Words spoken by Robert White, an appraiser, who checked out the inventory Nola Cronk had just acquired from Capital Gold Group. Cronk approached an appraiser after having a hellish battle with what she thought was a move to protect her retirement.

Nola Cronk’s husband had passed away, and unfortunately he was the one who took care of finances, so she was soon left to her own to find the right place for the wealth she had left. She expressed interest in Capital Gold Group who quickly took advantage of this vulnerable client. They first asked for her financial records, assuring her after viewing that she need to act quick and move over $300K into gold. Then the broker who spoke with her over the phone, soon received a signed contract and a done deal through persuasive tactics that left Cronk seemingly helpless. Even when her buyer’s remorse kicked in and she asked to lessen the investment amount, she was met with, “You’ll either buy it or we’ll take you to court and we’ll get everything you have.”

This holiday season, I came up with a not-so-original idea to buy (or give from stock) silver* as my trademark gift. Not only is it an educational tool that brings up questions about investing and the future of the dollar-based system, but it’s also worth a nice chunk of change. As we speak I’m packing for a family get together where I’ll be presenting my father with a nice 1 oz. bar of silver. It’s worth cash if he wants to cash it in, possibly even more cash if he wants to hold on to it for a while, and is a great collector’s item if he chooses to see it that way. I’m sure he will be thrilled!

The average spending habits of individuals, around Christmas, add up to about $650. If you take today’s silver prices and divide that up, you’ve got a gift for over 20 people on that list. Just think, people are getting gift cards, scarves, new socks, and toys (all wonderful and thoughtful, of course) but when they open your gift, even if they don’t appreciate it in the moment they’ll hopefully realize soon enough that you’ve given them something to learn from.

Now I usually do my dealing face to face with a local bullion shop, but just as Christmas shopping isn’t always done in a store anymore, neither are all precious metal purchases. Many friends and associates have mentioned the gold and silver buying options on eBay, Craigslist, and Amazon. Turns out it serves the same purpose as shopping for clothes online: it’s convenient. You don’t have to leave your chair. However, when factoring in the shipping, you are most almost always going to get a better deal buying direct from a dealer.

Another thing to note when shopping online for your bullion, aside from the convenience charge, is the fine print. The kind bullion buyer from www.targetrichenvironment.com shared a worthy scam you all should be aware of. On eBay beware of a silver bullion item with a vague description and a good price. That seller is hoping you skip the fine print and miss the fact that it is not the .999 you are looking for.

There are listings of supposed .999 silver accompanied by the words “100 Mills”. This isn’t pure silver. It is a copper bar or round plated in silver. The seller may tag the item as “1 Troy Oz. 100 Mills .999 Silver”.

For most of his time as a national political figure, Barack Obama has been careful to cloak his core socialist leanings behind a veil of pro-capitalist rhetoric. This makes strategic sense, as Americans still largely identify as pro-capitalist. However, based on his recent speech in Osawatomie, Kansas, the President appears to have reassessed the political landscape in advance of the 2012 elections. Based on the growth of the Occupy Wall Street movement, and the recent defeat of Republicans in special elections, he has perhaps sensed a surge of left-leaning sentiment; and, as a result, he finally dropped the pretense.

According to our President’s new view of history, capitalism is a theory that has “never worked.” He argues that its appeal can’t be justified by results, but its popularity is based on Americans’ preference for an economic ideology that “fits well on a bumper sticker.” He feels that capitalism speaks to the flaws in the American DNA, those deeply rooted creation myths that elevate the achievements of individuals and cast unwarranted skepticism on the benefits of government. He argues that this pre-disposition has been exploited by the rich to popularize policies that benefit themselves at the expense of the poor and middle class.

But Obama’s knowledge of history is limited to what is written on his teleprompter. And his selection of the same location that Teddy Roosevelt used to chart an abrupt departure into populist politics is deeply symbolic in the opposite way to that which he intended. It is not by some genetic fluke that Americans distrust government. It is an integral and essential part of our heritage. The United States was founded by people who distrusted government intensely and was subsequently settled, over successive generations, by people fleeing the ravages of government oppression. These Americans relied on capitalism to quickly build the greatest economic power the world had ever seen – from nothing.

But according to Obama’s revisionist version of American history, we tried capitalism only briefly during our history. First, during the Robber Barron period of the late 19th Century, the result of which was child labor and unprecedented lower-class poverty. These ravages were supposedly only corrected by the progressive policies of Teddy Roosevelt and Woodrow Wilson. We tried capitalism again in the 1920s, according to Obama, and the result was the Great Depression. This time, it allegedly took FDR’s New Deal to finally slay that capitalist monster. Then, the account only gets more farcical. Apparently, we tried capitalism again under George W. Bush, and the result was the housing bubble, financial crisis, and ensuing Great Recession. Obama now argues that government is needed once again to save the day.

This view is complete fiction and proves that Obama is not qualified to teach elementary school civics, let alone serve as President of the United States. I wonder what other economic system he believes we followed prior to the 1890s and 1920s (and during the 1950s and 1960s) that that he now seeks to restore? Capitalism did not start with J.P. Morgan in 1890s or John D. Rockefeller in the 1920s as the President suggests. In fact, it was about that time that capitalism came under attack by the progressives. We were born and prospered under capitalism. The Great Depression did not result from unbridled capitalism, but from the monetary policy of the newly created Federal Reserve and the interventionist economic policies of both Hoover and Roosevelt – policies that were decidedly un-capitalist.

The prosperity enjoyed during mid-20th century actually resulted from the incredible progress produced by years of capitalism. Contrary to Obama’s belief, the New Deal and Great Society did not create the middle class; it was, in fact, a direct result of the capitalist industrial revolution. The socialist programs of which Obama is so fond are the reasons why the middle class has been shrinking. America’s economic descent began in the 1960s, when we abandoned capitalism in favor of a mixed economy. By mixing capitalism with socialism, we undermined economic growth, and reversed much of the progress years of laissez-faire had bestowed on average Americans. The back of the middle class is being broken by the weight of government and the enormous burden taxes and regulation place on the economy.

America’s first experiment with socialism, the Plymouth Bay Colony, ended in failure, and our most successful colonies – New York, Virginia, Massachusetts – were begun primarily as commercial enterprises. When the founding fathers gathered to write the Constitution, they represented capitalist states and granted the federal government severely limited powers.

Apparently, Obama thinks our founders’ mistrust of government was delusional, and that we were fortunate that far wiser groups of leaders eventually corrected those mistakes. The danger, as Obama sees it, is that some Republicans actually want to reverse course and adopt the failed ideas espoused by great American fools like George Washington, Thomas Jefferson, John Adams, and Benjamin Franklin.

The President unknowingly illustrated his own contradictory thinking with the importance he now places on extending the temporary payroll tax cuts. If all that stands between middle-class families and abject poverty is a small tax cut, imagine how much damage the far more massive existing tax burden already inflicts on those very households! If Obama really wants to relieve middle-class taxpayers of this burden, he needs to reduce the cost of government by cutting spending. After all, there is no way to pay for all the government programs Obama wants simply by taxing the rich.

History has proven time-and-again that capitalism works and socialism does not. Taking money from the rich and redistributing it to the poor does not grow the economy. On the contrary, it reduces the incentives of both parties. It lowers savings, destroys capital, limits economic growth, and lowers living standards. Maybe Obama should take his eyes off the teleprompter long enough to read some American history. In fact, he could start by reading the Constitution that he swore an oath to uphold.

If it sounds too good to be true, it probably is. Although we refer to the conventional pathways to purchasing gold, I’m sure over time as you begin immersing yourself in the precious metal’s community you will find yourself looking for deals in all places. Your ears will begin to perk up when you hear of any bargain that comes in right at, or under, spot price.

This scam is to remind you that whether or not it is a licensed business or an individual on the street, having your gold or silver’s legitimacy confirmed is a must before following through with a purchase. One way of knowing is dealing with a well known dealer with a great reputation. Learn a lesson from this woman.

Last week, in Bakersfield, CA, a scammer approached a woman in a Big Lots expressing her desperation to sell the gold bars she had in her possession to pay for an emergency surgery for her father. Her scamming-sidekick soon arrived saying he had found a store to purchase the bar for $12,000 but had to wait until 5 p.m. to go back and sell the next bar due to the low amount of cash the store held on hand.

Deutsche Bank’s Lewis: Gold, Agriculture, Are “Safest Long Positions”

Bloomberg – Michael Lewis, Deutsche Bank’s Global Head of Commodities Research, reports that gold and other commodities are “still cheap” and that gold’s recent rally, while record-breaking, is “not yet extreme.” Demand from emerging markets remains strong for all commodities. Lewis noted that gold is below its 1980 peak in terms of rate of appreciation, inflation-adjusted producer price, and inflation-adjusted consumer price. ETFs and central bank purchases are new sources of demand that were not present in the late ’70s.

Read Full Article>>

The World Does Not Need to End for $10,000/oz Gold

Wall Street Journal – Shayne McGuire, manager of the $100 billion Teacher Retirement System of Texas, made a daring move in ’07 when he allocated aggressively into gold at $650/oz, against the anti-gold conventional wisdom of the pension industry. Thanks to McGuire’s courage, the fund was up 15.6% in its fiscal year ending in June ’10. Now, he has released a book saying gold will hit $10,000/oz before the rally is over. He points out that as little as 1% of total global stock and bond holdings moved into the metal would cause this ten-fold rise in price. Predicting a return to gold as money in the midst of high inflation, McGuire says that while “it seems like an aggressive call,” it’s really just “a return to normal.”

Read Full Article>>

JP Morgan: Dollar to Become World’s Weakest Currency

Bloomberg – JP Morgan’s research dept. predicts that the US dollar will continue to slide toward becoming the “world’s weakest currency.” They see the dollar hitting a target of 75 yen next year, 21% below its high of 95 yen earlier this year. JP Morgan’s analysts are perplexed that “The U.S. has the world’s largest current-account deficit but keeps interest rates at virtually zero.” This is widely understood to be a recipe for currency weakness. Bloomberg noted that the dollar has declined against 12 of its 16 most-traded counterparts this year.

Read Full Article>>

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

By Peter Schiff

From World War II until very recently, the West – specifically Europe and the United States – was on a course for greater centralization, greater integration, and greater economic intervention. But this consensus is breaking down. In Europe, the euro has gone from steadily adding new members to now facing the prospect of having its weaker members quit. In America, the US Congressional Supercommittee has now officially failed in its mandate to bring even meager cuts to the bleeding US deficit.

This is the beginning of the end. Both the EU and US are politically paralyzed, seeming only to be able to make compromises that involve more spending, more debt, and more central planning. The results are all too predictable to free-market thinkers: bailouts leading to moral hazard, low interest rates leading to ballooning debt, and eventually a cascade of systemic failures – leading to more bailouts.

This was confirmed yet again on Wednesday when central bankers on both sides of the Atlantic announced a coordinated tidal wave of new money to bailout the Western banking system yet again. Now, we’re left with a world where the only thing you can trust is the gold and silver in your pocket.

Like Lemmings Off a Cliff

The poison of Keynesianism has left the politicians unable to even listen to free-market solutions. Personally, I have found it nearly impossible to find a Keynesian professor or official to debate me – even though (or perhaps because) I have a track record of accurate economic predictions. You would think at least one of them would want to tell me why I’m wrong… to offer some excuses for their failure to predict the dot-com bubble, the housing bubble, or anything that has come after that.

This is just an illustration of what we, as investors and citizens, are facing. The halls of power, the media, and academia are completely closed off from reality. They’re clutching their theories and hoping that they don’t end up having to work for a living like the rest of us.

Europe

I have repeatedly stated that the fact that Germany has been resistant to printing more euros is the main argument in favor of the euro. Of course, the mainstream consensus is the opposite. The same people who pushed for entitlement programs that Western nations couldn’t afford are now arguing that the EU must use the power of the printing press to “help” bankrupt Greece, Italy, Spain, and others. Really, this is just a secret tax on those who chose to save for a rainy day, and it will lead the euro on the road to ruin just like the US dollar.

If Greece, Italy, et al, can’t take the austerity that comes with staying in the euro, they should withdraw and see how the bond markets treat them without the implicit backing of Northern Europe. Either way, they must be made to face the market consequences of their previous spending.

Unfortunately, with this past Tuesday’s announcement that the EU would provide another $10.7 billion bailout to Greece and Wednesday’s bank bailout announcement, there is no sign that Europe’s politicians are going to allow market forces to play out. Instead, repeated bailouts will ensure that other ailing economies, like Italy or Portugal, do not make the necessary cuts in time to avoid needing their own bailouts. And no one, save perhaps China, can afford to bail out the likes of Italy.

Thus, like pulling off a bandaid, the politicians have made the euro crisis more painful by drawing it out. This means more risk and more volatility for investors, causing them to abandon the supranational currency in droves.

America

Abandoning the euro looks like a wise course of action, but it becomes extremely unwise when you buy dollars instead. Remember, my concern with Europe is that they have started down a path that may lead them to the sorry state of the US. If you’re worried that your refrigerator doesn’t get as cold as it used to, you don’t move your perishables to another fridge that won’t even turn on!

The current state of the dollar is the nightmare scenario for the euro: no significant member-states are thriving, bailouts are assumed and given without significant debate, and the money supply is growing rapidly to cover the debts. At worst, the EU could be facing a rump euro comprised of the healthier Northern economies or years of debt monetization to try to “save” the PIIGS. But the US has already spent decades monetizing its debt and is now facing a ‘game over’ scenario. Remember, the EU might be going along with the latest bank bailout scheme, but the US Fed spearheaded it and the swaps are denominated in dollars.

The failure of the Congressional Supercommittee shows how laughable Washington – and, by extension, the dollar – has become. The Federal Reserve is frantically buying Treasuries at auction to make up for wilting demand from foreign creditors, such that it may soon hold 20% of all outstanding Treasury debt. Meanwhile, the Supercommittee failed in its meager mandate to slow the growth of new spending by $100 billion a year, barely a dent in an annual deficit that runs over $1 trillion a year – not to mention the $15 trillion in debt already accumulated. The failure caused ratings agency Fitch to downgrade its outlook on US credit, potentially joining S&P soon in stripping the US of its AAA. Perhaps the analysts at Fitch realize that if the Fed were to stop buying Treasuries, say because consumer prices started rising too quickly to ignore, then rising interest rates would add additional trillions to the debt problem, making default inevitable. Or maybe they’re starting to realize that getting paid back the whole coupon in worthless dollars is just another form of default.

In short, the US is going to be mired in economic depression for the foreseeable future, with no reform efforts likely, and so the Fed will continue printing as much as it can to paper over the problem. This is tremendously bearish for the dollar, even moreso than a euro facing the loss of a few weak member-states.

The Buck Stops Here

The knee-jerk buying of US dollars, which has sent metals prices on a roller coaster this fall, represents pure market manipulation by the Fed. Private buyers and foreign governments were selling dollars and Treasuries before this recent market action sent confusing signals. We saw a short rally, but on Wednesday’s bank bailout news, dollar selling resumed. Overall, the trend remains: the Fed will continue to buy a greater and greater share of US debt until all the new money it’s printing sends inflation into the double digits.

So, in a world where the two major reserve currencies are both faltering, where is global capital going to find safety?

A look at history sees periods of monetary debasement and market mania followed by a return to more fundamental values. Every successful civilization in history has relied on sound money to grow, always in the form of precious metals. With globalization, we live in a world where investors don’t have to live with their governments’ bad choices. Allocating a portion of your portfolio to precious metals means being able to sit on the sidelines and laugh at the comedy of the sovereign debt crisis. It means that when new dollars or euros are printed, your metals simply go up in price.

That is the ultimate resolution to this crisis. More banks, institutions, and individual investors will simply withdraw from the fiat money system and rely on precious metals as their reserve asset. As they do so, the fiat system will be all the weaker for the those left behind. After this period of uncertainty, a new consensus is sure to form, and the 24% run up this year alone indicates that gold may play a central role.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

By Jeff Nielson

While watching a little television the other night, I was once again confronted by my biggest pet peeve: investment professionals who confuse risk and volatility.

In this case, the offender was a TV commercial heralding the supposed virtues of an annuity with a “guaranteed rate of return.” The suggestion is that such an arrangement removes risk from the table. The investor is led to think, “If I pay monthly payments of $X now, I am guaranteed future payments of $Y in the future.” But every investment carries risk, and a fixed payout structure doesn’t obviate that risk.

These companies have a financial interest in confusing investors, but the unfortunate byproduct of decades of this sort of marketing is that very few people, and not even most financial journalists, know the difference between risk and volatility. As always, logical analysis starts with definition of terms. Indeed, once we simply note the nature of volatility and risk in explicit terms, the flaws to which I alluded should begin to become self-evident to readers.

While it can be very difficult to quantify risk, defining it is simple. Risk, in the context of investment, is the probability that something you purchased will end up being worth less than what you paid for it when you decide to sell it. We can get more technical by adding in the concept of opportunity costs, but it’s important for everyone to have at least an elementary understanding of risk first.

Volatility, on the other hand, is a concept that is as easy to recognize in the real world as it is to define. Volatility is a purely mathematical concept that refers exclusively to “deviations from the mean.”

If we establish a trend line for the price of any good/investment (often referred to as a “moving average”), volatility refers to the average size of the bounces in price on either side of the trend line. Most importantly, to the long-term investor, volatility is a small factor in assessing risk.

Here we can only point to the gross failure of all of the “experts” (and most of the financial advisors) in the investment community, who regularly and thoroughly confuse these two concepts to the point where the terms are treated as being virtually synonymous. This has resulted in the flawed investment principle that reducing volatility will (and must) reduce risk. Such thinking is deeply misguided, and following it has dire consequences for investors.

Recalling our definition of volatility, we should immediately note why it provides us little insight about risk: because it implies absolutely nothing about the direction of the trend for any particular investment, i.e. up or down. A particular investment can have a volatility of effectively zero, while marching steadily down to a valuation of zero.

The closest and most obvious example of a relentless downward trend with minimal volatility would be the US dollar. This example is useful for many reasons. First, the Federal Reserve has a statutory mandate to “protect the dollar” from risk, i.e. avoid a loss in value. However, in practice, the Federal Reserve has never followed that mandate; instead, it has sought to only minimize volatility.

The result? In the 98 years of the Fed’s existence, the US dollar has steadily lost 98% of its value. The Fed has succeeded in minimizing volatility throughout this long plunge in value; however, it has failed utterly in protecting dollar-holders from risk, or economic losses caused by holding dollars.

Many dollar-holders may still be yawning over this analysis. While no one likes the idea of a 98% loss, when spread over the very long-term, this may not seem like much of a risk. However, when we note that 75% of this decline has occurred just in the last 40 years, this should get their attention. When we further note that this alarming rate of currency-dilution has accelerated significantly just in the last five years, this should be enough to cause all rational dollar-holders to break into a cold sweat.

Meanwhile, clueless media drones still point to the dollar as a “safe haven,” basing this suicidal advice entirely on the fact that the dollar represents (relatively) low volatility – while totally ignoring the absolute risk represented by an accelerating, century-long trend toward zero.

Living in an era of “competitive devaluation,” where all of our governments have promised to race each other in driving the value of their currencies to zero, we finally see the truth about the world of fixed-income investments. Because the banker-paper in which they are denominated is plummeting in value at an unprecedented rate, these investments don’t provide “guaranteed income,” but rather only guaranteed losses.

It is the perfect illustration of the cliché of “the lobster in the pot.” The lobsters (bond-holders) may be entirely comfortable thanks to the slowly rising temperature of the water; however, they’re still going to end up boiled alive!

It is widely reported that real interest rates have never been so negative at any time in history. To translate this, the gap between what we earn in interest and what we lose in currency-dilution (i.e. inflation) has never been this large at any time in the history of modern markets.

Precisely how do the largest guaranteed losses in history on fixed-income investments represent a “safe haven”? This is something that the “experts” conveniently omit in dispensing their foolhardy advice.

Readers must realize, however, that there are viable options. Once we correctly define the problem, namely protecting ourselves from risk, we can begin to understand the solution to our problem: looking for investment products and opportunities which minimize risk rather than merely minimizing volatility.

The obvious starting point is to swap all of our bonds for bullion: a real safe haven. In the case of gold and silver, we have an asset class with a 2,000+ year track record for preserving wealth, combined with a 10+ year up-trend in this recent bull market. That is safety.

In comparison, we have US Treasuries. The starting point here is that with US interest rates are currently at 0%, leaving investors with no return and virtually no hope for price appreciation. On top of that, they are denominated in US dollars, which have already lost 98% of their value – and are losing value even faster every day.

Fiat currencies also have their own track record: a 1,000+ year history of always going to zero. We immediately see how utterly irrelevant it is that US Treasuries are a relatively low-volatility asset. There is no less-volatile number than zero!

In proclaiming buy-and-hold investing to be dead, the pseudo-experts masquerading as financial advisors have abandoned the fundamental principle of investing: buying undervalued assets – and then giving those assets the time necessary to mature. Instead, these charlatans have forced their clients to become short-term gamblers. Worse still, they are now consistently steering their clients toward the worst possible asset-classes rather than the best ones.

Most of the recent mass-market movements can be directly attributed to the failure by most investors to understand the fundamental conceptual difference between risk and volatility. In a market populated by panicked lemmings, we cannot avoid volatility. However, we can and must reduce risk – which begins by building an allocation of history’s true safe haven asset, precious metals.

I’ve told more than one concerned investor that when the gold price falls, they should “come back in three months” and see if they’re still worried. The idea is that the daily and monthly gyrations are nothing to fret over, that the price will recover and, in time, fetch new highs.

That advice has worked every time gold underwent any significant correction (except in late 2008, when one had to take a longer view than three months).

Here’s proof.

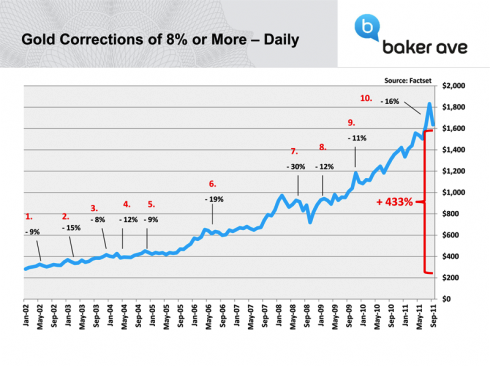

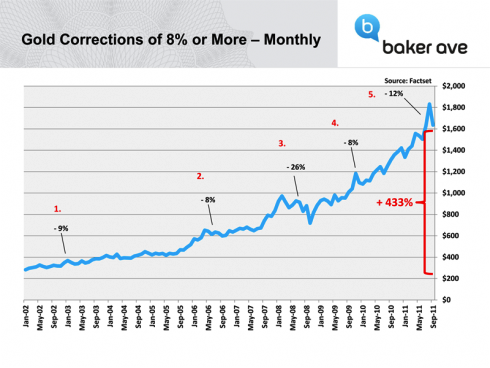

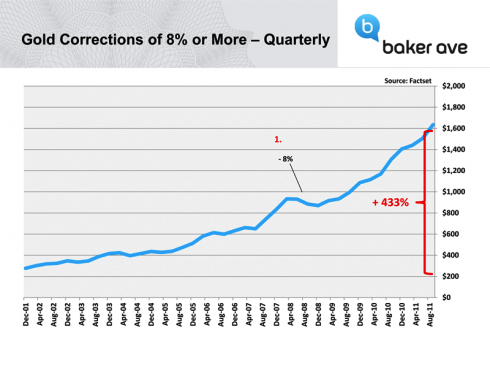

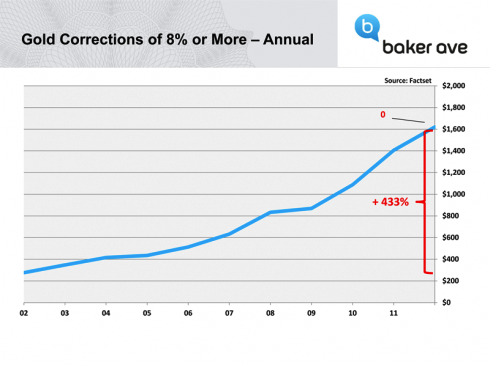

I’ve traded emails regularly with Brent Johnson of Baker Avenue Asset Management ever since meeting him at an investor event at which I spoke a couple years ago. He forwarded some charts he’d prepared for his clients that put gold’s September decline into perspective; it’s a good visualization of my standing advice to worriers.

The following charts document corrections in the gold price of 8% or more – first measured with daily prices, then monthly, quarterly, and finally annually. See if this doesn’t put things into perspective.

While the gold price has had plenty of big corrections since late 2001, they’re not so concerning when viewed beyond a day-to-day basis. In fact, if you could resist checking the gold price except once a quarter, one might wonder what all the fuss with price declines is about!

You’ll also notice that the September decline, when measured monthly, was our second biggest in the current bull market (and third when calculated daily). This suggests to me that unless we have another 2008-style meltdown in all markets, the low for this correction is in.

That’s not to say the price couldn’t fall from current levels, of course, nor that the market couldn’t get more volatile. It’s simply a reminder that when viewed on any long-term basis, corrections are nothing but one step down before the next two steps up. It tells us to keep the big picture in mind.

It also implies that pullbacks represent buying opportunities. It demonstrates that one could buy any 8% drop with a high degree of confidence. Keep that in mind the next time gold pulls back. Until the fundamental factors driving gold shift dramatically – something that would require most of them to completely reverse direction – I suggest deleting any worries about price fluctuations from your psyche.

And if you’re still a tad uneasy about today’s gold price, well, let’s talk next February.

It’s not just the bait and switch scams you have to watch out for; scams can be even scummier than you can imagine. This particular scam cost individuals tens of thousands as Global Bullion Exchange owner Jamie Campany mislead his over 1400 clients to invest in gold “accounts” that would never actually hold the bullion.

Jamie’s company was functioning out of a boiler room in Florida that was converted into a call center. His sales team would find leads, connect the phone number to addresses on Google Earth to see what kind of property the potential buyer owned. The salesperson would then carefully select a potentially profitable lead by finding the largest houses. When the home owner answered, the salesperson would proceed to use every tactic in the book to eventually scam the person into buying gold that the company didn’t own and never would convincing the customer that an account would hold the purchase until the client decided to cash in. They even talked people who had no free-flowing cash into investing!