The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

Could we be heading toward $5,000 gold?

Last week, there was a big sell-off in the bond market. Yields on the 10-year Treasury soared 11 basis points in one day. Global stock markets sold off the following morning and US stock markets followed suit. This week, things really got really ugly on Wall Street. The Dow dropped over 1,300 points in two days. In a video for SchiffGold, Peter Schiff said stock market investors “finally took notice of the carnage that was going on in the bond market.”

On Thursday, the price of gold popped, rising nearly 3%. But despite all of the action this week, most people in the mainstream remain complacent. The narrative is that this is a normal bull market correction. Peter said nothing could be further from the truth.

The economy is even a bigger bubble than the stock market.”

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

Will work for gold!

Who wouldn’t right? I don’t know about you, but I would work even harder for some gold than I would for dollars, knowing the Federal Reserve isn’t going to inflate the value of my gold away by 2% or more every year.

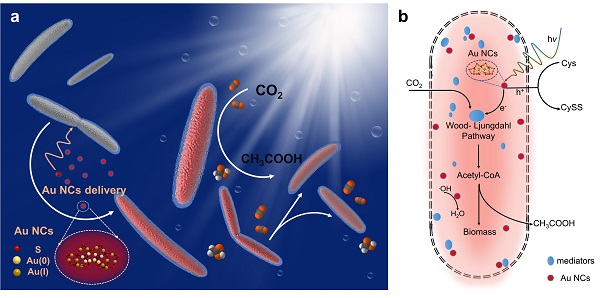

Well, apparently people aren’t the only organisms that know the value of gold. Scientists have discovered a bacterium that will work for us and actually help us create energy. But you have to pay it in gold.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

We’ve been saying gold and silver are on sale. Well, it appears investors are taking advantage of the bargain.

The sale of American Gold Eagle coins surged in September, according to the latest data from the US Mint. Investors snapped up 60,500 ounces of Gold Eagle bullion coins in various denominations. That compares with just 35,500 ounces in August — a 41% increase.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

A bill introduced in the US House would eliminate capital gains taxes on gold and silver bullion.

Rep. Alex Mooney (R-W.Va.) introduced HR6790 on Sept. 12. Titled the Monetary Metals Tax Neutrality Act of 2018, the legislation would amend the IRS code to exempt the sale of “refined gold or silver bullion, coins, bars, rounds, or ingots which are valued primarily based on their metal content and not their form,” from capital gains taxes.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.