Chinese gold consumption rebounded in 2021, rising by 36.53% year on year as the market continues to recover after taking a hard hit during the coronavirus pandemic.

More significantly, gold demand was up 11.78% compared with consumption in 2019, before the pandemic.

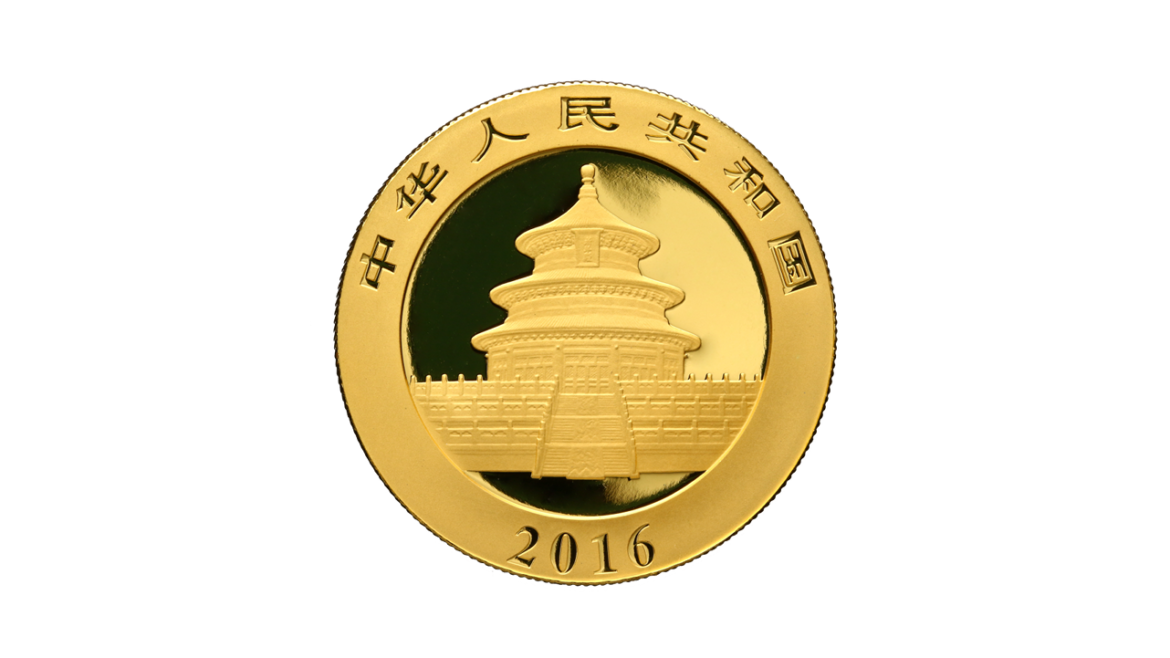

China ranks as the world’s number one gold consumer.

Is bitcoin an inflation hedge?

Peter Schiff recently appeared on RT Boom Bust with Natalie Brunell of Coin Stories to discuss inflation and whether bitcoin is a hedge. Peter said bitcoin is not an inflation hedge. He called it a “speculative token” with its price driven by supply and demand.

But what about gold? It didn’t perform like an inflation hedge in 2021 despite the inflation freight train. Peter said the reason gold has had some problems is because the market wrongly believes the Fed.

The Federal Reserve held its first FOMC meeting of 2022. The central bank didn’t do anything, but the tone coming out of the meeting was widely perceived as even more “hawkish.” Everybody is convinced the Fed really means it now. The inflation fight is on. Is it though? Host Mike Maharrey talks about the messaging and perceptions coming out of this meeting and calls it a big flim-flam.

Several states are considering bills to repeal the sales tax on precious metal bullion during the 2022 legislative session. Passage into law would relieve some of the tax burdens on investors, and would also take a step toward treating gold and silver as money instead of as commodities.

M2 increased by $201 billion in December.

This represents a 0.94% MoM increase which annualizes to 11.9%. For the entire year of 2021, M2 grew by an incredible $2.5 trillion or 13.1%!

This is extremely rapid money supply growth! The Fed can taper their asset purchases, but shrinking the Money Supply is the only way to rein in inflation.

The world’s largest gold ETF saw record inflows on Friday, a bullish sign for the yellow metal.

SPDR Gold Shares (GLD) ranks as the world’s largest gold fund. It saw a net inflow of $1.63 billion on Friday. It was the largest net inflow in dollar terms since the fund was listed in 2004.

For the past year, gold has been battling around the $1,800 an ounce psychological mark. Silver has faced a similar up and down battle near $25, albeit with more volatility.

Gold finished 2021 strong at $1830 but then a pullback happened followed by a quick rebound back above $1800 and now $1830. Will $1800 hold this time and provide support? Can silver break through $25 and unleash the bulls? Obviously, no one knows for sure, but taking a look at some indicators can provide some insight.

An article earlier this month reviewed the massive volume of physical metal leaving the bank House accounts over the last two years. December 2021 finished the year off with a massive drawdown in House account inventories. While the drawdown continues across most accounts, Bank of America has tried to recoup some of the physical metal that left its holdings in December. As the data below shows, this has led to an extremely strong January to kick-off 2022.

It is often said that perception is reality. Politicians spend a tremendous amount of time and energy trying to shape perceptions. So, how does the average American perceive the US economy? In this episode of the Friday Gold Wrap, host Mike Maharrey talks about economic perceptions – both those the politicians are trying to create and those actually held by American consumers.

Last month, we saw a small increase in metal stored in COMEX vaults, but that turned out to be a blip in the trend. Metal is leaving the COMEX vaults again.

This analysis focuses on gold and silver within the Comex/CME futures exchange. See the article What is the Comex? for more detail. The charts and tables below specifically analyze the physical stock/inventory data at the Comex to show the physical movement of metal into and out of Comex vaults.