There is a lot of talk about student loan forgiveness. The idea is wildly popular and it would relieve a huge burden crushing millions of Americans. But is there any downside to this idea? In this episode of the Friday Gold Wrap podcast, host Mike Maharrey talks about the student loan debacle and the possible downside of loan forgiveness. He also touches on the shaky labor market and why the bond market can’t tell us anything about inflation.

The US dollar has been showing significant weakness over the last several weeks. The dollar index closed at 90.814. Just two weeks ago, it was in the 94 range. Compared to the Swiss franc, the dollar is at a 6-year low. In his podcast, Peter talked about the dollar weakness and the Federal Reserve policy that’s causing it. The crazy thing about the rising inflation expectation is that the Fed appears poised to try to fight it with even more inflation.

Now it’s time to talk Christmas!

I know. A lot of people started with Christmas the day after Halloween. This absolutely drives me crazy. Why do we just skip over Thanksgiving? Thanksgiving is a magnificent holiday! I mean, it’s important to give thanks. And who doesn’t want to eat large amounts of delicious food and watch football? But in this day and age, Thanksgiving gets completely run over by Christmas.

After a dismal November, gold and silver are starting to show some signs of life. But what caused the big drop in the price of precious metals last month? Was it warranted? In this episode of the Friday Gold Wrap podcast, host Mike Maharrey looks at the economic and monetary fundamentals and tries to bring us back to reality. He argues that despite the optimism about a coronavirus vaccine, nothing will fundamentally change.

After two months of net global declines in gold holdings, central banks became net buyers again in October.

Gold-buying by central banks has slowed from the record pace we saw in 2018 and 2019, but many countries continue to load up on the yellow metal. In October, central banks added a net 22.8 tons of gold to their reserves, according to the latest data compiled by the World Gold Council.

Pierre Lassonde has said gold could skyrocket to $15,000 to $20,000 an ounce as the Dow-to-gold ratio falls to 1-to-1. Has his view changed?

Lassonde is the founder of Franco-

Peter Schiff spoke with Jay Martin backstage at the Cambridge Gold Summit. During the discussion, Peter and Jay took a step back from the immediate market volatility and news of the day to look at the big picture. Gold was a topic of discussion and Peter emphasized that the yellow metal has stood the test of time when it comes to preserving wealth.

The Dow Jones cracked 30,000 this week and stocks continue to surge generally upward as investors are embracing risk-on sentiment based on high hopes a vaccine may put an end to the coronavirus pandemic. But there’s more to it than that. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey takes a deeper look at what’s really driving this market mania, and he also takes down the myth that printing more money means more wealth.

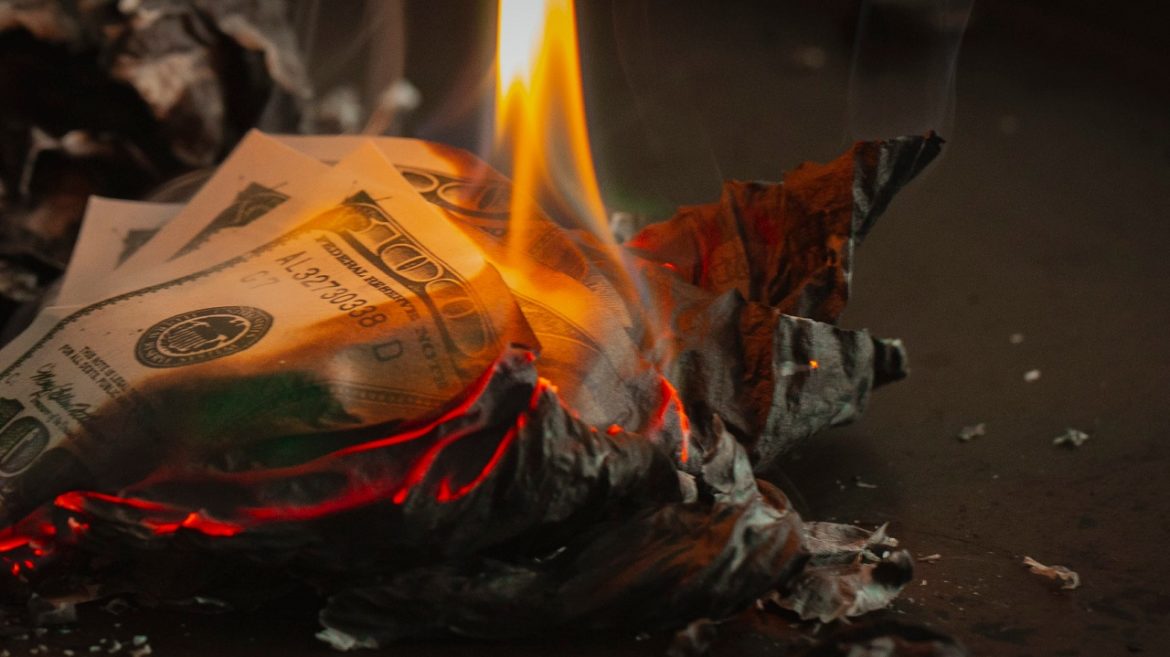

We’ve written extensively about the government intentionally devaluing our money. As one economist put it, the intentionally inflationary policies of central banks and governments are “daylight robbery.” But what’s the solution to this problem?

Economist Thorsten Polleit argues we need a free market in money. But is this possible? Wouldn’t this create monetary chaos?

I had a friend in high school who was always finding money. He’d frequently be walking along, look down, and spot a quarter or a dime at his feet. And it wasn’t just pocket change. He’d frequently find paper money too. I was with him when he picked up a $100 bill lying on the ground in the mall parking lot.