Retail sales surged in January, creating the impression that the economy is humming along nicely. After all, there can’t be a problem if consumers are out there consuming, right?

But a lot of people are ignoring a key question: how are people paying for this shopping spree?

The data over the last several months has been spot on in predicting the moves in gold and silver. November showed the market was in neutral, but then the December analysis correctly identified an impending move upward, and the January review concluded that gold may need a breather before moving higher.

So, what about this month?

Gold inventory in COMEX vaults declined by nearly 5% in a single month.

This analysis focuses on gold and silver within the Comex/CME futures exchange. See the article What is the Comex? for more detail. The charts and tables below specifically analyze the physical stock/inventory data at the Comex to show the physical movement of metal into and out of Comex vaults.

Virtually everybody agrees that government spending is necessary to support the economy and society in general. We may debate vigorously about what exactly the government should spend money on, but few people will entertain the thought that maybe the government shouldn’t spend money at all. Most fail to even acknowledge that even the best government spending comes with a cost.

One of the characteristics of gold is that it preserves wealth in a world of constantly devaluing fiat currency.

Put another way, it preserves your purchasing power over time.

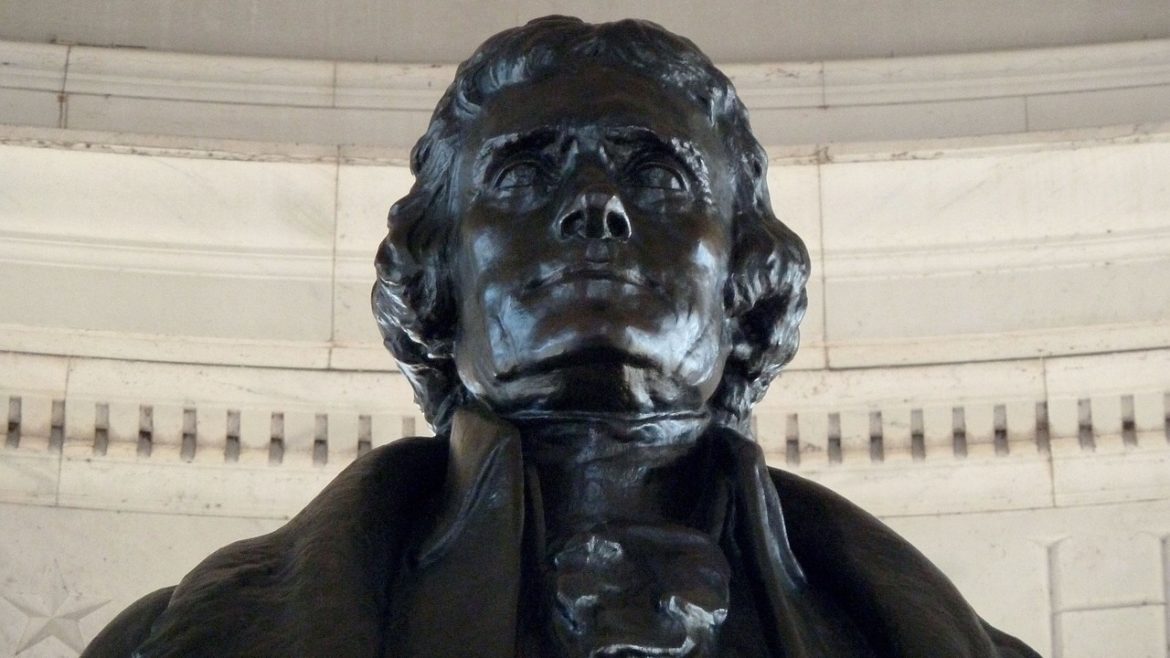

The way Thomas Jefferson handled the national debt should serve as a blueprint for today. But instead, modern presidents look more like college students on a spending spree with their first credit cards.

The January CPI report threw cold water on the idea that the Federal Reserve has inflation under control. While the headline annual CPI came down a tick to 6.4%, month-on-month prices rose by 0.5%. After the data came out, Peter Schiff appeared on NTD News to explain why inflation is going to get even worse.

After charting its biggest increase since 2007 in the third quarter, household debt surged again in Q4 as Americans try to borrow their way out of the squeeze soaring price inflation has put on their wallets.

Total household debt rose by $394 billion in the last quarter of 2022, according to the latest New York Fed Household Debt and Credit report. It was the biggest quarter-on-quarter rise in two decades.

Despite the hotter-than-expected CPI report, the mainstream still seems convinced that the Federal Reserve can get inflation under control and bring the economy to a soft landing. But Peter Schiff argues that the central bank can’t win this fight – at least not without crashing the economy. Since the Fed isn’t willing to do that, it won’t go all-in. In effect, the Fed brought a knife to an inflation gunfight.

Garbage in, garbage out. The phrase is usually associated with computers, but it also applies to the formulas used to generate government economic data. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey goes over the January CPI and retail sales data with that phrase in mind.