Mark Twain once said there are lies, damn lies, and statistics. The government excels in all three. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey digs into the recent jobs data. He reveals that the numbers just don’t add up and explains why the labor market might not be as awesome as the mainstream keeps telling you. He also talks about the newest data on central bank gold buying.

Stocks have struggled in recent days due to some better-than-expected economic data and more hawkish talk from Fed officials. This has revived fears that the Federal Reserve could make a mistake and raise rates too high and keep them there too long, sparking a recession. In his podcast, Peter Schiff said the markets are worried about the wrong mistake.

A shrinking trade deficit was the primary reason GDP jumped in the third quarter. But that trade deficit relief is already reversing.

The October trade deficit swelled to $78.2 billion, a 5.4% increase. It was the second straight month of trade deficit growth.

Peter Schiff recently appeared on Real America with Dan Ball to talk about the economy, energy prices, and inflation. Peter said if you think inflation was bad this year, wait until next year with a much weaker dollar.

According to the Democrats and many mainstream pundits, the US economy is “resilient.” As Laura Ingraham put it, “it’s all peaches and cream according to Joe and his team.”

But what’s the truth?

Peter Schiff painted a less rosy picture during his appearance on The Ingraham Angle, saying the coming currency crisis is going to fuel the inflationary fire.

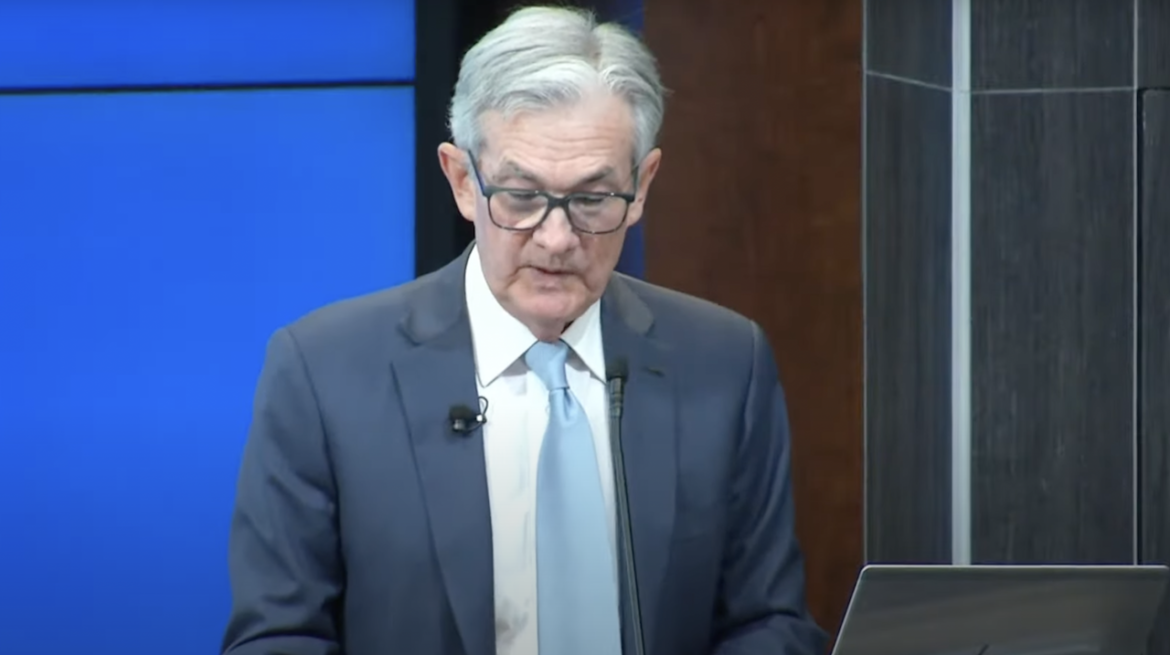

Federal Reserve Chairman Jerome Powell came out this week and indicated the central bank is set to pivot away from its aggressive rate hikes. But he couched the announcement in hawkish terms. The markets bought the pivot and ignored the hawkishness. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey puts Powell’s remarks in a broader context and speculates about what might be coming down the pike.

Inflation was running rampant for months before the Federal Reserve launched its inflation fight. As you’ll recall, we were told over and over again that inflation was transitory. But now that the central bank is on the job, most people are confident Powell and Company can get rising prices back under control.

Perhaps they shouldn’t be so confident.

Federal Reserve Chairman Jerome Powell all but confirmed a soft pivot by the central bank in its inflation fight on Wednesday, while trying to maintain a hawkish demeanor.

The markets appear to be buying the pivot, but they are ignoring Powell’s “tough guy” spin.

The powers that be keep telling you that the economy is fine and inflation has likely peaked. But you’re not buying the story.

Consumer confidence fell for the second straight month in November as worries about inflation and the trajectory of the economy persist.

When people talk about “inflation” today, they generally mean rising prices as measured by the Consumer Price Index (CPI). But historically, “inflation” was more precisely defined as an increase in the amount of money and credit causing advances in the price level. Inflation used to be understood as an increase in the money supply. Rising prices were a symptom of inflation.

I find this change in definition problematic. But many disagree with me. They argue that I’m being pedantic and the definition doesn’t really matter all that much.