Inflation was running rampant for months before the Federal Reserve launched its inflation fight. As you’ll recall, we were told over and over again that inflation was transitory. But now that the central bank is on the job, most people are confident Powell and Company can get rising prices back under control.

Perhaps they shouldn’t be so confident.

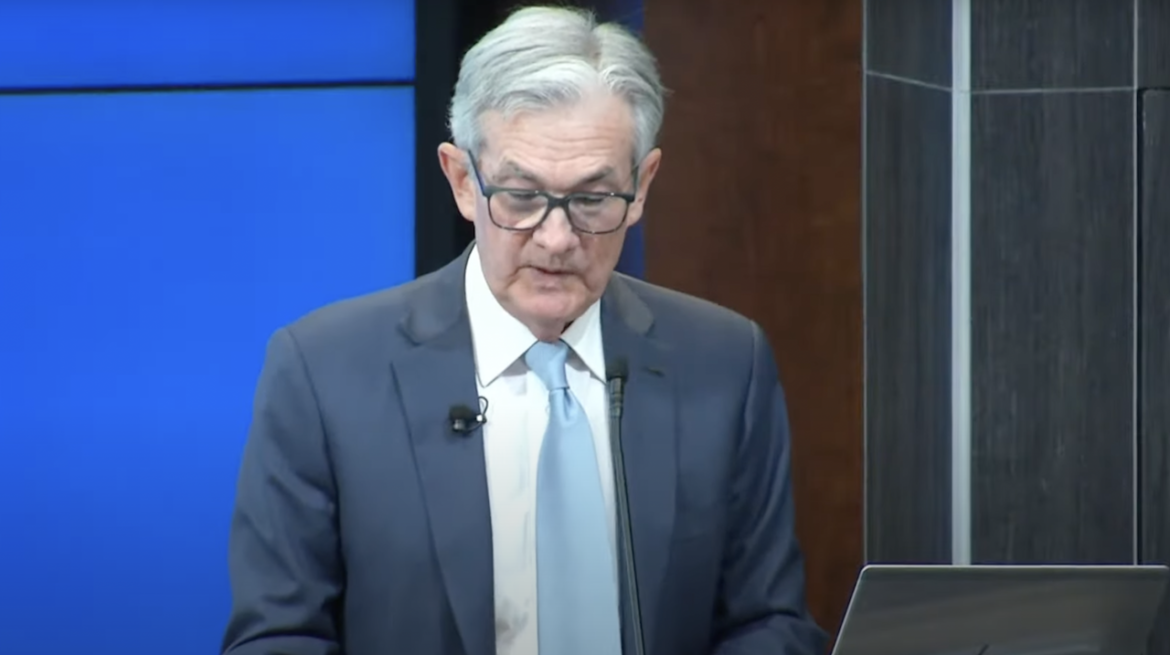

Federal Reserve Chairman Jerome Powell all but confirmed a soft pivot by the central bank in its inflation fight on Wednesday, while trying to maintain a hawkish demeanor.

The markets appear to be buying the pivot, but they are ignoring Powell’s “tough guy” spin.

The powers that be keep telling you that the economy is fine and inflation has likely peaked. But you’re not buying the story.

Consumer confidence fell for the second straight month in November as worries about inflation and the trajectory of the economy persist.

When people talk about “inflation” today, they generally mean rising prices as measured by the Consumer Price Index (CPI). But historically, “inflation” was more precisely defined as an increase in the amount of money and credit causing advances in the price level. Inflation used to be understood as an increase in the money supply. Rising prices were a symptom of inflation.

I find this change in definition problematic. But many disagree with me. They argue that I’m being pedantic and the definition doesn’t really matter all that much.

In another sign of a struggling economy, small businesses are having an increasingly hard time paying rent.

According to Alignable’s November Rent Poll, 41% of US small businesses reported they couldn’t pay their rent in full and on time in November. That was a 4 percentage-point increase from the previous month.

Based on the Consumer Price Index (CPI), prices were up 7.7% year-on-year in October. That’s a pretty hefty inflationary bite. But we’ve been saying the impact of inflation is a lot worse.

The increased cost of a Thanksgiving meal this year bears that out.

Your Thanksgiving meal cost about 20% more than it did last year. Why did it cost so much more? As Peter Schiff explained in his podcast, your more expensive Thanksgiving came to you courtesy of the US government and its inflation tax.

There are a lot of things they didn’t teach you in school. In this episode of the Friday Gold Wrap, host Mike Maharrey tells you a Thanksgiving story you’ve probably never heard before – at least not from your school teacher. He also touches on the Fed minutes that came out this week that seem to confirm a soft pivot on rate hikes.

Interest rate hikes get most of the attention as the Federal Reserve fights inflation, but balance sheet reduction is arguably more important. And it’s not going well.

Since the Fed stopped buying Treasuries and started letting bonds fall off its books as they mature, the bond market has experienced increasing volatility and liquidity problems. In fact, there is already talk about the possibility of the central bank abandoning quantitative tightening.

A lot of mainstream pundits concede that the US economy is heading for a recession as the Federal Reserve continues to crank up interest rates in its inflation fight. But as Peter Schiff explained in a recent podcast, there is plenty of data that indicates the economy is already in a recession.