Stock markets made new highs on Wednesday, but as Peter Schiff explained in his latest podcast, there are a lot of cracks under the surface. The markets are surging forward even as they overlook bad economic data and chilly political winds.

As expected, the Federal Reserve cut rates for the third time this year. We’re now down to 1.5%. The Fed hinted that cuts are likely on pause for now. But should we believe it? Was this the end of a mid-cycle adjustment? Or should we expect more moves by the central bank? In this episode of the Friday Gold Wrap podcast, host Mike Maharrey breaks down rate cut 3.0 and what it could mean for the precious metals markets.

As expected, the Federal Reserve cut interest rates another 25 basis points on Wednesday.

The mainstream read the post FOMC meeting comments to be relatively hawkish, saying Powell and Company seemed to indicate that future rate cutting is on pause.

Peter Schiff opened up his podcast reminding us that just one year ago, the Fed was raising rates and telling us it would continue to do so through 2019. It also claimed that quantitative tightening was on “autopilot.”

The bond market flashed a major recession warning sign as the yield curve inverted this week. Meanwhile, Trump whipsawed markets when he appeared to blink in the never-ending trade war with China. That made for an interesting week for gold. In this week’s Friday Gold Wrap podcast, host Mike Maharrey breaks down the events of the last few days and their impact on precious metals. He also remembers an important day in history that went mostly unnoticed in the mainstream.

The gold market took a one-two punch on Tuesday as Trump made some concessions in the trade war and inflation numbers came in a bit higher than expected. Peter Schiff talked about it in his latest podcast, saying gold traders still don’t understand the gold rally.

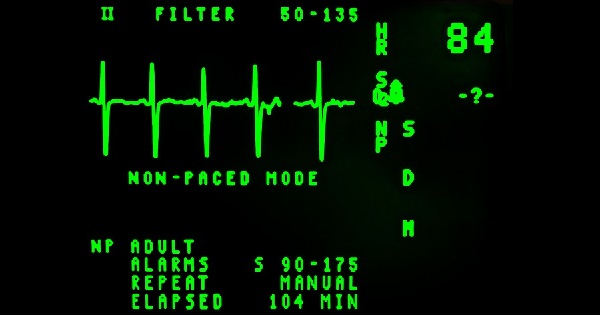

The Federal Reserve has the US economy on monetary life support and Daily Reckoning managing editor Brian Maher says it will never again breathe on its own. As hedge fund manager Kyle Bass put it, the economy is trapped within the inescapable tractor beam of zero percent interest rates.

The Federal Reserve FOMC met this week. When it was all said and done, the Fed did nothing. We’re stuck in neutral.

As expected, there was no rate hike. Fed Chair Jerome Powell indicated that the central bank would likely maintain this neutral stance into the foreseeable future, staying patient, neither raising nor lowering rates. So, why in the world did markets react like the Fed just jacked up interest rates? On this episode of the Friday Gold Wrap, host Mike Maharrey talks about it. He also gives an overview of the most recent World Gold Council demand report.

The Federal Reserve Open Market Committee meeting wrapped up yesterday with Fed policy still in neutral.

As expected, the FOMC left interest rates unchanged and seemed to indicate it doesn’t plan to do anything at all in the near-term. Jerome Powell’s comments dampened expectations that the central bank might move to cut rates in the coming months.

The committee is comfortable with current policy stance. Don’t see a strong case for a rate move either way.”

Most took Powell’s comments to be less dovish than expected, but Peter Schiff said he thinks the Fed is a lot more dovish than it admits.

Peter Schiff recently appeared on RT to talk about rising oil prices, how they relate to inflation and what it could mean for the US economy.

The mainstream pundits and economists keep telling us inflation is “tame.” But is it really? Or are they just not looking in the right place? In this episode of the Friday Gold Wrap, host Mike Maharrey talks about inflation and how it factors into the bubble economy. He also covers the week’s activity in the gold market and gives you your daily dose of dumb.