Apparently, the American consumer has bought into the notion that everything is great in the economy. Consumer confidence surged to an 18-year high this month and is close to the all-time record.

The Conference Board Consumer Confidence Index jumped to 138.4, up from 134.7. Analysts expected a dip.

A recent Paul Krugman New York Times column praised the success of the Keynesian macro model in the wake of the 2008 financial crisis. In his view, the Federal Reserve did exactly what was necessary – pushed interest rates to zero and launched rounds of quantitative easing to jumpstart demand. As Tom Woods and Bob Murphy put it in a recent episode of the Contra Krugman podcast, “we agree that Krugman’s model did great…if we overlook all the times it blew up in his face.”

As is typical of Keynesians, Krugman ignores the side-effects of Federal Reserve policy. It works for a while, but it perpetuates the boom-bust business cycle. Sure, the economy today seems to be booming, but there is a rotten underbelly that most everybody in the mainstream seems to be ignoring. Peter Schmidt offers a succinct breakdown of Keynesian-based Fed policy and reveals why its doomed to failure.

The EU has announced it will create a special payment channel to circumvent US economic sanctions and facilitate trade with Iran.

Last month, German foreign minister Heiko Maas called for the creation of a new payments system independent of the United States. The announcement Monday sets that plan in motion.

The Dow Jones pushed into record-high territory again late last week. As Peter Schiff pointed out in his latest podcast, Pres. Trump was out there pointing out the record run on Wall Street and claiming responsibility for this bull market. Just turn on Fox News and hardly a segment will go by that somebody isn’t reminding you about how great the economy is. Peter said it reminds him how people were talking up George W. Bush before the Great Recession.

Some people out there in the mainstream are saying now is the time to buy gold.

In recent months, the mainstream investment world has by and large either ignored the yellow metal or outright spurned it. After all, stocks are soaring. The economy is doing “great.” There’s nothing to worry about — at least that’s the mantra. But we’re starting to see a little bullishness for gold out there in the mainstream.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

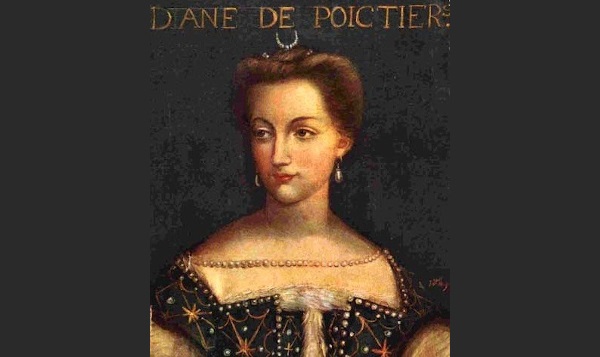

Do you want to maintain your youthful appearance?

Drink a 16th-century concoction made from gold!

Of course, the main reason it will keep you looking young is that it will kill you young. But if you’re OK with that little side-effect, this just might be the anti-aging solution you’re looking for.

A bill introduced in the US House would eliminate capital gains taxes on gold and silver bullion.

Rep. Alex Mooney (R-W.Va.) introduced HR6790 on Sept. 12. Titled the Monetary Metals Tax Neutrality Act of 2018, the legislation would amend the IRS code to exempt the sale of “refined gold or silver bullion, coins, bars, rounds, or ingots which are valued primarily based on their metal content and not their form,” from capital gains taxes.

If you look at past financial and economic crises, what is the common denominator?

Debt.

That’s why we talk so much about debt on these pages.

Yields have been on the rise this week in the midst of a bond market sell-off.

Two-year borrowing costs hit their highest level in a decade Wednesday. The yield on the 2-year Treasury climbed to 2.816%. Meanwhile, the 10-year Treasury yield hit a four-month high of 3.07%.

What’s going on here?