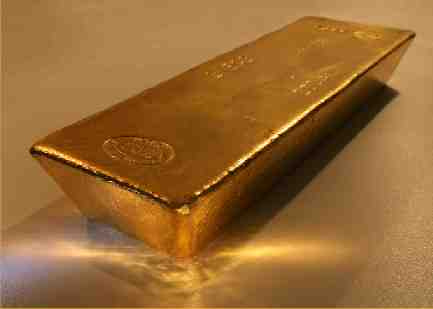

The price of gold hit six-month lows in recent days, primarily driven down by a surging dollar. Peter Schiff has been saying investors shouldn’t get too caught up in greenback hoopla. This is likely an upside correction in a dollar bear market. As it turns out, Peter is not alone in this assessment. At least a few mainstream analysts agree, and they see gold rallying by the end of the year, according to Bloomberg.

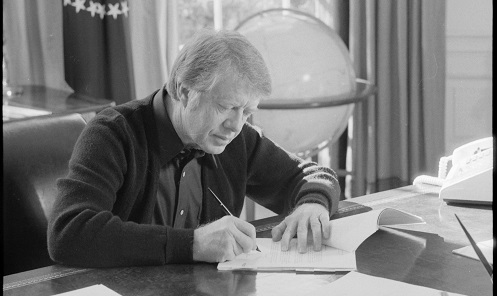

The Dow Jones was up Friday, avoiding it ninth consecutive down day. As Peter Schiff noted on his most recent podcast, such a long stretch of declines is pretty rare. Eight straight down days has only happened 43 times since the Dow launched in 1896. The last time we had nine straight days of Dow Jones decline, Jimmy Carter was president.

Peter said this is a little ironic because he sees another Carter-era phenomenon on the horizon – stagflation.

We’ve written a lot about government debt and warning signs in the Treasuries market. The US government needs to sell over a trillion dollars in bonds a year over the next few years to finance its skyrocketing deficit. Who exactly will buy all of these government bonds remains unclear and the impact on interest rates could send shockwaves through the entire US economy.

Equally troubling, but less often discussed, are the risks piling up in the corporate bond market.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

It looks like we’re heading toward a full-blown trade war.

As the war continues to escalate. Pres. Trump has levied more tariffs on Chinese imports in retaliation for China’s retaliation after the US announced its first round of tariffs. A lot of people seem to think this is bullish for the dollar. In fact, the greenback has surged in recent weeks. But in his latest podcast, Peter Schiff said this is a bunch of nonsense.

Humans are by nature somewhat myopic. We tend to focus primarily on what is right in front of us and filter out things further removed. As a result, we can sometimes overlook important factors.

As Americans, we generally devote most of our attention on American policy. We follow political maneuverings in Washington D.C., study the Fed’s most recent pronouncements and track the US stock markets. But we also need to remember there is a whole wide world out there that can have a major impact on the larger economy and our investment portfolio.

One factor that could potentially rock the world economy that a lot of American may not be aware of is the mess in the European banking system.

Jerome Powell is like a kid playing with matches and he’s dangerously close to starting a fire he isn’t going to be able to control.

The Federal Reserve nudged interest rates up again last week. It was the seventh hike since the Fed launched the current tightening cycle in December 2015. The Fed Funds Rate (FFR) currently sits at around 2%. Although this remains historically low, it may already be near the cycle peak. That means we may be close to a major economic downturn, as indicated by analysis by GoldMoney’s Alasdair MacLeod recently published at the Mises Wire.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

If you saw the headlines about the latest retail sales figures, you probably noticed adjectives like “hot,” “booming” and “sizzling.” Total retail sales including food services were up 5.9% year-on-year in May.

That’s an impressive number until you factor in inflation. In fact, a decline in the dollar’s purchasing power accounted for nearly half the gains in retail sales.

As expected, the Federal Reserve nudged rates up another .25 basis points on Wednesday. Perhaps more significantly, the Fed took a more hawkish tone than expected, signaling it would likely increase rates two more times this year for a total of four hikes. The central bank had been projecting three 2018 rate increases.

A buildup in inflation pressures was a major reason for the Fed’s more hawkish tone. According to the latest data released by the Bureau of Labor and Statistics, the Consumer Price Index (CPI) jumped by 2.8% year-over-year in May. The central bankers projected inflation will likely run above their 2% target into the near future. Analysts expect the CPI to hit 2.1% this year and run at that level through 2020.

In his latest podcast, Peter Schiff said higher inflation might be a victory for the Federal Reserve, but it will be a big loss for consumers. In fact, we are heading for a no-growth, high-inflation economy.