In a surprise move earlier this month, OPEC announced further oil production cuts of about 1.16 million barrels per day. Analysts projected the cuts could raise the price of oil by $10 per barrel. Peter Schiff recently appeared on NewsMax’s Wake Up America and explained why these production cuts will further complicate the Federal Reserve’s efforts to fight price inflation, and more broadly, how global moves like this and others undermine the dollar.

Peter Schiff appeared on TraderTV to talk about the failure of Silicon Valley Bank and Signature Bank, the bailout, and what might lie ahead. Peter emphasized that this banking crisis isn’t over. In fact, it is just the beginning of a much worse financial crisis.

Most people in the mainstream seem to think that the recent bank bailout plugged the crack in the dam and stabilized the banking sector. But one big bank boss disagrees. In an annual letter, JP Morgan Chase CEO Jamie Dimon said that the banking crisis isn’t over and that we will feel its repercussions for years to come.

In the aftermath of the failure of Silicon Valley Bank and Signature Bank, many rushed to blame their demise on a lack of regulation. In particular, they focused on the fact that these banks were not required to undergo a Federal Reserve stress test.

Indeed, small and midsize banks are exempt from the stress test requirement. Did that lead to the current banking crisis?

Could the commercial real estate market be the next thing to break in this bubble economy?

The rampant money creation and zero percent interest rates during the COVID pandemic on top of three rounds of quantitative easing and more than a decade of artificially low interest rates in the wake of the 2008 financial crisis created all kinds of distortions and malinvestments in the economy and the financial system. It was inevitable that something would break when the Federal Reserve tried to raise interest rates in order to fight the price inflation it caused with its loose monetary policy.

Peter Schiff appeared on NTD News to talk about the bank bailout and the March Federal Reserve meeting. During the conversation, Peter explained that everybody is going to pay for these bailouts because they will ultimately devalue the dollar as inflation skyrockets.

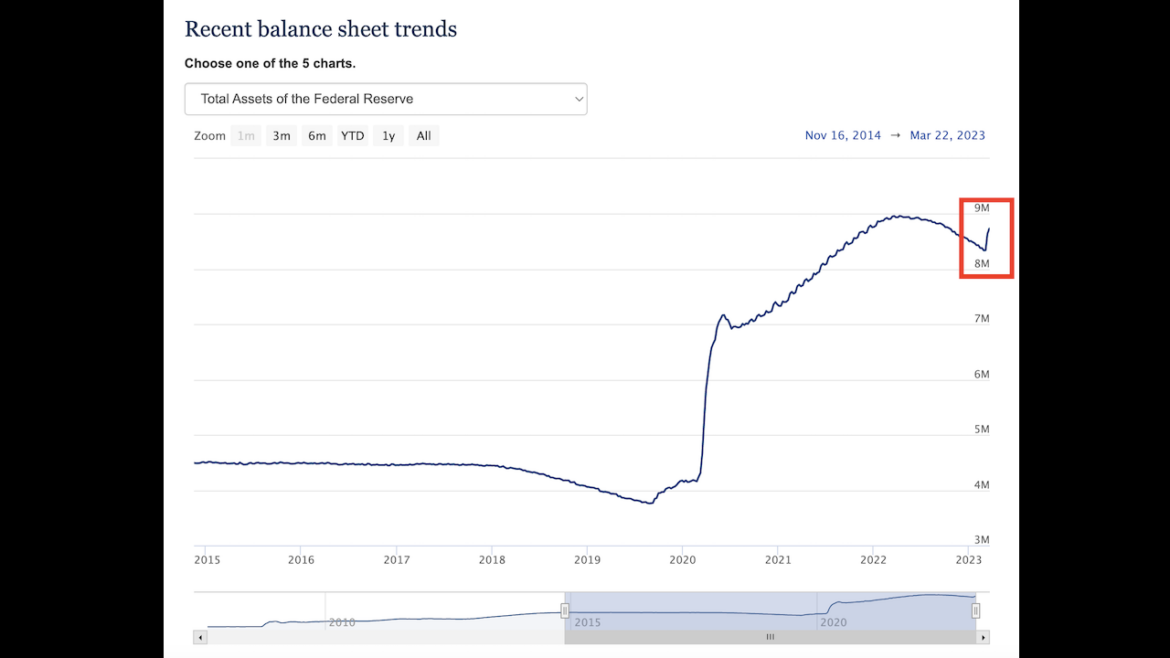

In the week before it raised interest rates another 25 basis points to fight inflation, the Federal Reserve added more than $94 billion to its balance sheet. This was on top of the nearly $300 billion it piled onto the balance sheet in the first week of its bank bailout.

The balance sheet reveals that Fed has loaned banks nearly $400 billion in money created out of thin air in just two weeks.

Peter Schiff appeared on Real America with Dan Ball to talk about the bank bailout, the unfolding financial crisis, the Fed and inflation. He said this is a sequel to 2008 and like all sequels, it’s going to be worse.

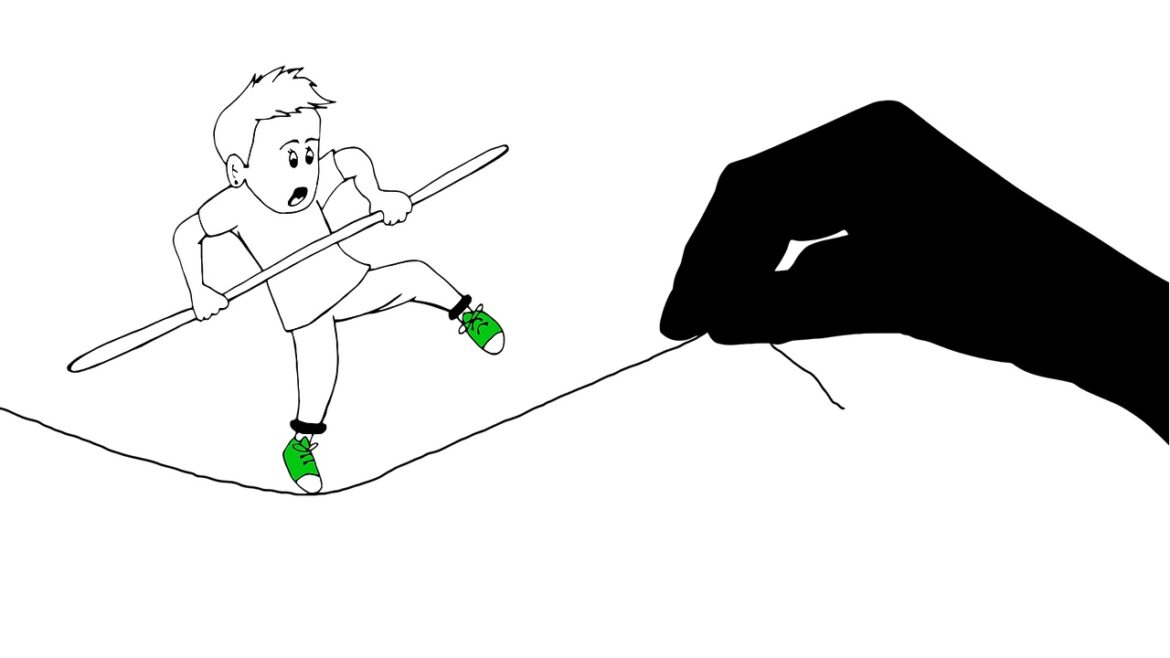

On Wednesday, the Federal Reserve raised interest rates again despite the problems in the banking system. In this episode of the Friday Gold Wrap, host Mike Maharrey talks about the Fed’s inflationary efforts to paper over the problems in the financial system while still keeping up the pretense of an inflation fight. He says it’s like trying to thread a needle with rope.

The Federal Reserve is trying to walk a tightrope — in a hurricane.

After rate hikes resulted in the collapse of Silicon Valley Bank and Signature Bank, the Federal Reserve and the US Treasury stepped in with a bailout. With that hole in the dam seemingly plugged for the time being, the Fed pushed forward and raised interest rates by another 25 basis points at its March meeting.