08 and Like All Sequels It Will Be Bad (Video)

In the wake of the stock market plunge last week, Pre. Donald Trump said the market drop wasn’t because of his trade war. Trump said, “That wasn’t it. The problem I have is with the Fed. The Fed is going wild. They’re raising interest rates and it’s ridiculous.” He also said the Fed is “going loco.” In a Thursday interview, the president doubled down, saying “I’m paying interest at a high rate because of our Fed. And I’d like our Fed not to be so aggressive because I think they’re making a big mistake.”

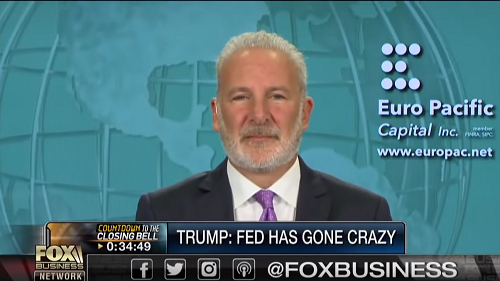

Peter Schiff appeared on Fox Business Countdown to the Closing Bell along with National Alliances head of fixed income Andy Brenner to talk rate hikes, the stock market and where things might go next.

Liz Claman started the segment off asking Peter if this recent drop in stocks was merely a correction and should the president be blaming the Fed.

Well, all bear markets start out as corrections. I think this one is probably a bear market. It’s long overdue. But Donald Trump said the Fed has gone crazy. He’s wrong. They didn’t just go crazy. They’ve been crazy for a long time. It was crazy to lower interest rates down to zero. It was even crazier to leave them there as long as they did. The only sane thing they’ve done is raise them back up. But what is crazy is for the Fed to believe they could raise interest rates without pricking their own bubble, which is exactly what they’ve done. This is a bigger bubble than the one that blew up in 2008 and the crisis that is going to ensue is going to be far larger … Thanks to the Fed and cheap money, we have more debt than ever before. Individuals, corporations, the government is loaded up with debt. And as interest rates go up that debt is unserviceable.”

Brenner said he doesn’t think we are entering a bear market, but he does see a correction of 15 to 20%. He also said Trump was looking for a scapegoat in the Fed.

Peter then went a step further and said this will is more than a bear market. We’re on the brink of a recession.

This is a bubble — not just in the stock market, but the entire economy. So, the Fed has distoreted more than just marktes. And the problem is this recession is going to be far more painful, and far deeper than the one we had in ’08 and ’09 because it’s also going to be accompanied by rising consumer prices. I think as Americans lose their jobs, they’re going to see the cost of living going up rather dramatically, and so this is going to make it particularly painful.”

Peter also noted that Trump said the Fed should wait to raise rates so the federal government can pay off some of its debt – meanwhile he is exploding the debt.

He signed on to tax cuts and spending increases. That is the worst thing to do when interest rates are going up. You don’t want to go deeper into debt. You want to try to pay down the debt. The way to pay down debt is run a surplus.”

Brenner took issue with Peter’s recession assumption. He said, “I’ll give you a correction,” but that was as far as he was willing to go. Brenner noted strong GDP growth and low unemployment. He said the real concern is in the emerging markets, not the US economy. But Peter said the only reason emerging markets are down is because everybody thinks the Fed is going to keep raising rates and shrinking its balance sheet. He said the Fed is eventually going to do an about-face. Peter then outlined some signs warning of a recession including the auto sector and home builders.

This is one of the longest economic expansions ever. It has required the greatest amount of monetary stimulus to produce it. And it’s a gigantic bubble. If this whole thing is built on a mountian of debt, as interest rates go up, the thing collapses. And as the dollar goes down, the cost of living is going to go up.”

Peter stayed on in the next segment with several Fox Business stock traders. You’ll want to watch the rest of the video. Peter explains why this is going to be a sequel to 2008. And like all sequels — it’s going to be bad.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

This weekend, Todd Sachs interviewed Peter on the state of the economy. They discuss the parallels between now and the 2007-2008 housing crisis, the role of economic sentiment in voters’ opinions, and why foreign central banks are losing faith in the dollar.

This weekend, Todd Sachs interviewed Peter on the state of the economy. They discuss the parallels between now and the 2007-2008 housing crisis, the role of economic sentiment in voters’ opinions, and why foreign central banks are losing faith in the dollar. Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] Peter released a brief video addressing the looming resurgence of inflation. Ironically, on the back of disappointing inflation numbers, gold witnessed a dip below $2000 on Tuesday due to higher-than-expected CPI data.

Peter released a brief video addressing the looming resurgence of inflation. Ironically, on the back of disappointing inflation numbers, gold witnessed a dip below $2000 on Tuesday due to higher-than-expected CPI data. Gold surged to a new record high of $2135 early Sunday morning before pulling back sharply Monday. In this video, Peter Schiff explains why this is a buying opportunity. After setting the record, gold quickly sold off and consolidated, dropping over $100 back to around $2,020. Some people see the quick selloff as a bearish […]

Gold surged to a new record high of $2135 early Sunday morning before pulling back sharply Monday. In this video, Peter Schiff explains why this is a buying opportunity. After setting the record, gold quickly sold off and consolidated, dropping over $100 back to around $2,020. Some people see the quick selloff as a bearish […] During a recent interview at the 2023 Precious Metals Summit Zurich event, Doom, Boom & Gloom Report publisher Marc Faber says now is the time to buy gold, silver and platinum because inflation is here to stay.

During a recent interview at the 2023 Precious Metals Summit Zurich event, Doom, Boom & Gloom Report publisher Marc Faber says now is the time to buy gold, silver and platinum because inflation is here to stay.