Chinese investors are turning to gold.

China Daily called the demand for gold “robust” through the first three quarters of 2023 and said it is expected to continue “as economic and geopolitical uncertainties may drive up investors’ purchases of safe-haven assets.”

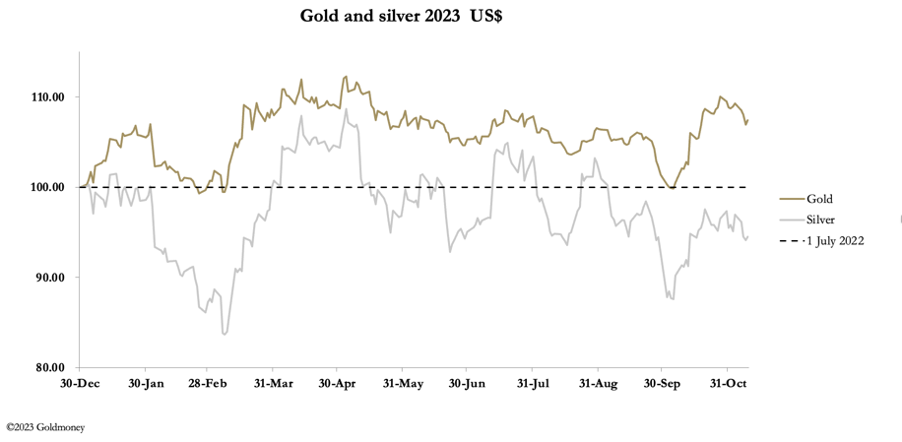

Ahead of a possible challenge on the $2,000 level, gold consolidated recent rises this week, and silver held up well. This morning in European trade, gold was $1995, up $15 from last Friday’s close, and silver was $23.70, unchanged on the week. Comex volumes were healthy, despite the Thanksgiving holiday in the US.

Did you know Thanksgiving almost didn’t happen thanks to the Pilgrims’ experiment with socialism? It didn’t work. Fortunately, they figured out some economic truths and the rest is history. In this episode of the Friday Gold Wrap, host Mike Maharrey tells the Thanksgiving story you almost certainly didn’t hear in school. He also explains why today is called Black Friday.

Everybody seems convinced that the Federal Reserve has won the inflation fight, there will be no more interest rate hikes, and rate cuts are right around the corner. But as Friday Gold Wrap host Mike Maharrey reminds us, it’s not over until the fat lady sings. And she hasn’t sung a note. In this episode, he breaks down the latest CPI data and explains why the victory dance might be premature.

The technical position for gold is looking very positive for higher prices. But technical analysis should be backed by fundamentals.

To a large extent, fundamentals are in the eye of the beholder, whose opinions in any situation can vary from positive to negative and everything in between. But even for the economic optimists, there are gathering clouds on the horizon likely to continue undermining the global economic outlook, the dollar, and all financial asset values. Fiat currencies are being downgraded relative to real money, which is gold.

Greenlight Capital reported a major increase in its exposure to gold as the hedge fund’s founder worries about the direction of the markets. In a Q3 letter to investors, David Einhorn expressed concern about geopolitical uncertainty, the rising price of oil, and inflation.

From time to time, Peter Schiff hosts Q&A sessions with premium subscribers to his podcast covering a wide range of investing and economic topics. In this video clip, Peter publicly answers eight questions on gold, silver, and general investment strategies.

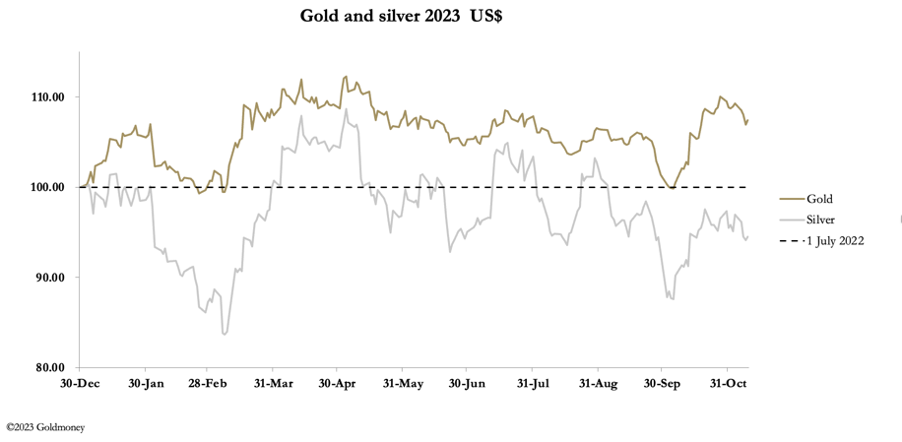

This week, gold and silver extended their correction of October’s sharp rise. In European trade this morning, gold was $1953, down $24 from Last Friday, and silver was $22.54, down 66 cents. Comex volume in both contracts was moderate.

The Great Game of Geopolitics faces a new challenge. The new hotspot is Israel and the Muslim Middle East. Ukraine is all but over, and the US is likely to abandon her to her fate — like Afghanistan.

We shall have to see how both will play out. Meanwhile, energy prices are set to keep inflation and interest rates high, undermining governments, banking systems, and businesses dependent on cheap credit.

Mainstream pundits and government officials keep talking about the strong economy and resilient consumers while ignoring what’s driving them – borrowing. To listen to them, you would think the road to prosperity is paved with credit cards. In this episode of the Friday Gold Wrap host Mike Maharrey breaks down the recent household debt data and explains why this isn’t the sign of a strong economy. He also highlights some interesting silver demand news.