In the wake of two major bank failures, Federal Deposit Insurance Corporation (FDIC) deposit insurance effectively went to infinity. And there is no reason to believe it will be temporary.

As Silicon Valley Bank and Signature Bank were toppling, the government rushed in to guarantee 100 percent of both banks’ deposits. It was touted as an emergency measure to maintain confidence in the banking system and prevent runs at other banks. In effect, it bailed out wealthy depositors at two failing banks.

The dust continues to settle after the failure of Silicon Valley Bank and Signature Bank, and the ensuing government bailout. Many people in the mainstream seem to think the crisis has passed. But a closer look at the condition of the banking system reveals these two banks were just the tip of the iceberg. Peter Schiff appeared on NewsMax Wake Up America to talk about the financial crisis. He said that there are more bailouts to come.

Peter Schiff recently appeared on Brighteon.com with Mike Adams to talk about the failure of SVB and Signature Bank, the bailouts and the potential ramifications. During the interview, Peter explained the difference between SchiffGold and a lot of the other gold companies out there.

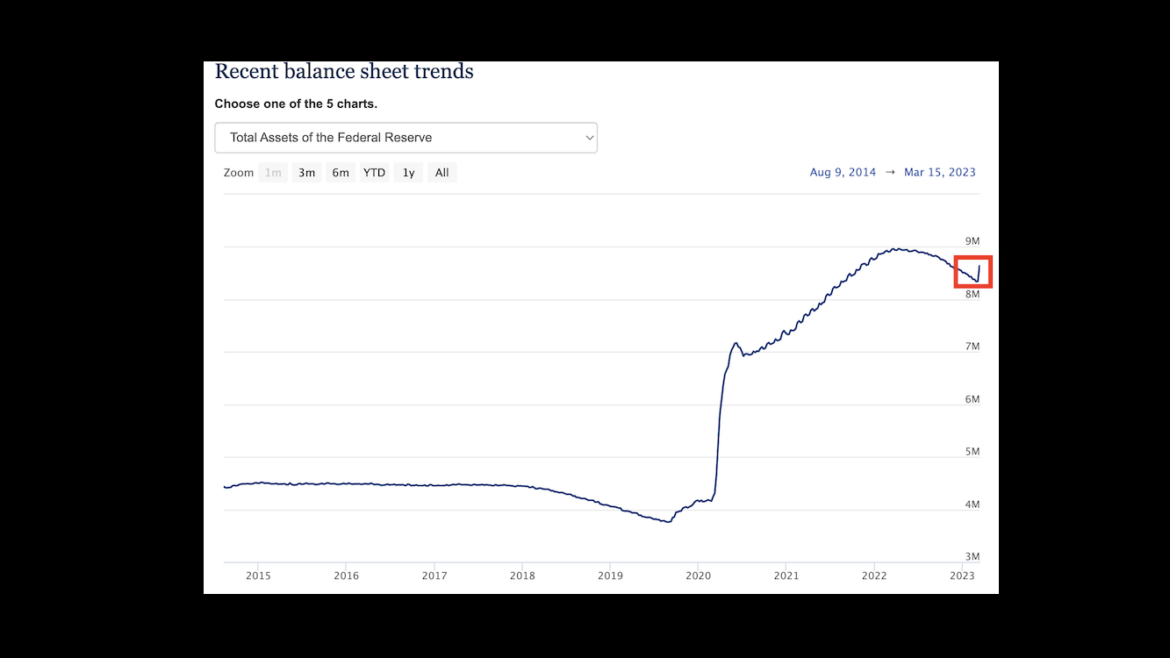

The Federal Reserve added nearly $300 billion to its balance sheet in a single week as it kicked off its loan bailout program for banks.

In effect, the Fed loaned troubled banks $300 billion of new money that was created out of thin air.

In other words, we got $300 billion in inflation in a single week.

Friday gold wrap host Mike Maharrey has been saying something is going to break in the economy for months due to the Federal Reserve’s monetary tightening to fight price inflation. Last Friday, something broke when Silicon Valley Bank collapsed followed quickly by the demise of Signature Bank. It was the first crack in the dam. The Fed rushed in to plug the leak, but was it enough? In this episode of the podcast, Mike talks about the response to these bank failures and the possible ramifications.

As the old saying goes, if it looks like a duck, walks like a duck, and quacks like a duck, it’s probably a duck.

Well, if it looks like a bailout, walks like a bailout, and talks like a bailout, it’s probably a bailout.

On June 14, 2022, Peter Schiff appeared on Ingraham Angle, and he said, “Thanks to the Federal Reserve, everybody has so much debt that we can’t afford to pay an interest rate high enough to fight inflation. But it is going to be high enough to cause a massive recession and another financial crisis that’s worse than the one we had in 2008.”

On March 13, 2023, Peter was on Ingraham Angle again, this time to talk about the beginning of that financial crisis.

As we start to sort through the fallout of the failure of Silicon Valley Bank and Signature Bank and the government’s reaction to it, the next question is: what’s next?

Government officials and mainstream pundits insist everything is fine now. They say quick government action averted a crisis. But in his podcast, Peter Schiff said this is really just the beginning of the next financial crisis.

Artificially low interest rates blew up a big housing bubble. In a podcast, Peter Schiff explained that it is actually a bigger bubble than the one preceding the 2008 crash. But this time, it is combined with an overall bubble in the entire economy that dwarfs ’08. Peter said all of this has the makings of another massive financial crisis.

Most people have a sense of history that goes back about two weeks. This is especially true in the world of investing and finance. As a result, people have a hard time seeing the big picture. For instance, a lot of people think the current inflation crisis was only due to the Fed failing to respond fast enough. As Peter Schiff pointed out, this inflation was in fact decades in the making.

And as James Anthony pointed out, the current inflation problem along with all of the big economic crises that occurred in the 20th and 21st centuries have one commonality — progressive government coupled with monetary policies run by the Federal Reserve.