It’s the Fed’s “hold my beer” moment.

After more than a year in which Federal Reserve leadership appeared clueless, pollyannish, and indecisive, the Fed is conducting a full-throated messaging campaign to show that it is as serious as cancer about the inflation surge that is scaring the bejesus out of consumers, investors, and economists.

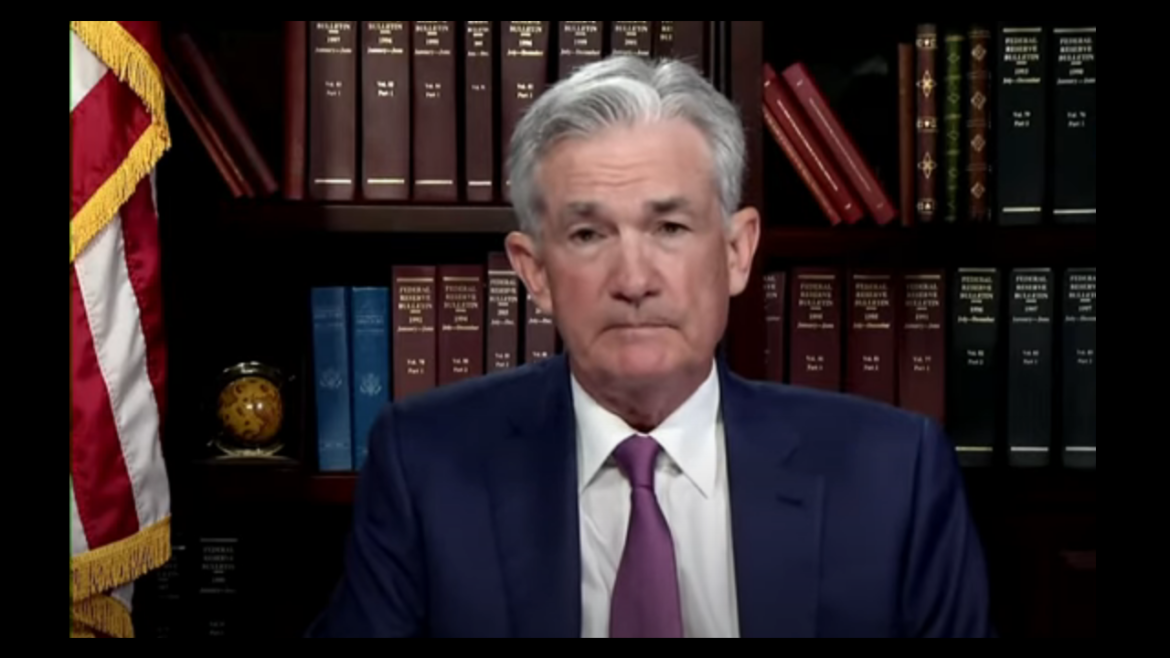

Federal Reserve Chairman Jerome Powell spoke during the Wall Street Journal’s Future of Everything Festival on Tuesday and continued to talk tough about fighting inflation, all the while spinning Keynesian economic myths. In his podcast, Peter broke down Powell’s comments and talked about what he thinks the central bank will really end up doing.

American consumers are in a sour mood, but they haven’t stopped spending money. The problem is they’re spending money they don’t have. And they’re getting less for it.

If you want freedom, you need sound money.

So, argues economist Ludwig von Mises.

It is impossible to grasp the meaning of the idea of sound money if one does not realize that it was devised as an instrument for the protection of civil liberties against despotic inroads on the part of governments. Ideologically it belongs in the same class with political constitutions and bills of right.”

The Fed continues to talk tough about fighting inflation. And the markets seem to be listening. But in his podcast, Peter Schiff said you need to look at what the Fed is actually doing. And it’s not doing much.

When we got the March CPI data last month, the mainstream crooned that it looked like we were at peak inflation. This was wishful thinking. The April CPI data that came out this week, along with the producer price numbers, indicate that we’re still climbing that inflation mountain. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey digs into the data and discusses how it could impact the trajectory of Fed monetary policy and the economy.

Americans are feeling the pinch of inflation. Wages are up but consumers are worse off. Average hourly earnings have risen by 5.5% over the last year. But factoring in rising costs, real earnings are down 2.6%. So, how are Americans making ends meet?

They’re charging it.

The March Consumer Price Index (CPI) was 8.5% annually, the highest since December 1981. But the mainstream narrative was that inflation had probably peaked because core inflation, stripping out more volatile food and energy, “only” rose by 0.3%. Mainstream pundits reasoned that the oil shock in the wake of Russia’s invasion of Ukraine primarily drove the huge 1.2% month-on-month CPI gain. And since core CPI appeared to be slowing, inflation was cooling.

The April CPI data undercuts this narrative.

Last week, the Fed raised interest rates by 0.5%. It was the biggest rate increase since the year 2000. But it was hardly aggressive in light of the current bout of inflation. Not only that, Jerome Powell took a future 75 basis point hike off the table. In his podcast, Peter Schiff argued that no matter what the Fed does, it has already lost the inflation fight.

The Fed hiked rates 0.5% this week in an effort to stem the inflation tide. But the economy already looks shaky and the central bank has barely started this inflation fight. Friday Gold Wrap host Mike Maharrey breaks down the messaging that came out of the Fed meeting and concludes the central bank is getting closer and closer to a crossroads. What will the central bank do? And what will it mean for the economy?