The current economic environment is generally supportive of commodities. Higher inflation rates, improving economic conditions and commodity supply shortages all favor this sector. As a result, investors are increasing allocations to commodities. And according to a report published by the World Gold Council, gold is positioned as the most effective commodity investment in a portfolio.

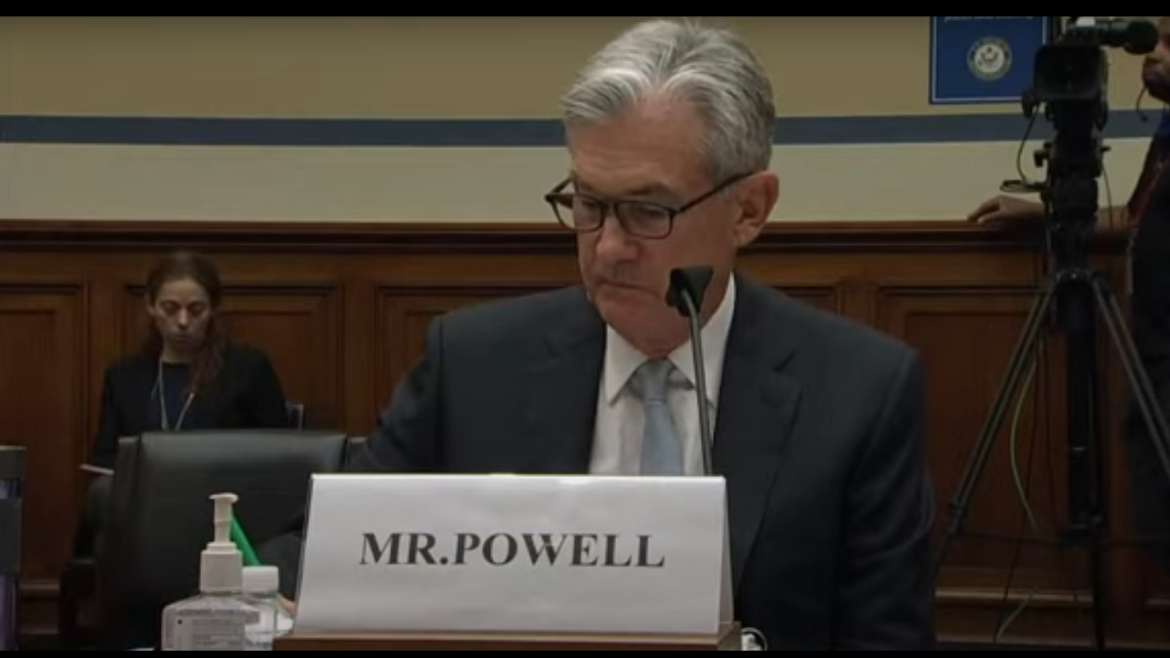

During a Q&A with students and teachers, Federal Reserve Chairman Jerome Powell praised the bad economics that drove the government response to the coronavirus pandemic. In this clip from his podcast, Peter Schiff breaks down everything Powell got wrong.

During the Zoom event, Powell went out of his way to praise Congress for passing the “CARES Act.” The Coronavirus Aid, Relief, and Economic Security Act was the first $2.2 trillion stimulus plan Congress passed in response to the pandemic back in March 2020.

M2 Money Supply is measured by the Federal Reserve to calculate the amount of money in the financial system. Historically, the term inflation was defined as an expansion of the money supply that generally led to higher prices. Therefore increases in M2 is the measure of inflation. This analysis reviews the changes in money supply as a potential indication of future price increases.

This analysis focuses on gold and silver physical delivery on the Comex set for September 21, 2021. See the article What is the Comex for more detail.

This month marks the 50th anniversary of President Richard Nixon slamming shut the so-called “gold window” and severing the last ties between the dollar and gold.

On Aug. 15, 1971, Nixon ordered Treasury Secretary John Connally to uncouple gold from its fixed $35 price and suspended the ability of foreign banks to directly exchange dollars for gold. Nixon’s order was the end of a path off the gold standard that started during President Franklin D. Roosevelt’s administration, and it set the foundation for the massive government spending and inflation we’re dealing with today.

Dallas Federal Reserve President Robert Kaplan has been one of the more hawkish Fed members. On Aug 11, he said the Fed should announce a quantitative easing taper in September and begin slowing asset purchases in October. But two weeks later, Kaplan backed off that assertion, saying that with the surge of COVID-19, he was open to adjusting his view. In an interview on CNBC’s “Squawk Box,” financial analyst Jim Grant explained why the Fed is playing with fire.

After being put on pause due to a coronavirus surge, the recovery of India’s gold market appears to be back on track.

As prices continue to spiral upward and the Federal Reserve maintains its inflationary monetary policy, a lot of people in the mainstream keep talking about inflation as a good thing. Peter Schiff said it seems like they’re trying to soften us up and make us willing to accept higher inflation. But as he explains in this clip from his podcast, these pundits are missing a fundamental truth — no matter how much money the Federal Reserve prints, it can’t print actual stuff.

While there is a lot of talk about the Federal Reserve tapering its asset purchases, no such tapering is actually happening.

In the week ending Aug. 18, the Fed pushed its balance sheet to yet another record with the addition of another $85.4 billion in Treasuries and mortgage-backed securities. The balance sheet now stands at a record $8.34 trillion.

There’s been a lot of talk about the Federal Reserve tapering its asset purchases. Peter Schiff talked about it during his podcast, saying even if the Fed does get around to tapering, that doesn’t equate to a legitimately tight monetary policy. Furthermore, any tapering today sows the seeds for its own destruction.